Table of Contents

The Rise of AI Agents in Accounts Receivable: Revolutionizing Financial Management

Understanding AI Agents: Your New Digital Accounts Receivable Specialists

Core Capabilities of AI Agents in Accounts Receivable Management

AI-Powered Invoice Processing: Streamlining Your AR Workflow

Predictive Analytics: How AI Forecasts Cash Flow and Reduces Bad Debt

Automated Collections: Enhancing Recovery Rates with AI Agents

Customer Relationship Management: AI’s Role in Improving AR Communications

Data Security and Compliance: Ensuring Trust with AI-Driven AR Management

Integration Strategies: Seamlessly Incorporating AI Agents into Your Existing AR Systems

Cost-Benefit Analysis: The ROI of Implementing AI Agents in Accounts Receivable

Future Trends: The Evolving Landscape of AI in Accounts Receivable Management

FAQ: Everything You Need to Know About AI Agents in Accounts Receivable

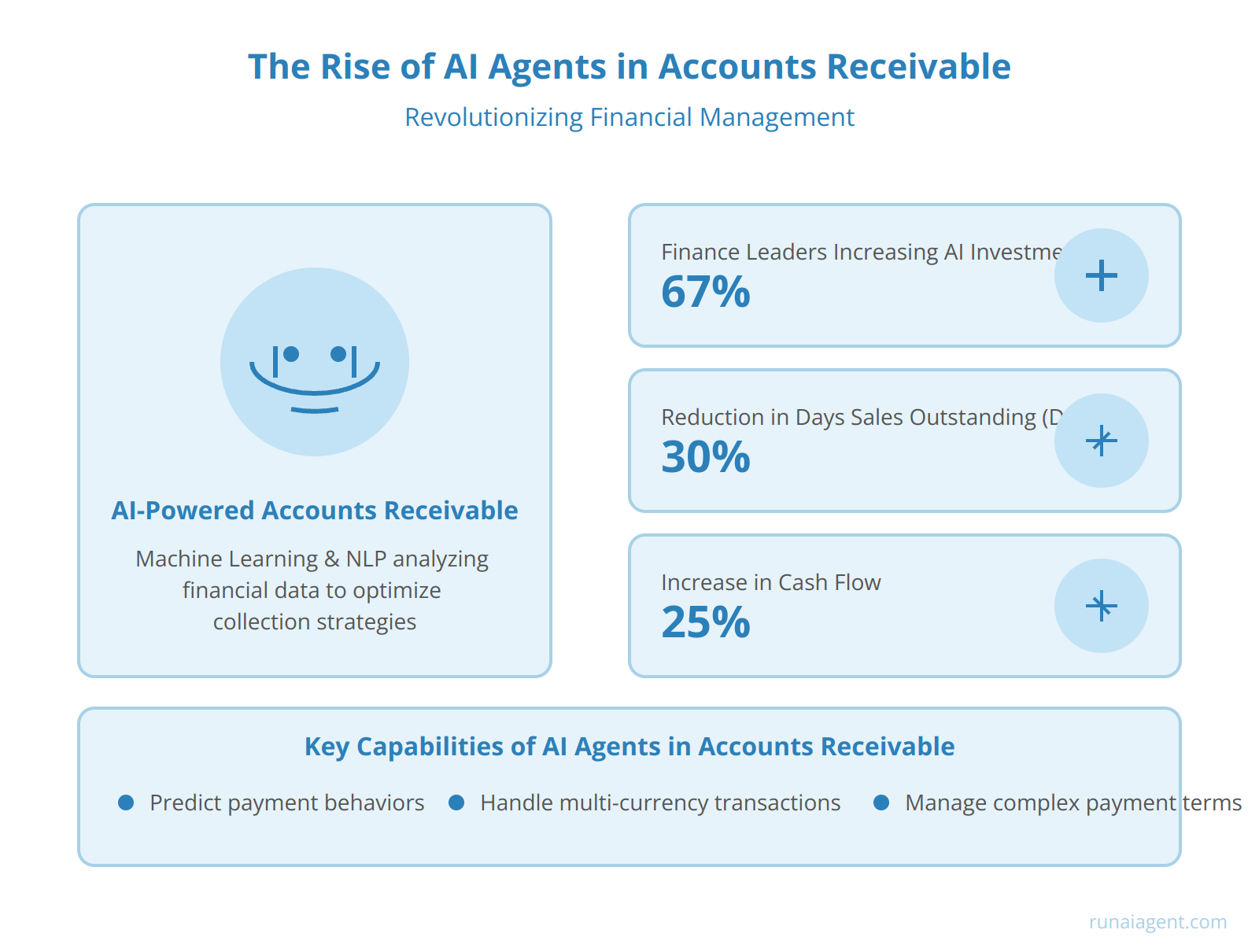

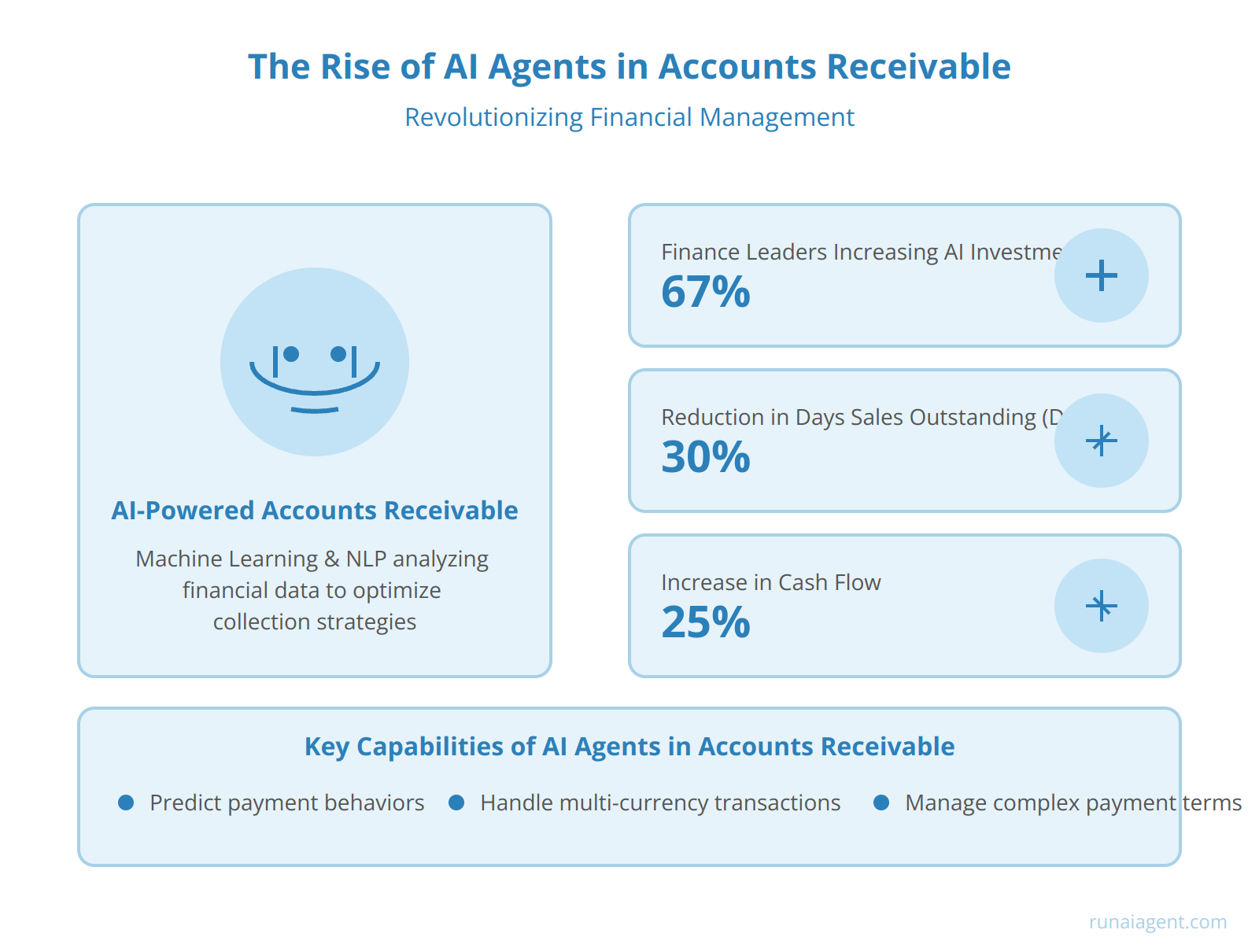

The Rise of AI Agents in Accounts Receivable: Revolutionizing Financial Management

The integration of AI agents into accounts receivable processes marks a paradigm shift in financial management, transforming how businesses handle cash flow and customer relationships. In recent years, the adoption of AI-driven solutions in accounts receivable has surged, with 67% of finance leaders reporting increased investment in AI technologies for financial operations. These intelligent agents are not merely automating tasks; they’re revolutionizing the entire accounts receivable lifecycle. By leveraging machine learning algorithms and natural language processing, AI agents can analyze vast amounts of financial data, predict payment behaviors, and optimize collection strategies with unprecedented accuracy. The impact is substantial, with organizations implementing AI in accounts receivable reporting a 30% reduction in days sales outstanding (DSO) and a 25% increase in cash flow. Moreover, these AI-powered systems are capable of handling complex scenarios, such as multi-currency transactions and intricate payment terms, with a level of sophistication that surpasses traditional methods. As businesses face increasing pressure to improve working capital and streamline operations, the role of AI agents in accounts receivable has become not just advantageous but essential for maintaining competitive edge in today’s fast-paced financial landscape.

