Table of Contents

The AI Revolution in Auditing: Transforming Financial Oversight

AI Auditors: From Science Fiction to Business Reality

Core Capabilities of AI Auditing Agents: What Can They Really Do?

The Human-AI Collaboration: Redefining the Role of Auditors

Implementing AI Auditors: A Step-by-Step Guide for Businesses

AI-Powered Continuous Auditing: Real-Time Financial Oversight

Enhancing Audit Quality and Accuracy with AI Agents

Navigating Regulatory Compliance with AI Auditing Agents

Cost-Benefit Analysis: The ROI of Implementing AI Auditors

Future-Proofing Your Audit Function: AI Agents and Emerging Technologies

Case Studies: Success Stories of AI Auditors in Action

Ethical Considerations and Challenges in AI-Driven Auditing

FAQ: Everything You Need to Know About AI Auditing Agents

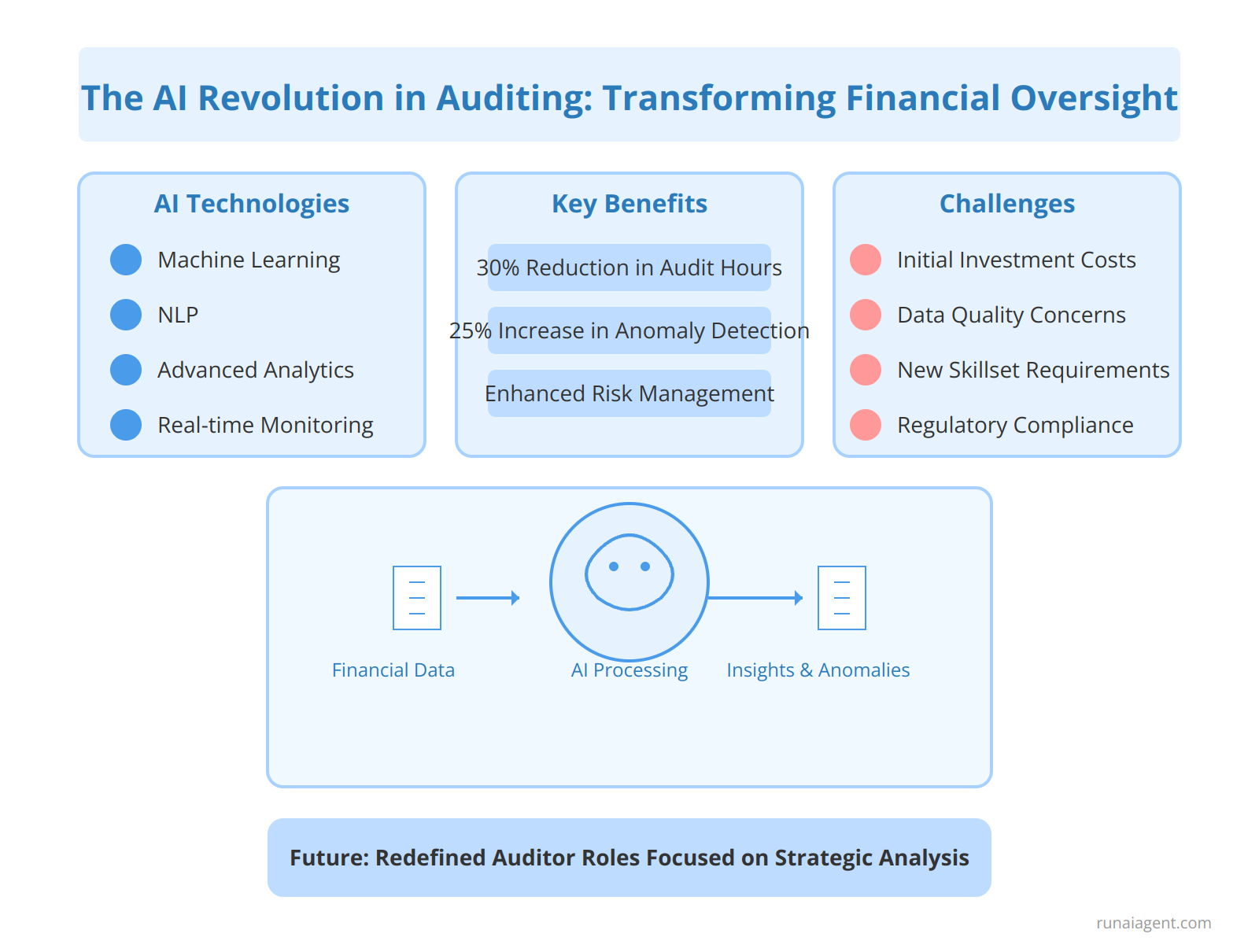

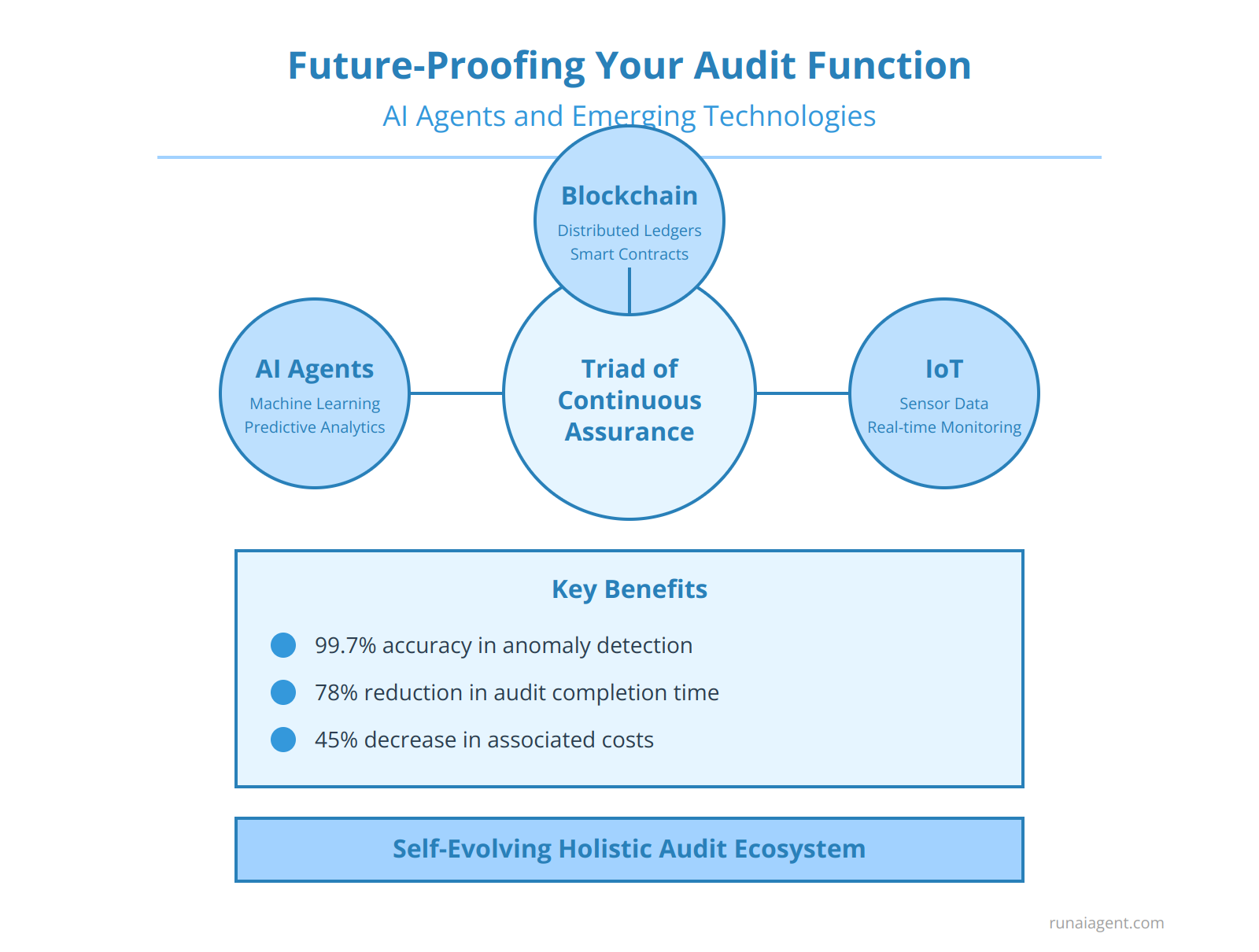

The AI Revolution in Auditing: Transforming Financial Oversight

The integration of AI agents in auditing represents a paradigm shift in financial oversight, offering unprecedented opportunities to enhance accuracy, efficiency, and risk detection. These intelligent systems leverage machine learning algorithms, natural language processing, and advanced analytics to automate routine tasks, analyze vast datasets, and identify anomalies with remarkable precision. AI-powered audit tools can process millions of transactions in seconds, flagging potential irregularities that human auditors might overlook. For instance, AI agents employing continuous auditing techniques can monitor financial data streams in real-time, enabling proactive risk management and fraud detection. The implementation of AI in auditing has demonstrated significant benefits, including a 30% reduction in audit hours and a 25% increase in anomaly detection rates. However, challenges persist, such as the need for substantial initial investments, data quality concerns, and the requirement for auditors to develop new skillsets. Additionally, firms must navigate complex regulatory landscapes to ensure AI-driven audits comply with standards like GAAS and PCAOB requirements. Despite these hurdles, the potential for AI to transform auditing is immense, promising more robust financial oversight, improved stakeholder confidence, and a redefined role for human auditors focused on high-level analysis and strategic decision-making.