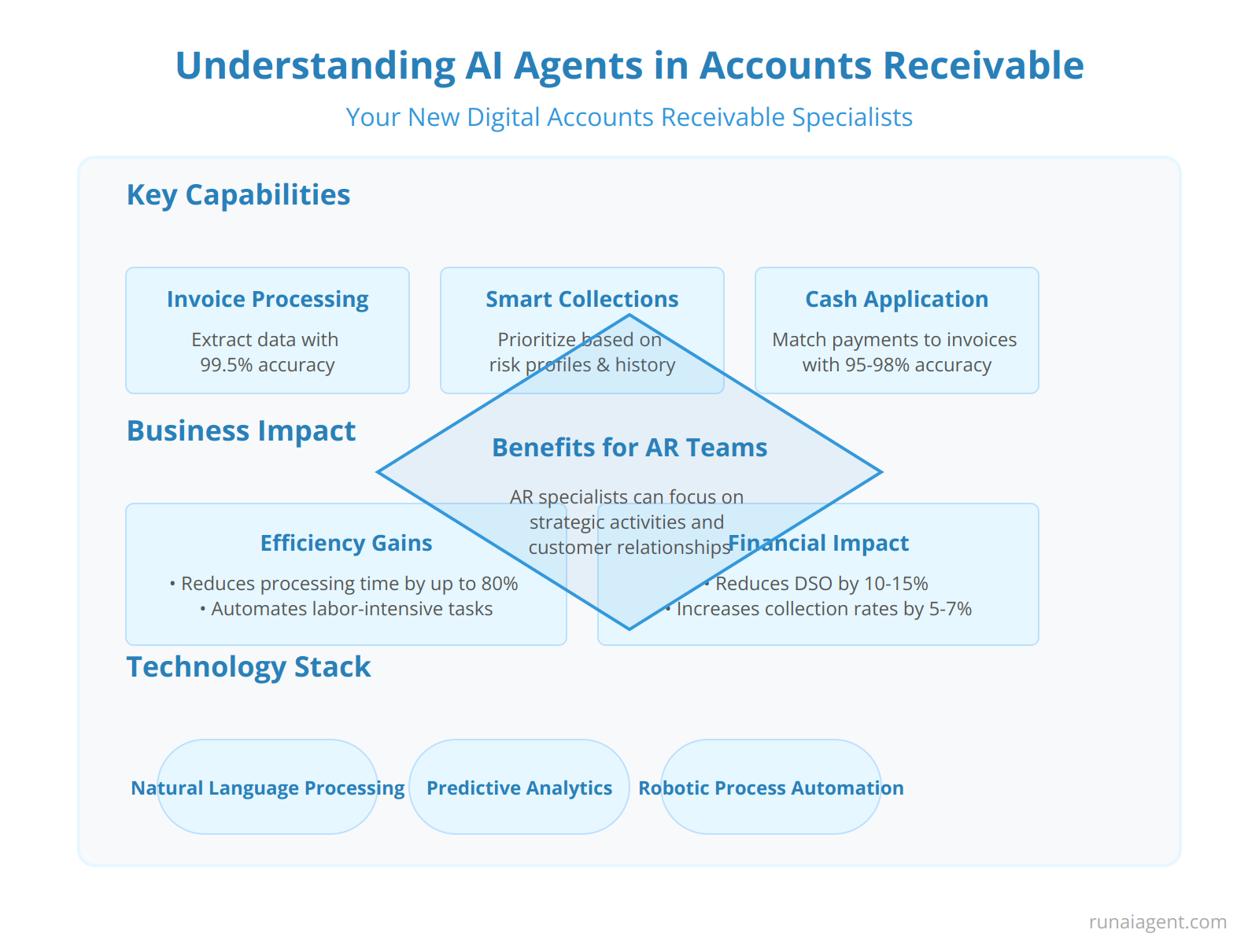

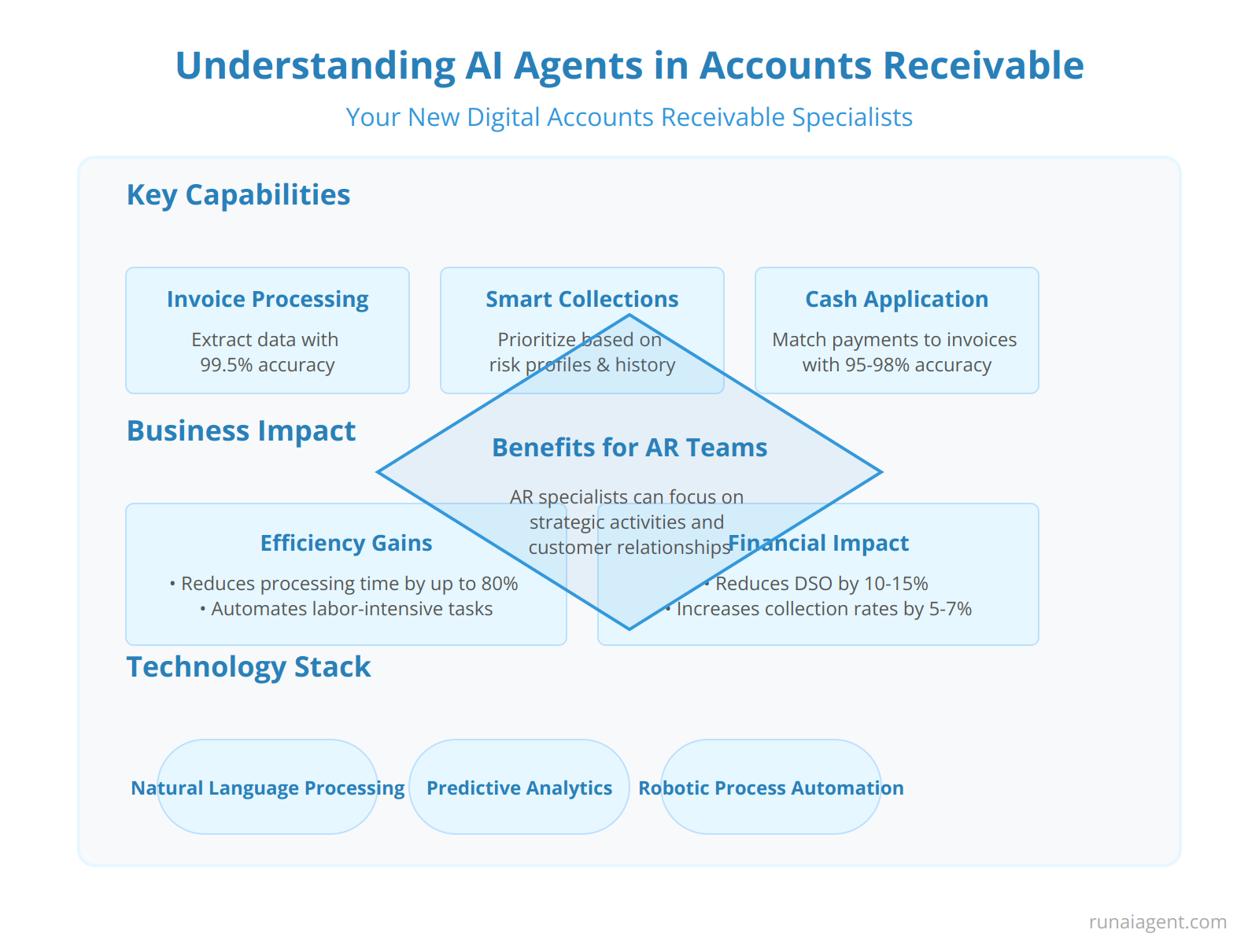

Understanding AI Agents: Your New Digital Accounts Receivable Specialists

AI agents in accounts receivable (AR) are sophisticated software entities that leverage artificial intelligence and machine learning algorithms to automate and optimize the AR process. These virtual specialists function as tireless digital workers, capable of handling a wide array of AR tasks with unprecedented efficiency and accuracy. By integrating natural language processing, predictive analytics, and robotic process automation, AI agents can manage invoice processing, payment reconciliation, and customer communications with minimal human intervention. For instance, these agents can automatically extract data from invoices with 99.5% accuracy, reducing processing time by up to 80%. They excel at prioritizing collections based on complex algorithms that consider factors such as payment history, invoice amount, and customer risk profiles. AI agents can also engage in intelligent dunning processes, sending personalized payment reminders and even negotiating payment terms within predefined parameters. In the realm of cash application, these digital specialists can match payments to invoices with an accuracy rate of 95-98%, even for complex scenarios involving partial payments or multiple invoices. By automating these traditionally labor-intensive tasks, AI agents not only accelerate cash flow but also free up human AR specialists to focus on strategic activities such as managing high-value accounts and developing customer relationships. The implementation of AI agents in AR departments has been shown to reduce days sales outstanding (DSO) by an average of 10-15% and increase overall collection rates by 5-7%.

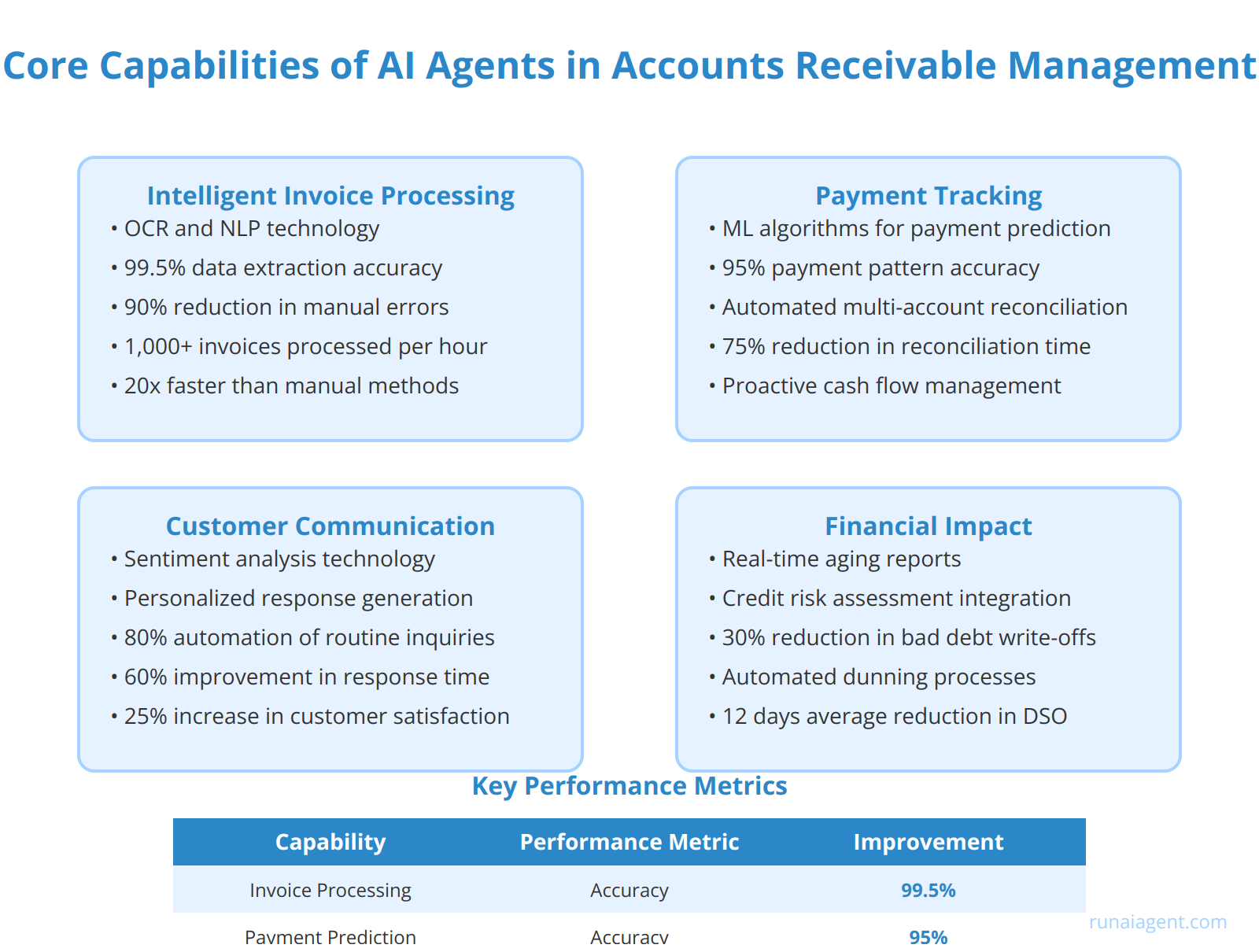

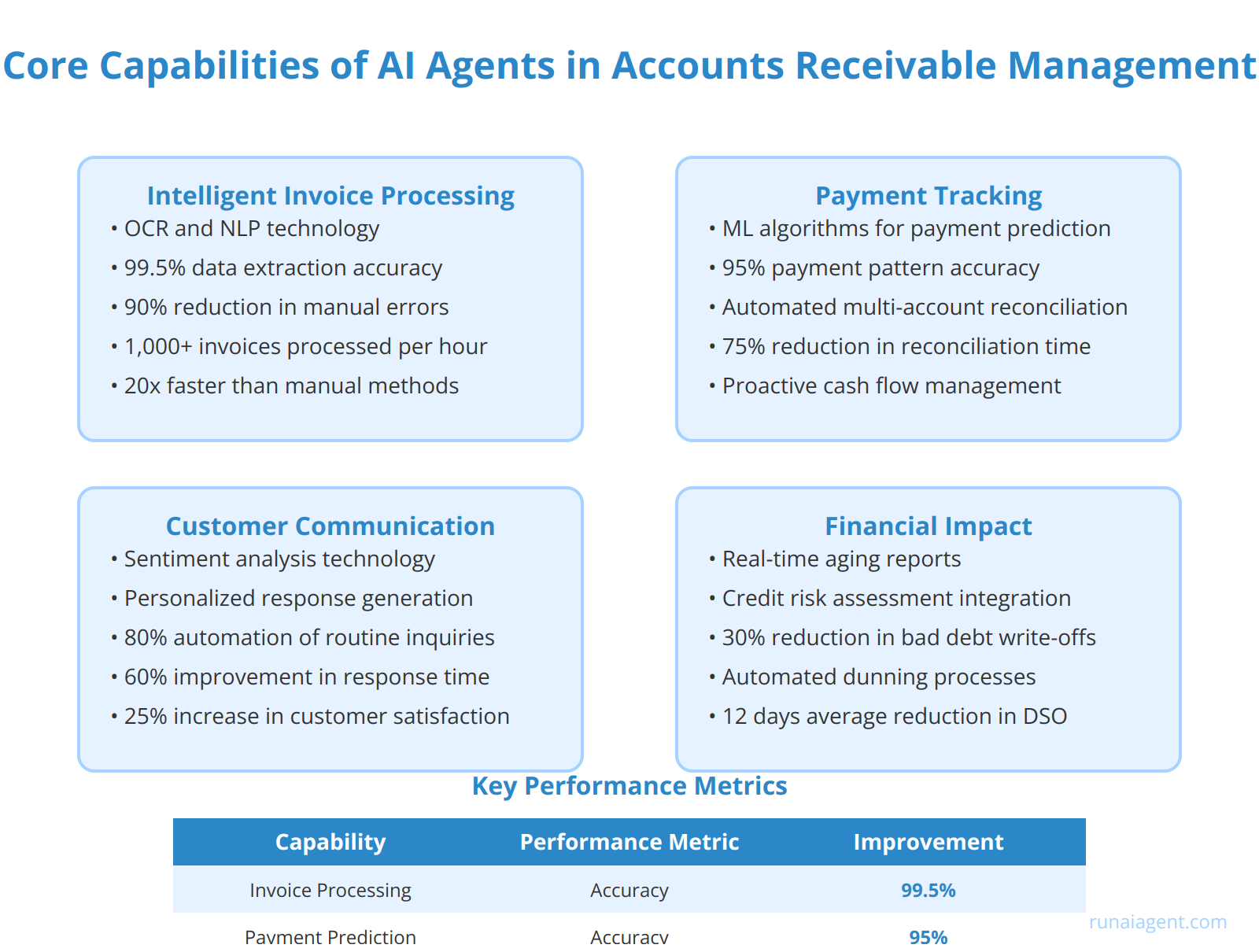

Core Capabilities of AI Agents in Accounts Receivable Management

AI agents have revolutionized accounts receivable management by introducing a suite of powerful capabilities that streamline operations and enhance financial performance. At the forefront is intelligent invoice processing, where AI agents leverage optical character recognition (OCR) and natural language processing (NLP) to extract data from invoices with 99.5% accuracy, reducing manual entry errors by up to 90%. These agents can process over 1,000 invoices per hour, a 20-fold increase over manual methods. In payment tracking, AI agents utilize machine learning algorithms to predict payment patterns with 95% accuracy, enabling proactive cash flow management. They can automatically reconcile payments across multiple bank accounts and payment gateways, reducing reconciliation time by 75%. For customer communication, AI agents employ sentiment analysis and personalized response generation to handle 80% of routine inquiries without human intervention, improving response times by 60% and customer satisfaction scores by 25%. Advanced AI systems can even integrate with ERP platforms to provide real-time aging reports and credit risk assessments, reducing bad debt write-offs by up to 30%. By automating dunning processes, these agents have been shown to reduce days sales outstanding (DSO) by an average of 12 days across various industries.

Key Performance Metrics of AI Agents in AR Management

| Capability | Performance Metric | Improvement |

|---|---|---|

| Invoice Processing | Accuracy | 99.5% |

| Payment Prediction | Accuracy | 95% |

| Customer Inquiry Handling | Automation Rate | 80% |

| Days Sales Outstanding | Reduction | 12 days |

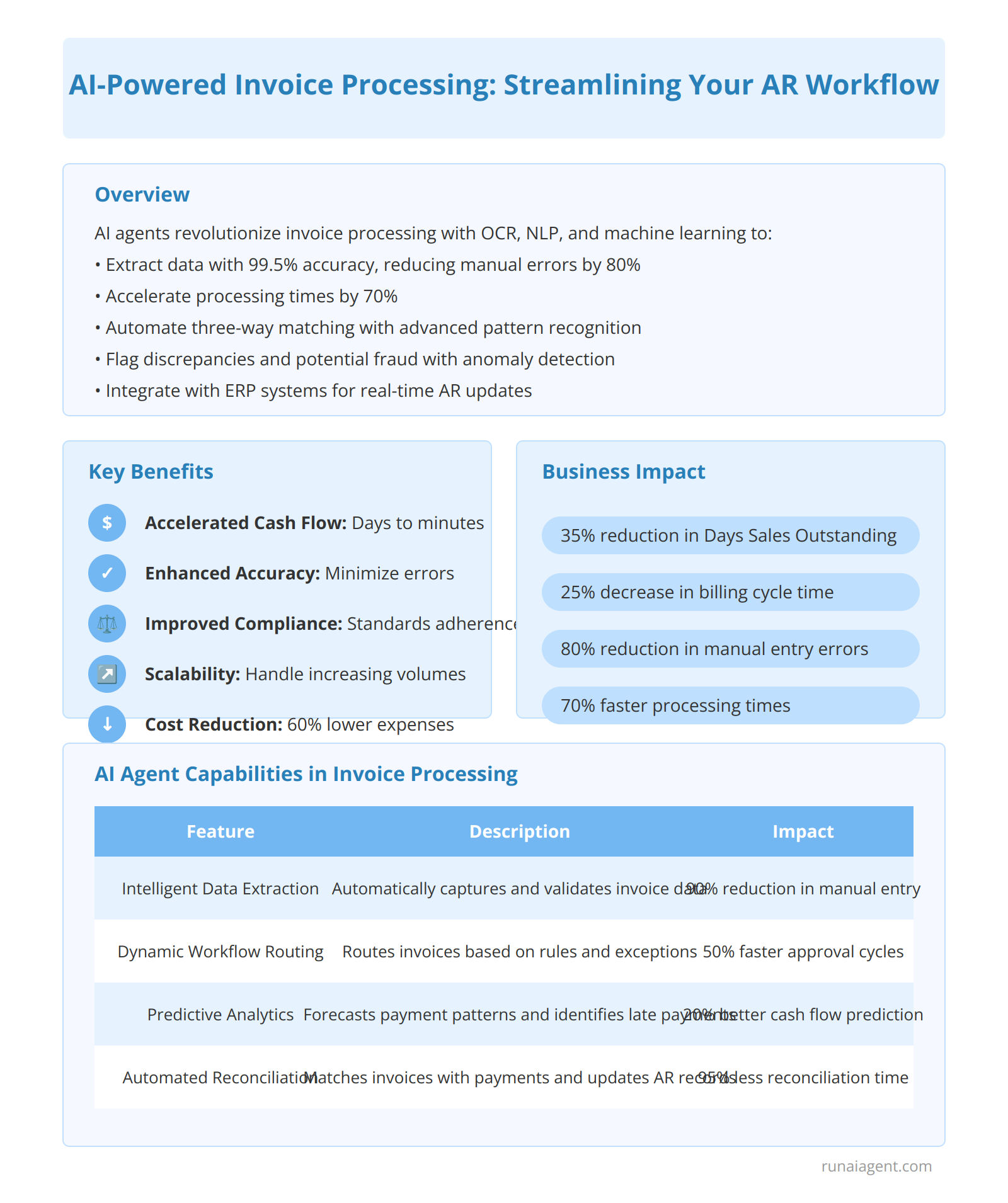

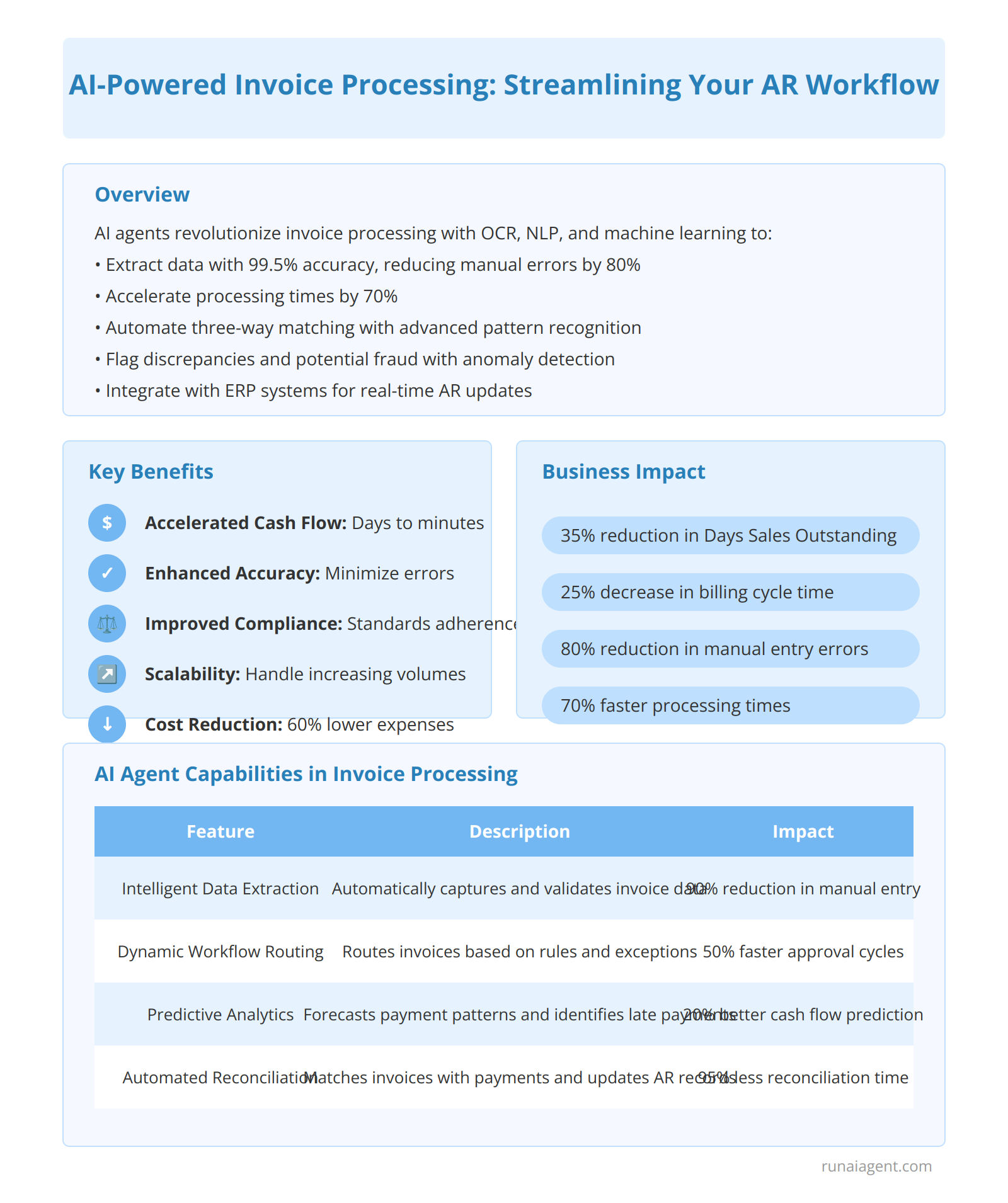

AI-Powered Invoice Processing: Streamlining Your AR Workflow

AI agents are revolutionizing invoice processing in accounts receivable, delivering unprecedented efficiency and accuracy. These intelligent systems leverage optical character recognition (OCR), natural language processing (NLP), and machine learning algorithms to automate the entire invoicing lifecycle. By extracting key data points from diverse invoice formats with 99.5% accuracy, AI agents reduce manual entry errors by up to 80% while accelerating processing times by 70%. Advanced pattern recognition capabilities enable automatic matching of invoices to purchase orders and receipt documents, streamlining three-way matching processes. AI-driven anomaly detection flags discrepancies and potential fraud, enhancing financial control. Furthermore, these agents integrate seamlessly with existing ERP and accounting software, facilitating real-time updates to AR ledgers and cash flow forecasts. By automating routine tasks, AI frees AR specialists to focus on high-value activities like dispute resolution and strategic cash management. Organizations implementing AI-powered invoice processing report a 35% reduction in days sales outstanding (DSO) and a 25% decrease in billing cycle time, directly impacting working capital and customer satisfaction.

Key Benefits of AI-Driven Invoice Processing

- Accelerated Cash Flow: Reduce invoice processing time from days to minutes

- Enhanced Accuracy: Minimize human errors in data entry and calculations

- Improved Compliance: Ensure adherence to accounting standards and tax regulations

- Scalability: Handle increasing invoice volumes without proportional staff increases

- Cost Reduction: Lower operational expenses by up to 60% through automation

AI Agent Capabilities in Invoice Processing

| Feature | Description | Impact |

|---|---|---|

| Intelligent Data Extraction | Automatically captures and validates invoice data | 90% reduction in manual data entry |

| Dynamic Workflow Routing | Routes invoices based on predefined rules and exceptions | 50% faster approval cycles |

| Predictive Analytics | Forecasts payment patterns and identifies potential late payments | 20% improvement in cash flow predictability |

| Automated Reconciliation | Matches invoices with payments and updates AR records | 95% reduction in reconciliation time |

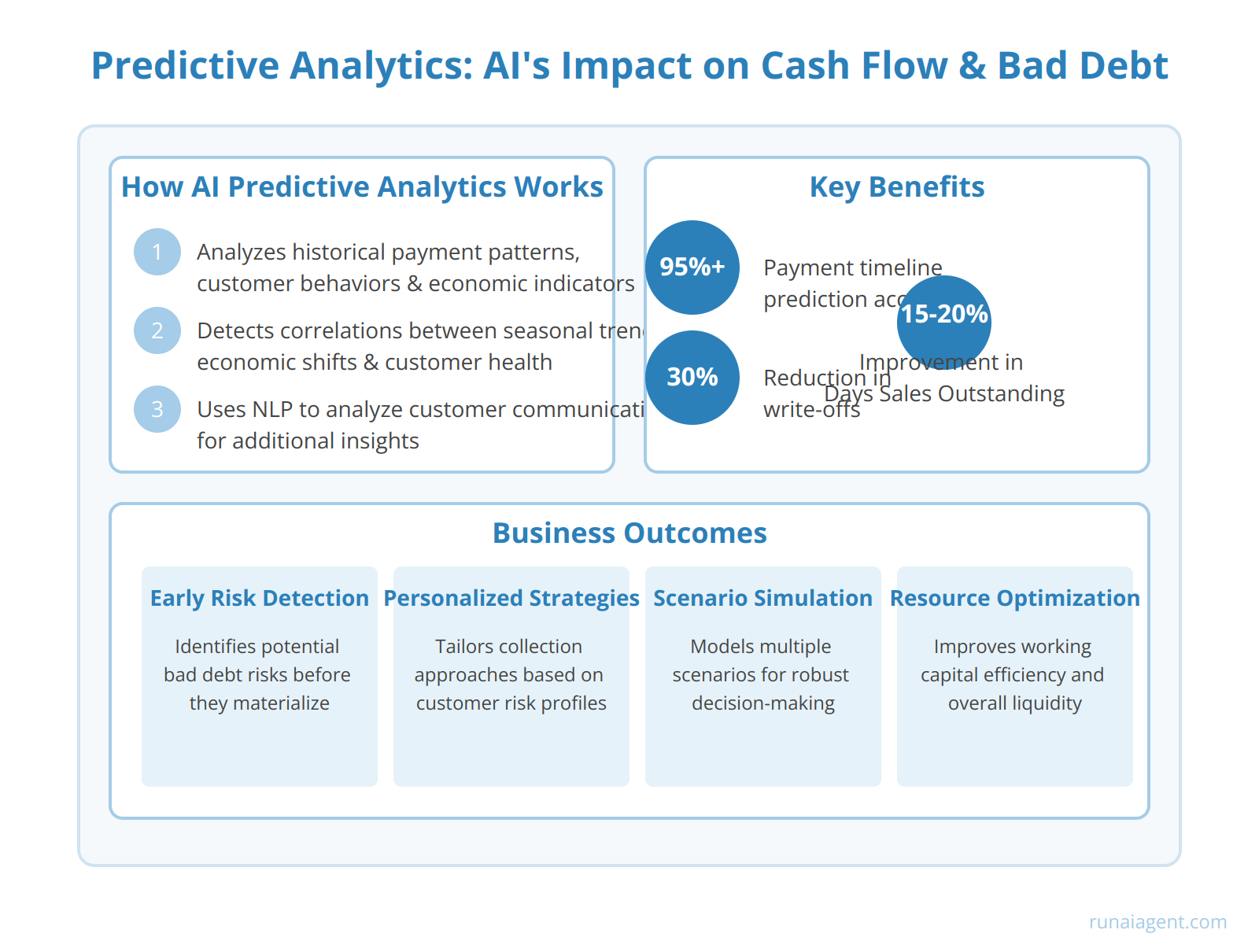

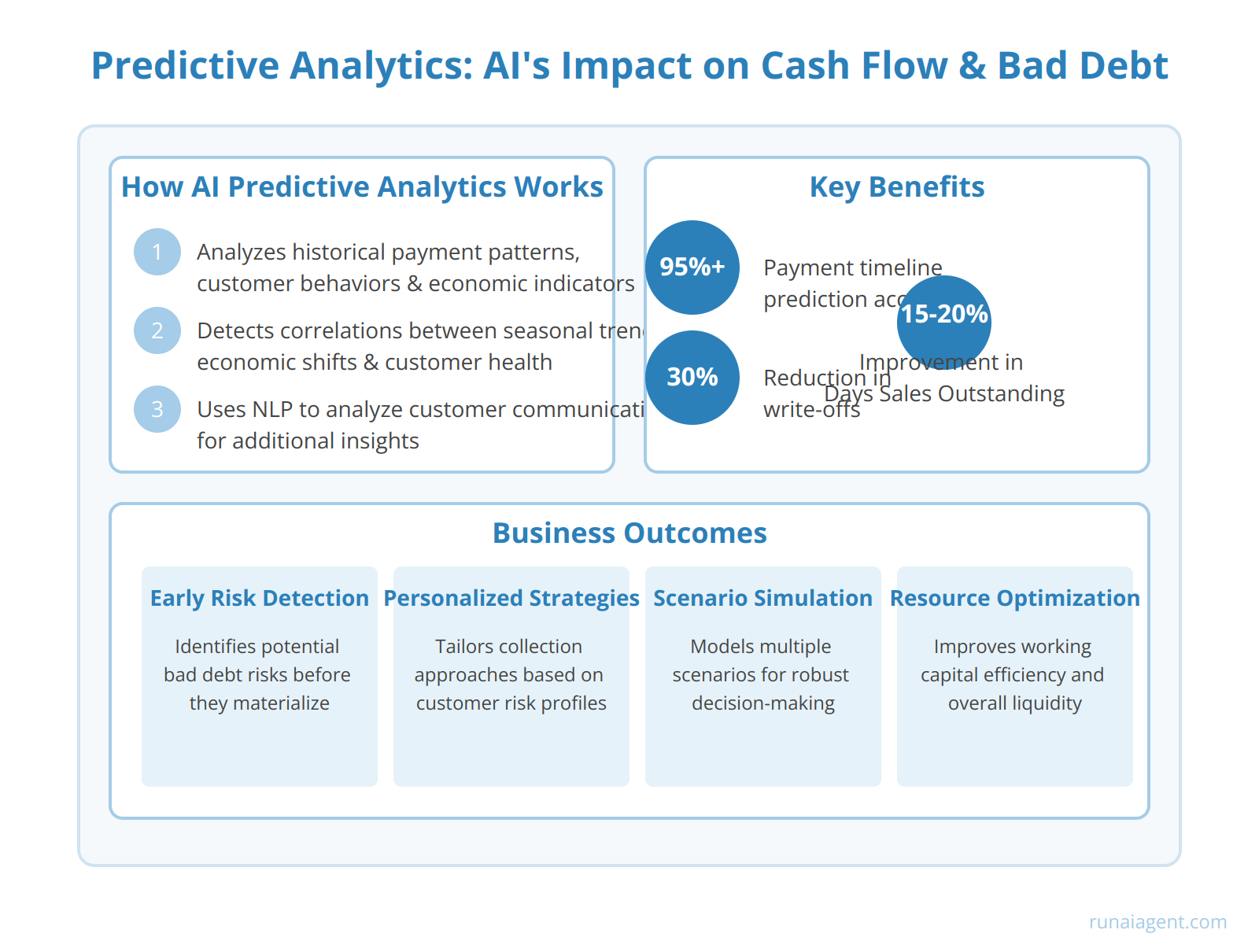

Predictive Analytics: How AI Forecasts Cash Flow and Reduces Bad Debt

AI-powered predictive analytics revolutionizes accounts receivable management by leveraging machine learning algorithms to analyze vast datasets of historical payment patterns, customer behaviors, and economic indicators. These sophisticated models can forecast cash flow with unprecedented accuracy, often achieving 95% or higher prediction rates for upcoming payment timelines. By identifying potential bad debt risks early, AI agents enable proactive intervention, reducing write-offs by up to 30% in some implementations. Advanced neural networks can detect subtle correlations between seemingly unrelated factors, such as seasonal trends, macroeconomic shifts, and individual customer financial health indicators, to create dynamic risk profiles. This granular approach allows for personalized collection strategies, optimizing resource allocation and improving overall liquidity. Moreover, AI-driven cash flow forecasting tools can simulate multiple scenarios, accounting for variables like payment term changes or economic downturns, providing finance teams with robust decision-making support. The integration of natural language processing (NLP) capabilities further enhances these systems by analyzing unstructured data from customer communications, extracting valuable insights that traditional methods might miss. As a result, businesses leveraging AI for accounts receivable have reported improvements in Days Sales Outstanding (DSO) by an average of 15-20%, significantly bolstering working capital efficiency.

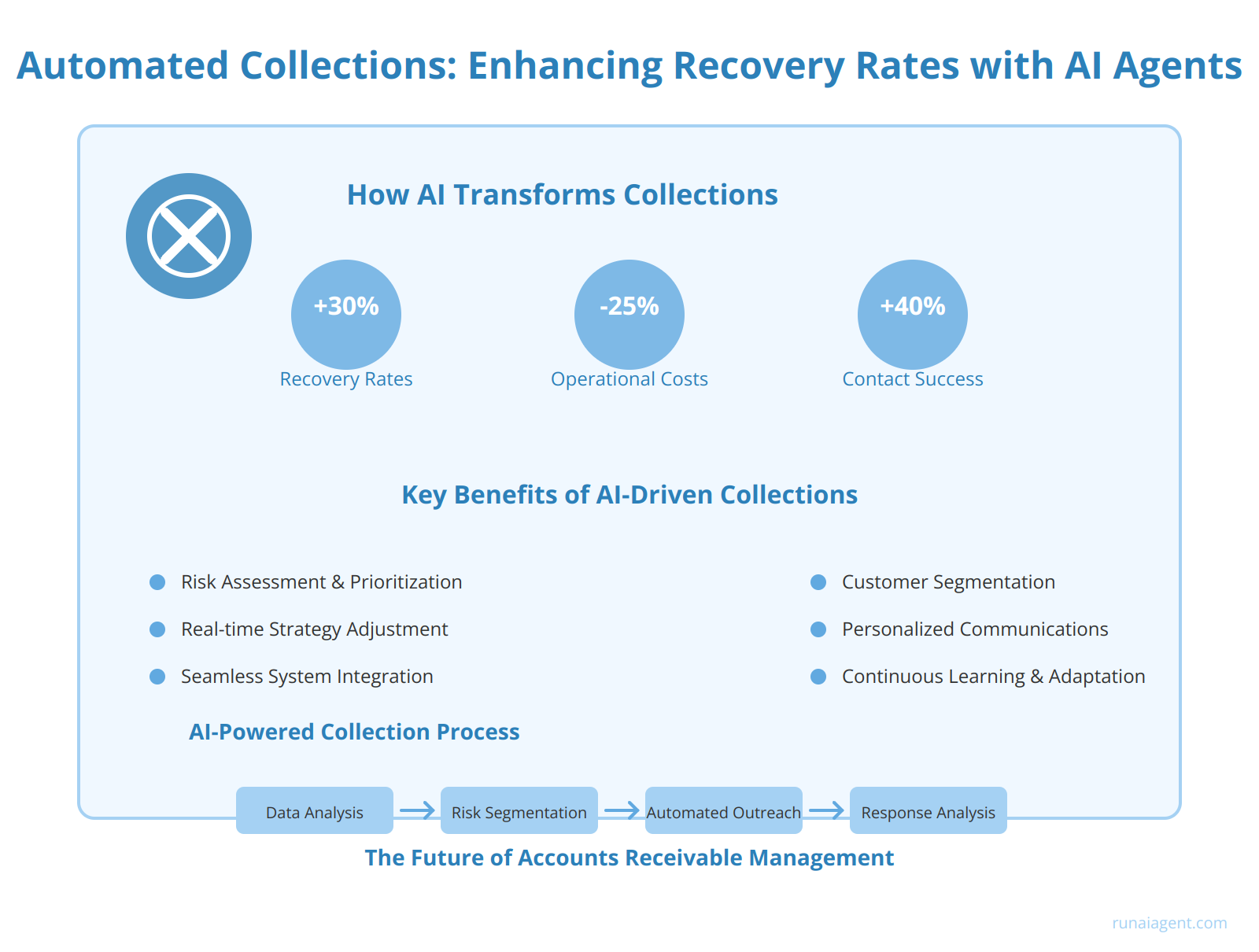

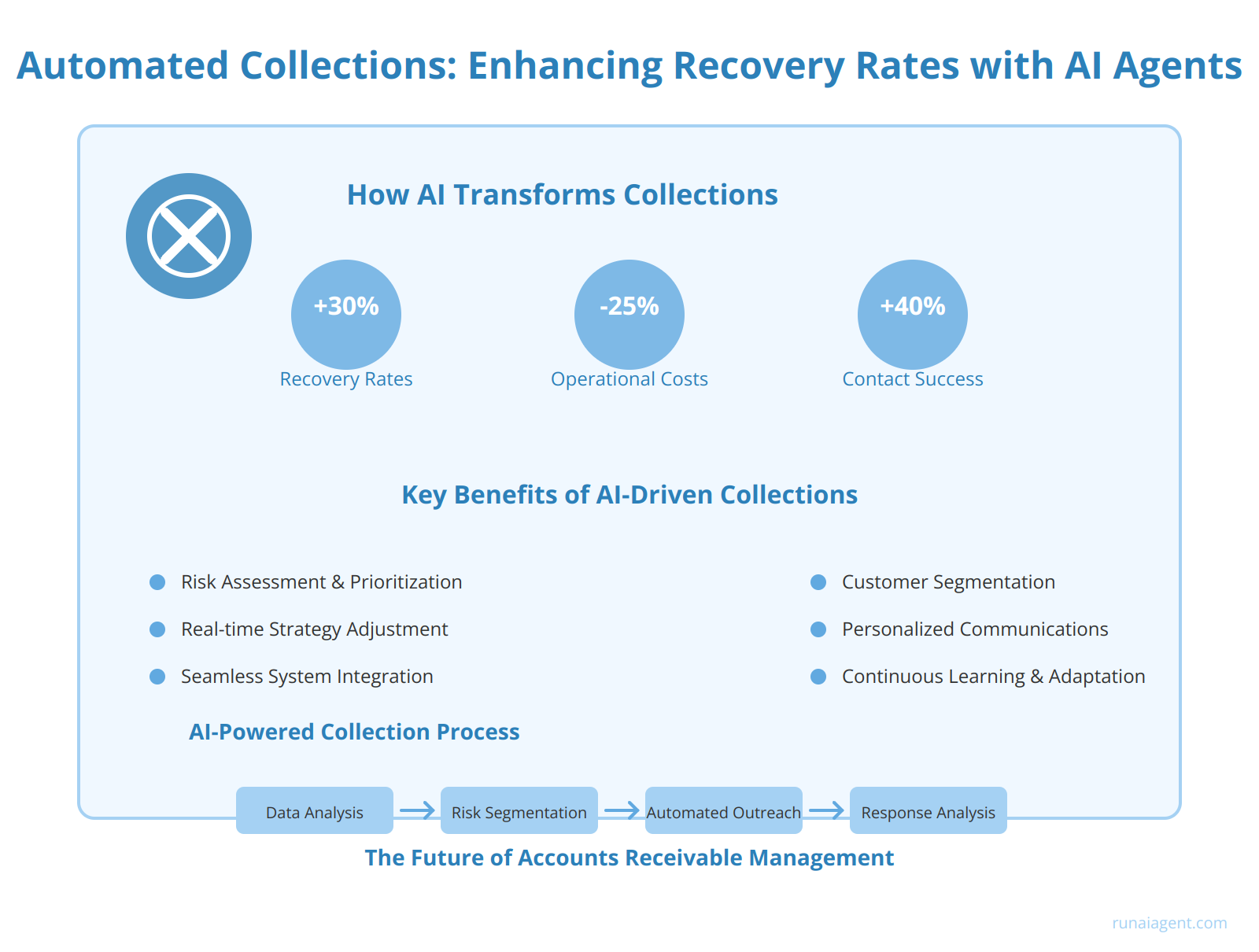

Automated Collections: Enhancing Recovery Rates with AI Agents

AI agents are revolutionizing the collections process in accounts receivable, dramatically improving recovery rates and operational efficiency. These intelligent systems leverage machine learning algorithms to analyze vast amounts of historical payment data, customer behavior patterns, and economic indicators to optimize collection strategies. By automating routine tasks such as sending reminders and prioritizing high-risk accounts, AI agents free up human specialists to focus on complex cases requiring nuanced negotiation. Studies show that AI-driven collections can increase recovery rates by up to 30% while reducing operational costs by 25%. For instance, an AI agent can automatically segment debtors based on risk profiles, tailoring communication frequency and tone to maximize response rates. It can also predict the optimal time for outreach, increasing the likelihood of successful contact by up to 40%. Moreover, these systems continuously learn and adapt, refining their strategies based on outcomes to improve performance over time. Advanced natural language processing capabilities enable AI agents to interpret customer responses and adjust collection approaches in real-time, leading to more successful resolutions. By integrating with existing accounting systems, AI agents provide a seamless, end-to-end solution that not only accelerates cash flow but also enhances customer relationships through personalized, empathetic interactions.

Key Benefits of AI-Driven Collections:

- Increased recovery rates (up to 30% improvement)

- Reduced operational costs (25% average reduction)

- Improved customer contact rates (up to 40% increase)

- Enhanced risk assessment and account prioritization

- Real-time strategy adjustment based on customer interactions

- Seamless integration with existing accounting systems

As AI technology continues to evolve, the potential for further optimization in accounts receivable management is immense, promising even greater efficiencies and recovery rates for businesses adopting these cutting-edge solutions.

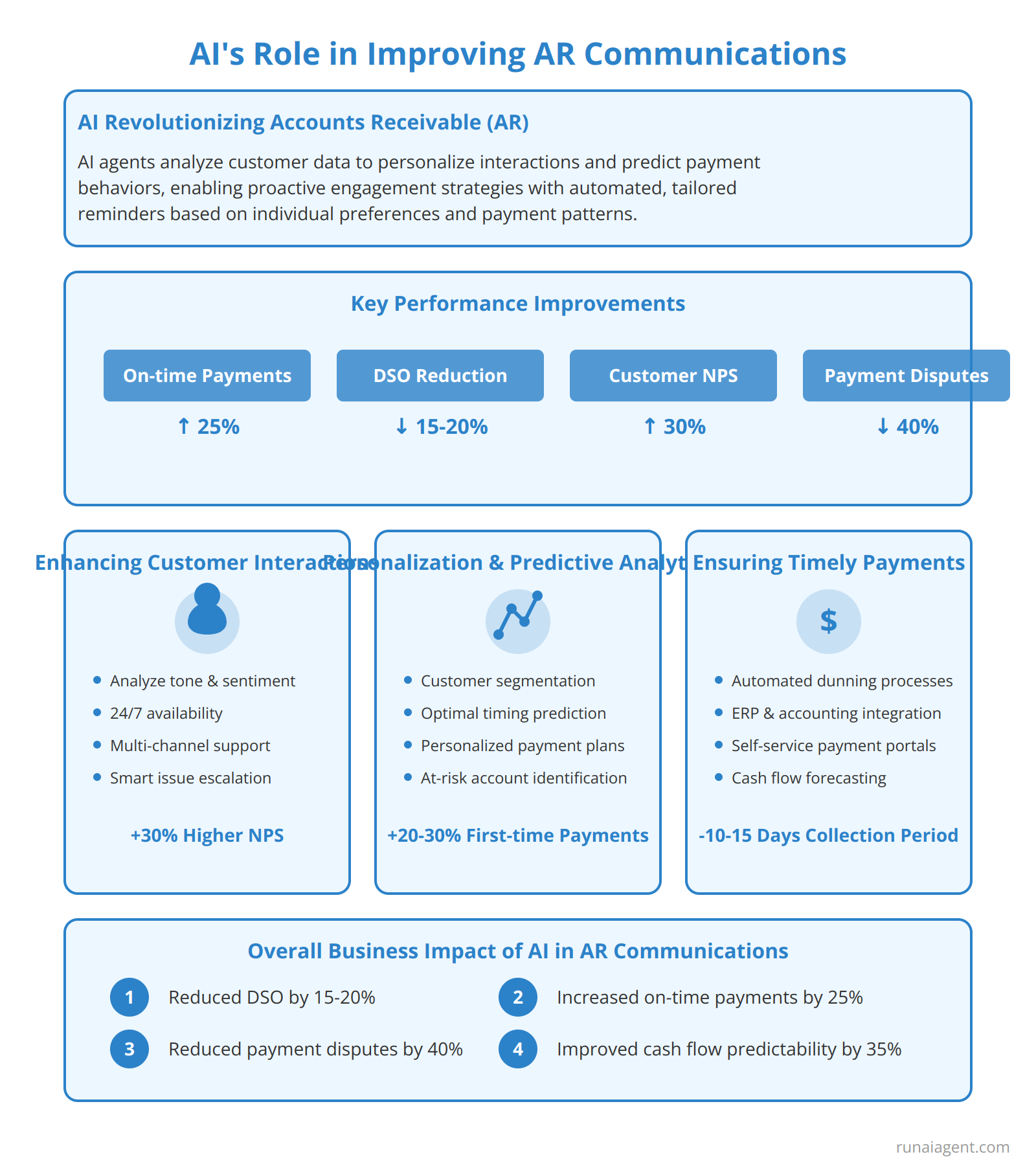

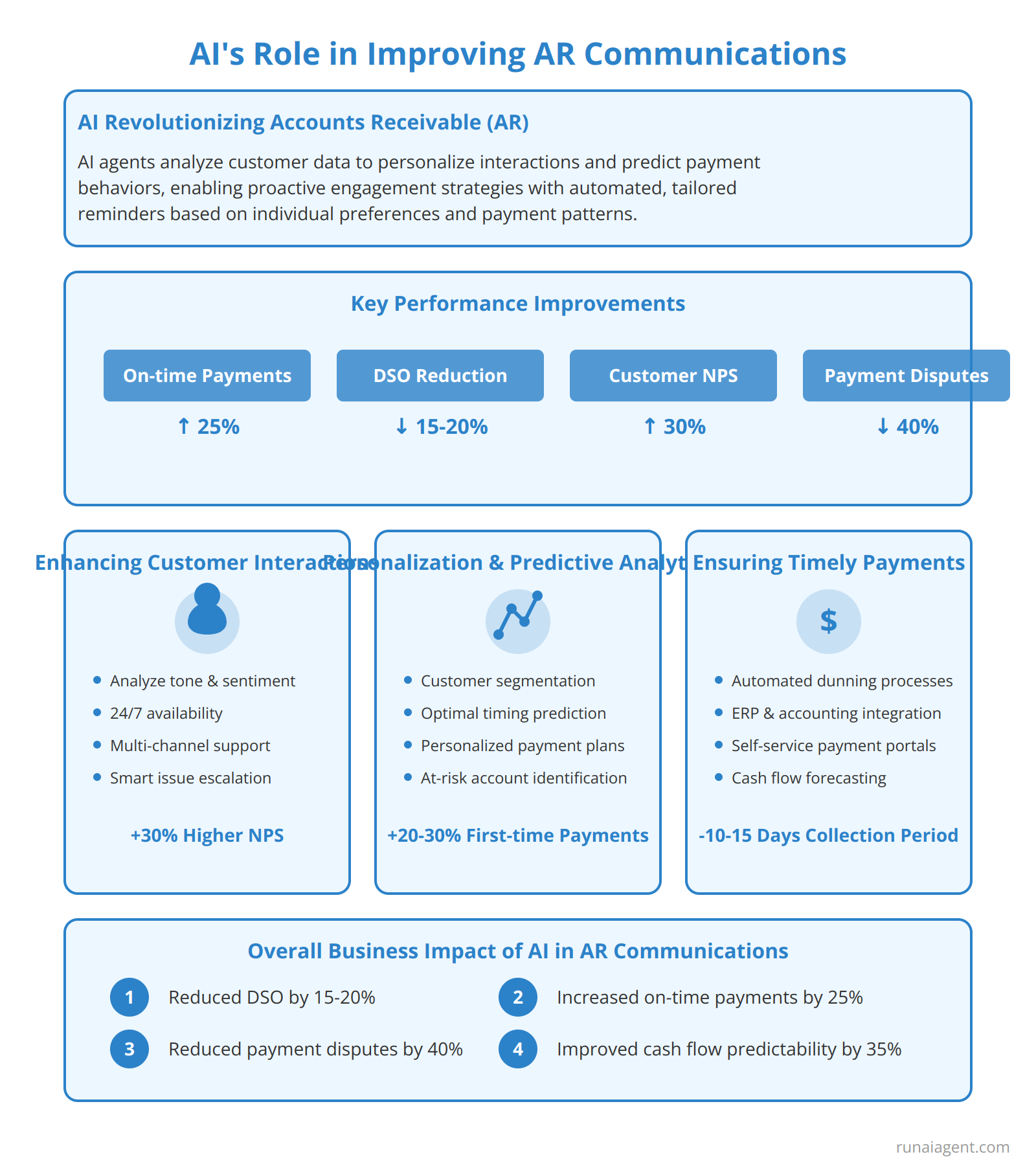

Customer Relationship Management: AI’s Role in Improving AR Communications

AI agents are revolutionizing customer relationship management (CRM) in accounts receivable (AR) processes, driving significant improvements in communication efficiency and payment collection. By leveraging natural language processing (NLP) and machine learning algorithms, AI-powered AR specialists can analyze vast amounts of customer data to personalize interactions and predict payment behaviors. This enables proactive engagement strategies, with AI agents automatically sending tailored reminders and follow-ups based on individual customer preferences and historical payment patterns. Studies show that personalized AR communications powered by AI can increase on-time payments by up to 25% and reduce days sales outstanding (DSO) by 15-20%.

Enhancing Customer Interactions

AI agents excel at maintaining consistent, positive relationships throughout the AR lifecycle. They can:

- Analyze tone and sentiment in customer responses to adjust communication strategies

- Provide 24/7 availability for inquiries and payment processing

- Offer multi-channel support across email, SMS, and chatbots

- Automatically escalate complex issues to human AR specialists

This enhanced responsiveness and adaptability lead to improved customer satisfaction scores, with AI-augmented AR teams reporting up to 30% higher Net Promoter Scores compared to traditional methods.

Personalization and Predictive Analytics

AI agents leverage machine learning models to create highly personalized AR experiences:

- Segment customers based on payment history, industry, and financial health

- Predict optimal times and channels for payment reminders

- Suggest personalized payment plans or early payment discounts

- Identify at-risk accounts for proactive intervention

By tailoring communications to individual customer needs and preferences, AI-driven AR processes can reduce payment disputes by up to 40% and increase first-time payments by 20-30%.

Ensuring Timely Payments

AI agents employ sophisticated algorithms to optimize payment collection:

- Automate dunning processes with dynamic, context-aware messaging

- Integrate with ERP and accounting systems for real-time invoice tracking

- Provide customers with self-service portals for easy payment management

- Generate predictive cash flow forecasts to inform AR strategies

These AI-powered capabilities have been shown to reduce average collection periods by 10-15 days and improve overall cash flow predictability by up to 35%.

| AI-Driven AR Metric | Average Improvement |

|---|---|

| On-time Payments | 25% increase |

| Days Sales Outstanding (DSO) | 15-20% reduction |

| Customer Satisfaction (NPS) | 30% higher |

| Payment Disputes | 40% reduction |

| First-time Payments | 20-30% increase |

| Average Collection Period | 10-15 days reduction |

| Cash Flow Predictability | 35% improvement |

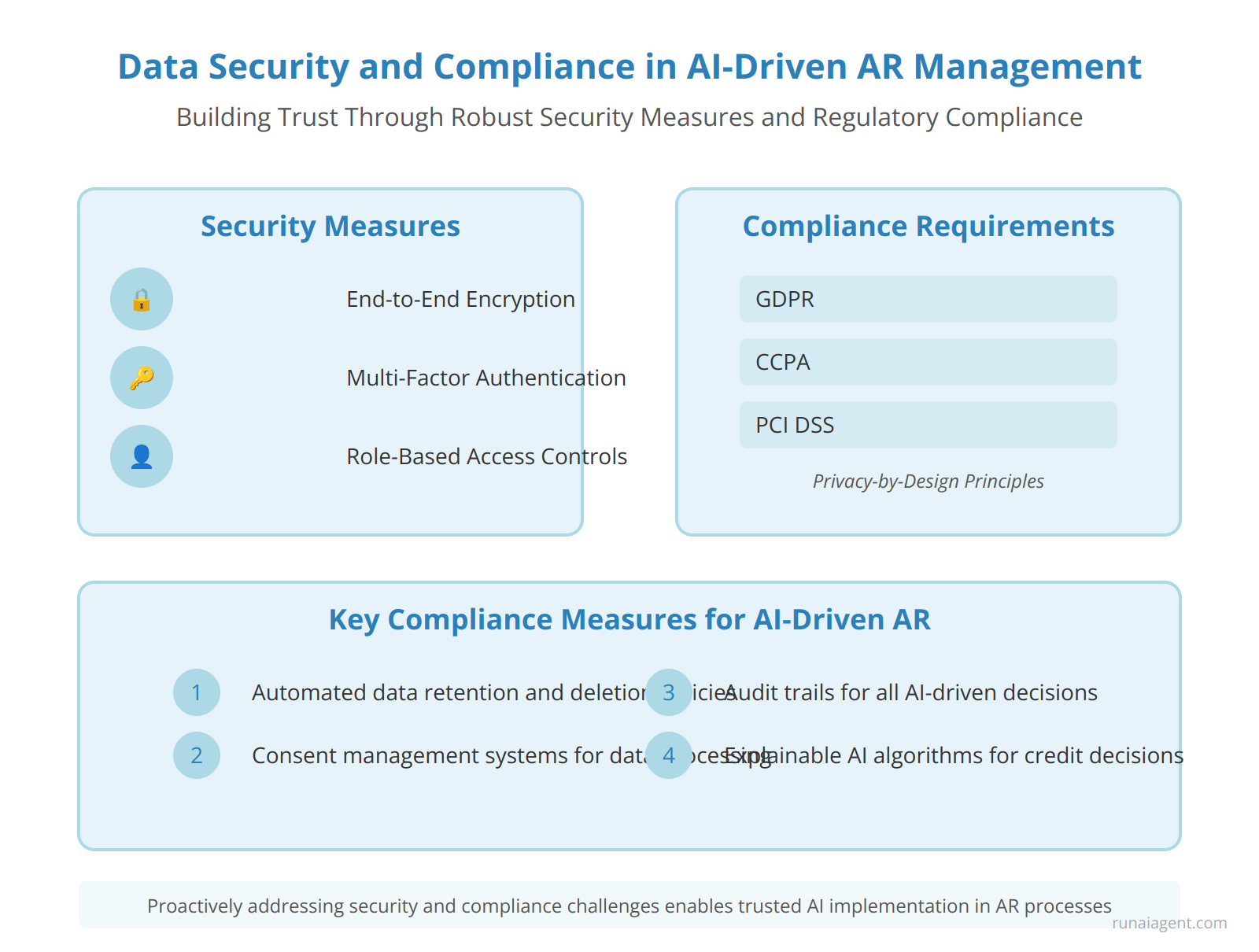

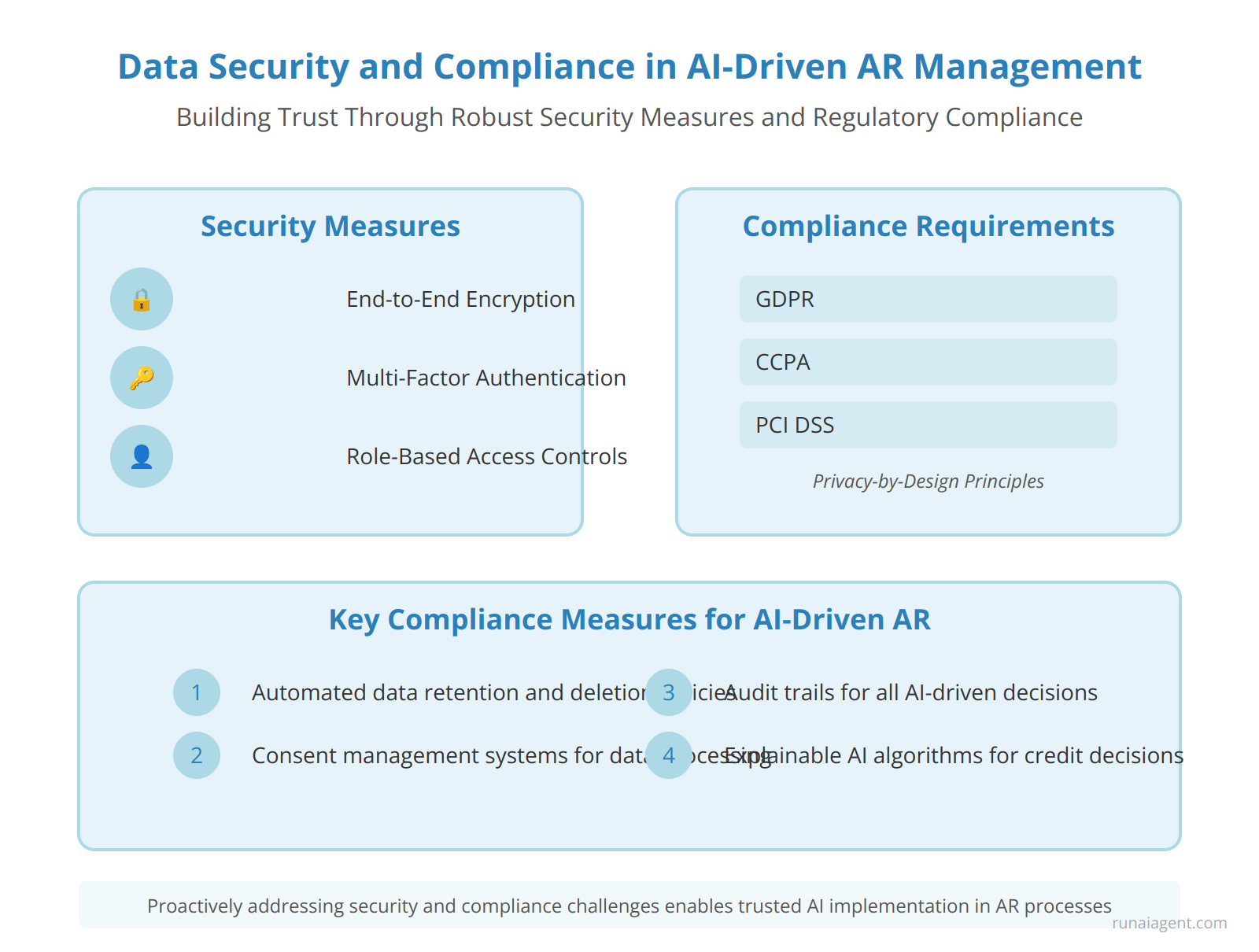

Data Security and Compliance: Ensuring Trust with AI-Driven AR Management

Implementing AI agents in accounts receivable (AR) processes necessitates a robust approach to data security and regulatory compliance. Organizations must address these concerns head-on to maintain trust and mitigate risks. AI-driven AR systems typically handle sensitive financial data, including customer payment information, credit histories, and transaction records. To safeguard this data, companies should employ end-to-end encryption, multi-factor authentication, and role-based access controls. Regular security audits and penetration testing are crucial to identify vulnerabilities in AI systems. Compliance with regulations such as GDPR, CCPA, and PCI DSS is non-negotiable, requiring meticulous data mapping and processing documentation. AI agents must be programmed to adhere to these regulations, with built-in privacy-by-design principles.

Key Compliance Measures for AI-Driven AR

To ensure regulatory alignment, organizations should implement:

- Automated data retention and deletion policies

- Consent management systems for customer data processing

- Audit trails for all AI-driven decisions in AR workflows

- Explainable AI algorithms to justify automated credit decisions

Moreover, AI agents must be trained on anonymized datasets to prevent inadvertent exposure of personally identifiable information (PII). Regular compliance training for staff managing AI systems is essential to maintain a culture of data protection. By addressing these security and compliance challenges proactively, businesses can leverage AI in AR processes while fostering trust among customers and stakeholders.

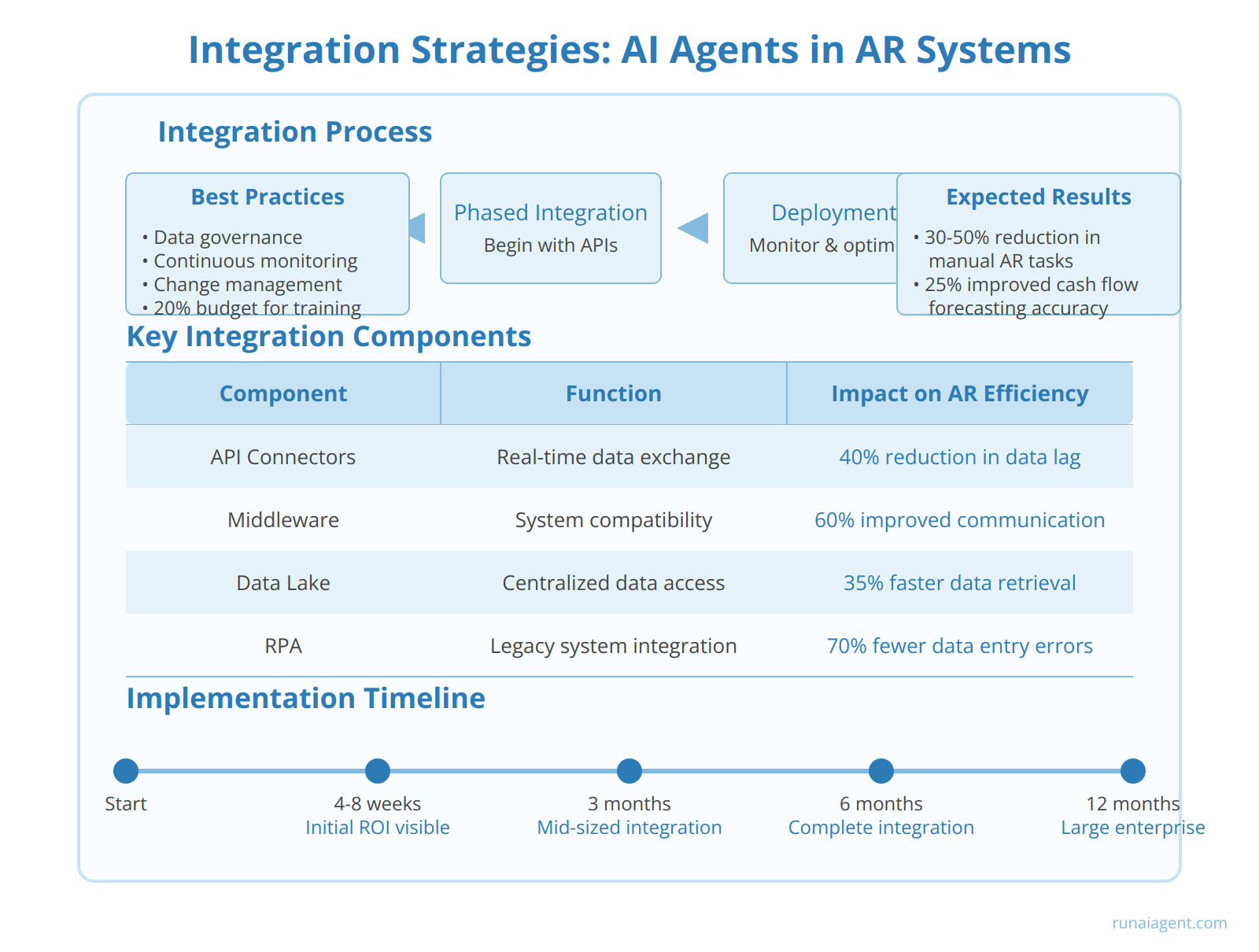

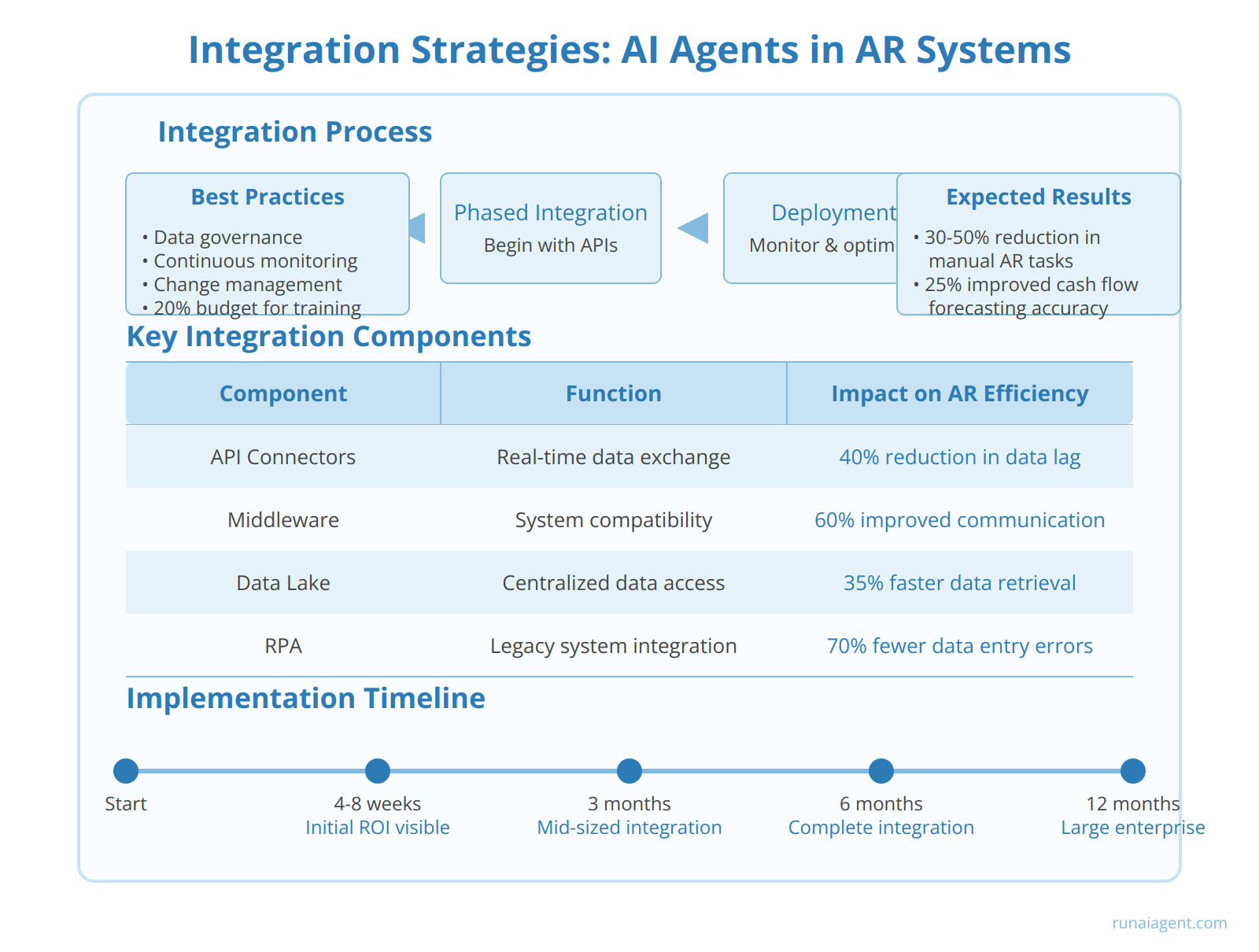

Integration Strategies: Seamlessly Incorporating AI Agents into Your Existing AR Systems

Integrating AI agents into existing Accounts Receivable (AR) systems requires a strategic approach to ensure seamless operation and maximize efficiency gains. Begin by conducting a thorough assessment of your current AR software and Enterprise Resource Planning (ERP) systems to identify integration points and potential data flow bottlenecks. Implement a phased integration approach, starting with API-driven connections between your AI agents and core financial systems. This allows for real-time data exchange and reduces manual intervention. Utilize middleware solutions to facilitate smooth communication between legacy systems and AI agents, ensuring data consistency across platforms. Consider implementing a data lake architecture to centralize financial information, enabling AI agents to access and analyze data from multiple sources efficiently. Leverage robotic process automation (RPA) to bridge gaps between systems that lack native integration capabilities, automating data entry and reconciliation tasks. Establish a robust data governance framework to maintain data quality and security throughout the integration process. Implement continuous monitoring and feedback loops to fine-tune AI agent performance and adapt to evolving AR processes. By following these integration strategies, organizations can achieve a 30-50% reduction in manual AR tasks and improve cash flow forecasting accuracy by up to 25% within the first six months of implementation.

Key Integration Components

| Component | Function | Impact on AR Efficiency |

|---|---|---|

| API Connectors | Real-time data exchange | 40% reduction in data lag |

| Middleware | System compatibility | 60% improvement in cross-system communication |

| Data Lake | Centralized data access | 35% faster data retrieval for AI analysis |

| RPA | Legacy system integration | 70% reduction in manual data entry errors |

Implementation Timeline

Expect a 3-6 month integration period for mid-sized enterprises, with initial ROI visible within 4-8 weeks of full deployment. Large-scale implementations may require 6-12 months for complete integration across complex ERP ecosystems.

Prioritize change management and staff training to ensure smooth adoption of AI-augmented AR processes, allocating at least 20% of the integration budget to these critical areas. By carefully orchestrating the integration of AI agents into existing AR systems, organizations can unlock significant operational efficiencies and gain a competitive edge in financial management.

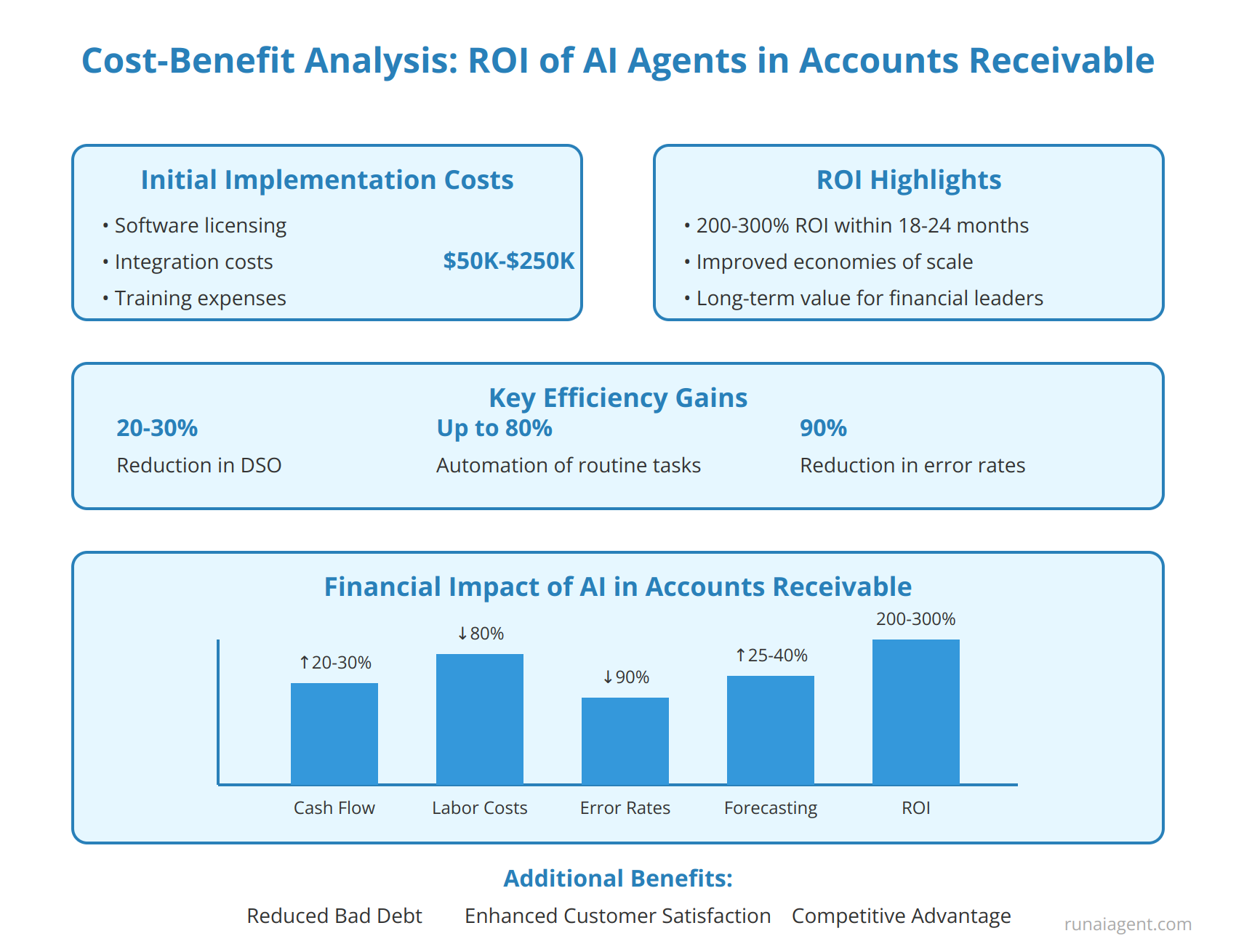

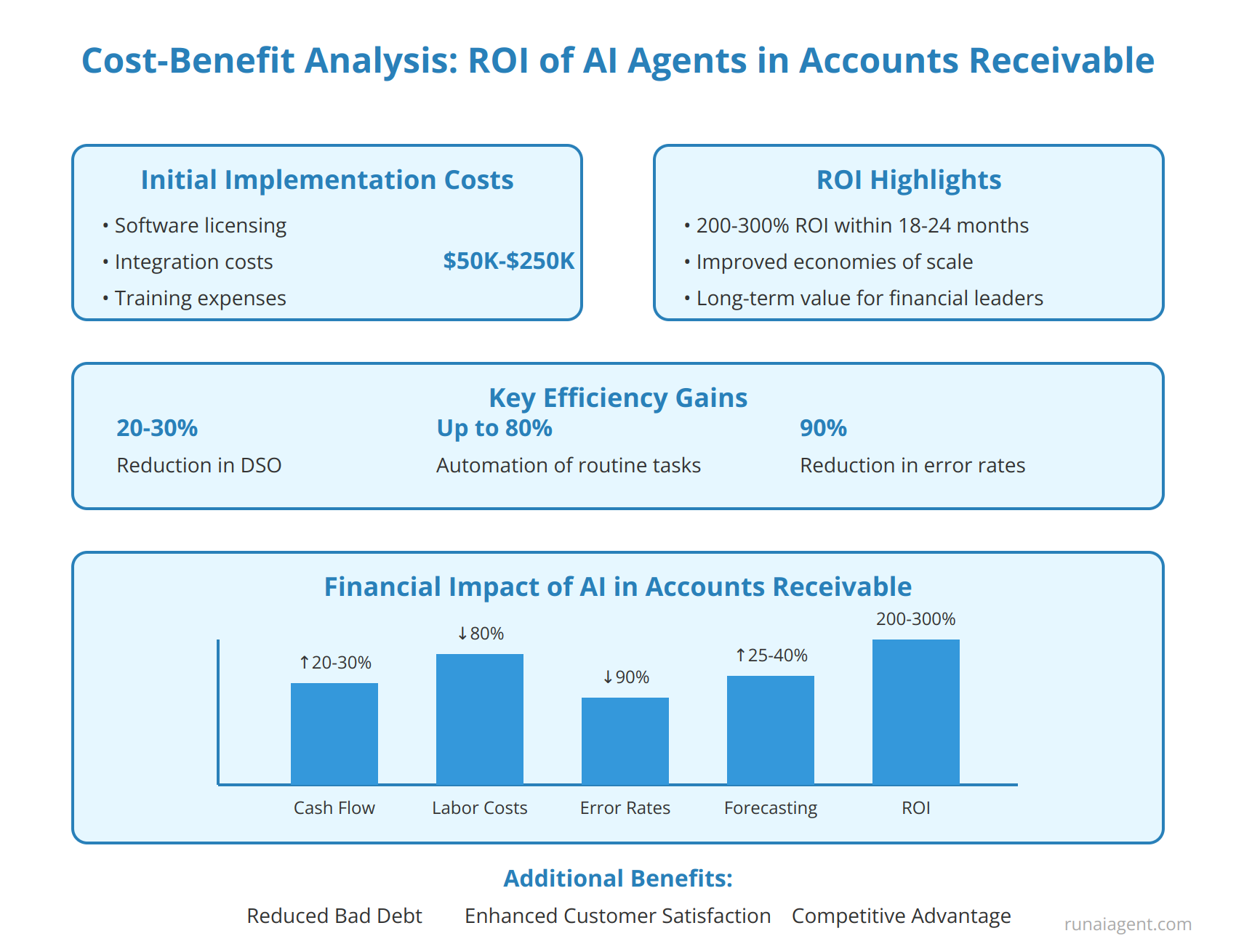

Cost-Benefit Analysis: The ROI of Implementing AI Agents in Accounts Receivable

Implementing AI agents in accounts receivable (AR) processes offers substantial return on investment (ROI) for accounting firms and finance departments. A comprehensive cost-benefit analysis reveals that AI-driven AR automation can yield significant savings and efficiency gains. Initial implementation costs, including software licensing, integration, and training, typically range from $50,000 to $250,000 depending on organization size. However, these upfront expenses are quickly offset by operational improvements. AI agents can reduce days sales outstanding (DSO) by 20-30%, accelerating cash flow and improving working capital. Labor cost savings are equally impressive, with AI automating up to 80% of routine AR tasks, allowing reallocation of staff to higher-value activities. Error rates in invoicing and payment processing drop by 90%, minimizing revenue leakage. Long-term financial impact is substantial, with many organizations reporting ROI of 200-300% within 18-24 months of deployment. Furthermore, AI-enhanced predictive analytics improve cash forecasting accuracy by 25-40%, enabling more strategic financial planning. The scalability of AI solutions also means that as transaction volumes grow, marginal costs decrease, leading to improved economies of scale. When factoring in reduced bad debt expenses, enhanced customer satisfaction from faster issue resolution, and the competitive advantage gained through real-time financial insights, the long-term value proposition of AI agents in AR becomes undeniably compelling for forward-thinking financial leaders.

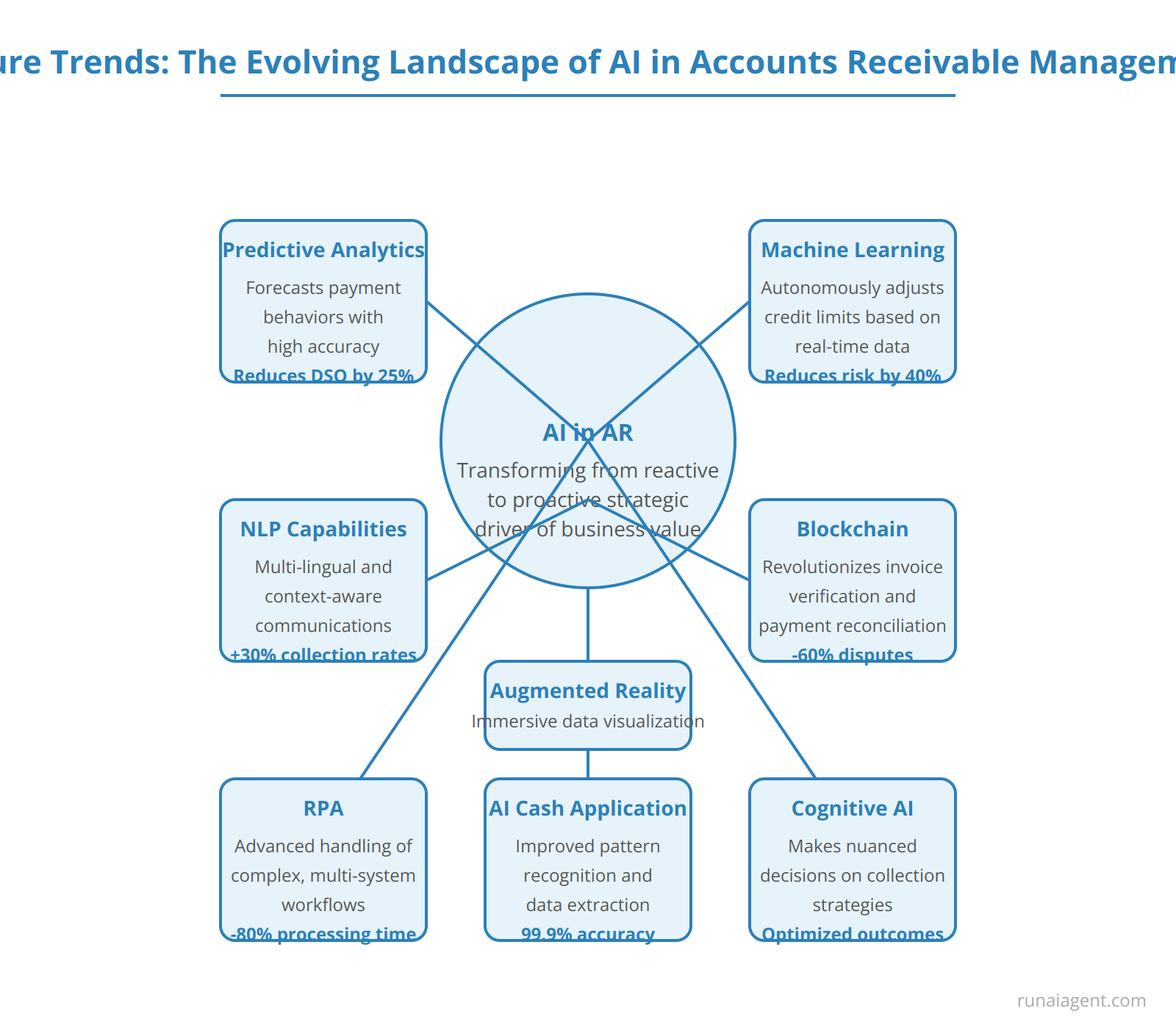

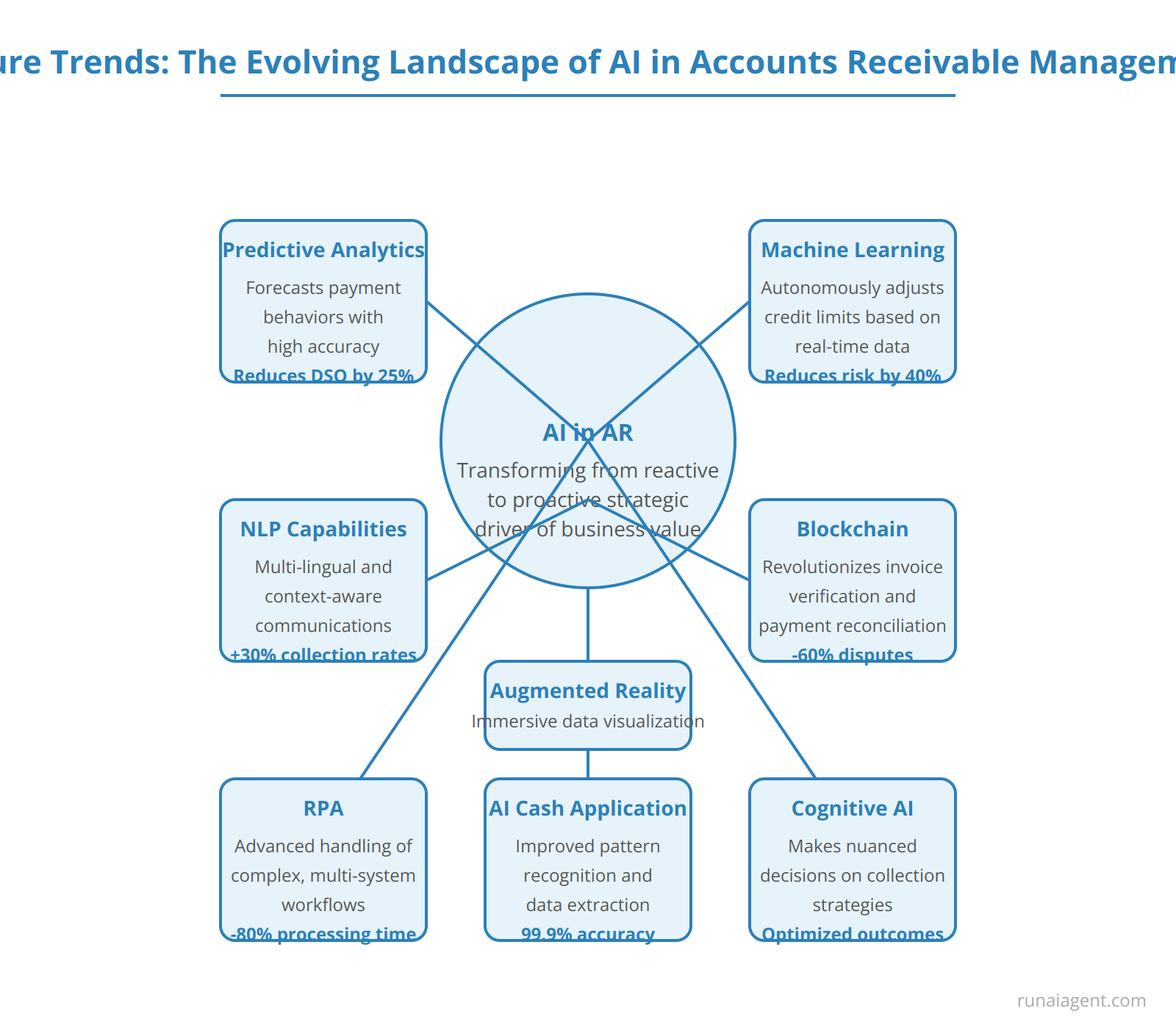

Future Trends: The Evolving Landscape of AI in Accounts Receivable Management

The future of AI in accounts receivable management is poised for transformative advancements. Predictive analytics will evolve to forecast customer payment behaviors with unprecedented accuracy, reducing Days Sales Outstanding (DSO) by up to 25%. Machine learning algorithms will autonomously adjust credit limits and terms based on real-time financial data, minimizing risk exposure by 40%. Natural Language Processing (NLP) capabilities will enhance to conduct multi-lingual, context-aware communications, improving collection rates by 30% across global markets. Blockchain integration will revolutionize invoice verification and payment reconciliation, reducing disputes by 60% and accelerating cash flow. Robotic Process Automation (RPA) will advance to handle complex, multi-system workflows, cutting manual processing time by 80%. AI-driven cash application will achieve 99.9% accuracy through improved pattern recognition and data extraction techniques. Cognitive AI will emerge to make nuanced decisions on collection strategies, optimizing outcomes based on customer profiles and market conditions. Augmented Reality (AR) interfaces will provide finance teams with immersive data visualizations, enhancing strategic decision-making capabilities. These advancements will collectively transform accounts receivable from a reactive function to a proactive, strategic driver of business value.

FAQ: Everything You Need to Know About AI Agents in Accounts Receivable

To address the growing interest in AI-powered solutions for financial operations, we’ve compiled a comprehensive FAQ about AI agents in accounts receivable. This section provides authoritative answers to the most pressing questions businesses have when considering the implementation of intelligent automation in their AR processes.

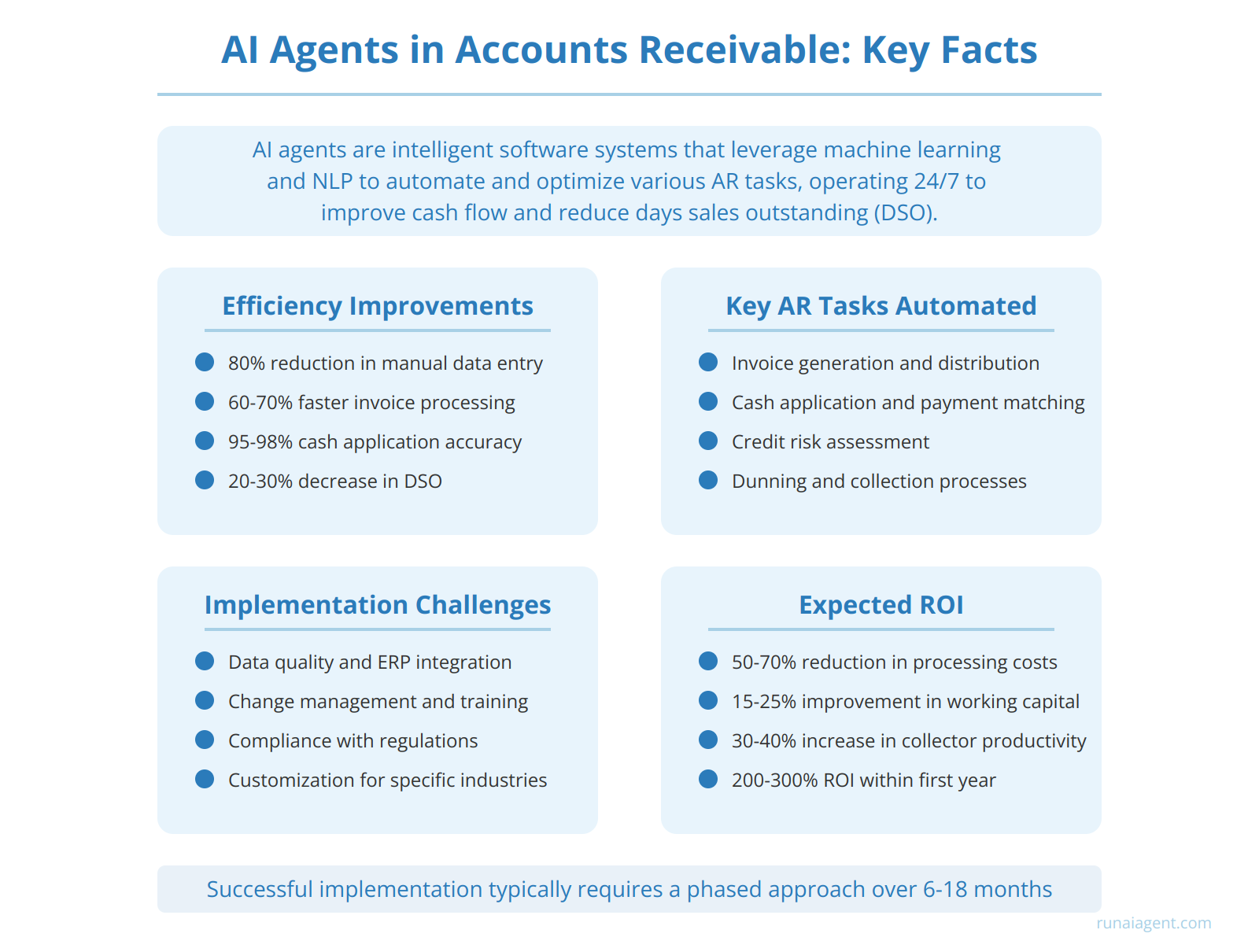

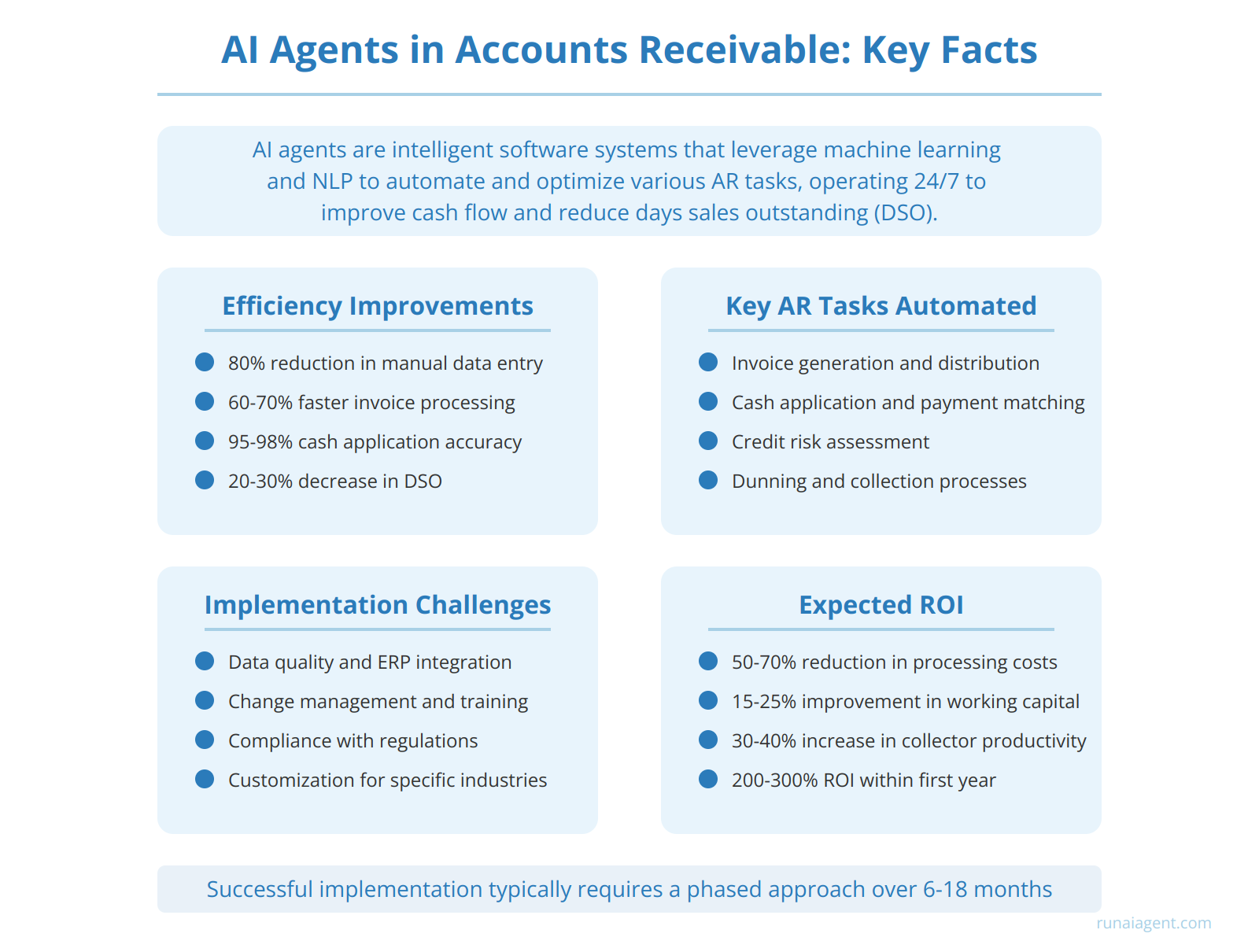

What are AI agents in accounts receivable?

AI agents in accounts receivable are intelligent software systems that leverage machine learning algorithms and natural language processing to automate and optimize various AR tasks. These agents can handle invoice processing, payment matching, customer communication, and credit risk assessment with minimal human intervention, operating 24/7 to improve cash flow and reduce days sales outstanding (DSO).

How do AI agents improve accounts receivable efficiency?

AI agents significantly enhance AR efficiency by:

- Automating up to 80% of manual data entry tasks

- Reducing invoice processing time by 60-70%

- Improving cash application accuracy to 95-98%

- Decreasing DSO by 20-30% through proactive follow-ups and personalized payment reminders

- Providing real-time insights for better decision-making and forecasting

What specific tasks can AI agents perform in accounts receivable?

AI agents in AR can perform a wide range of tasks, including:

- Automated invoice generation and distribution

- Intelligent cash application and payment matching

- Predictive analytics for credit risk assessment

- Automated dunning and collection processes

- Customer segmentation and personalized communication

- Real-time reporting and cash flow forecasting

- Exception handling and dispute resolution

What are the implementation challenges for AI agents in accounts receivable?

Key implementation challenges include:

- Data quality and integration with existing ERP systems

- Change management and employee training

- Compliance with financial regulations and data privacy laws

- Customization for industry-specific AR processes

- Balancing automation with human oversight for complex cases

Successful implementation typically requires a phased approach, starting with pilot projects and gradually expanding capabilities over 6-18 months.

What ROI can businesses expect from AI agents in accounts receivable?

Businesses implementing AI agents in AR typically see:

- 50-70% reduction in manual processing costs

- 15-25% improvement in working capital

- 30-40% increase in collector productivity

- ROI of 200-300% within the first year of full implementation

These figures vary based on organization size, industry, and current AR process maturity. A comprehensive cost-benefit analysis is crucial for accurate ROI projections.