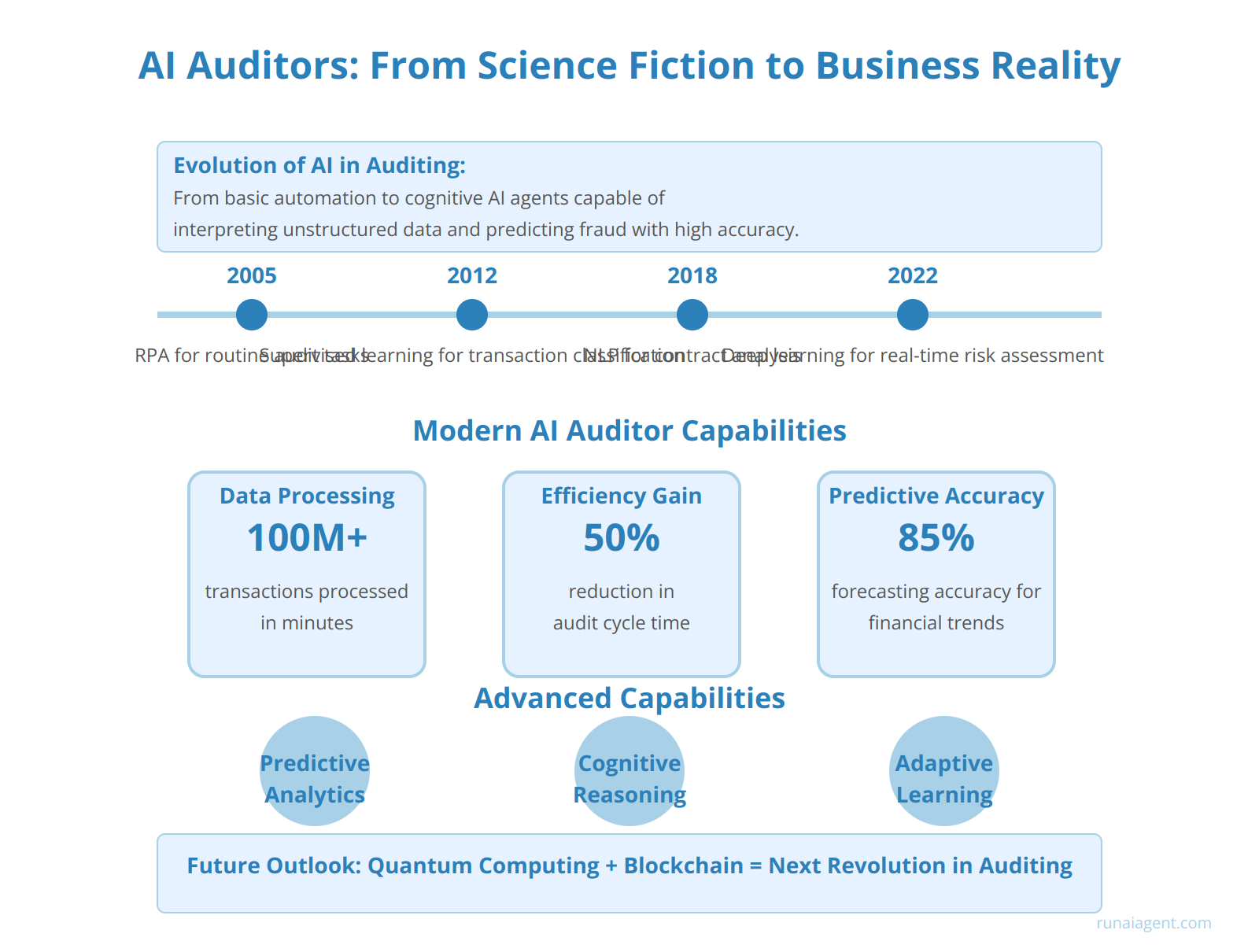

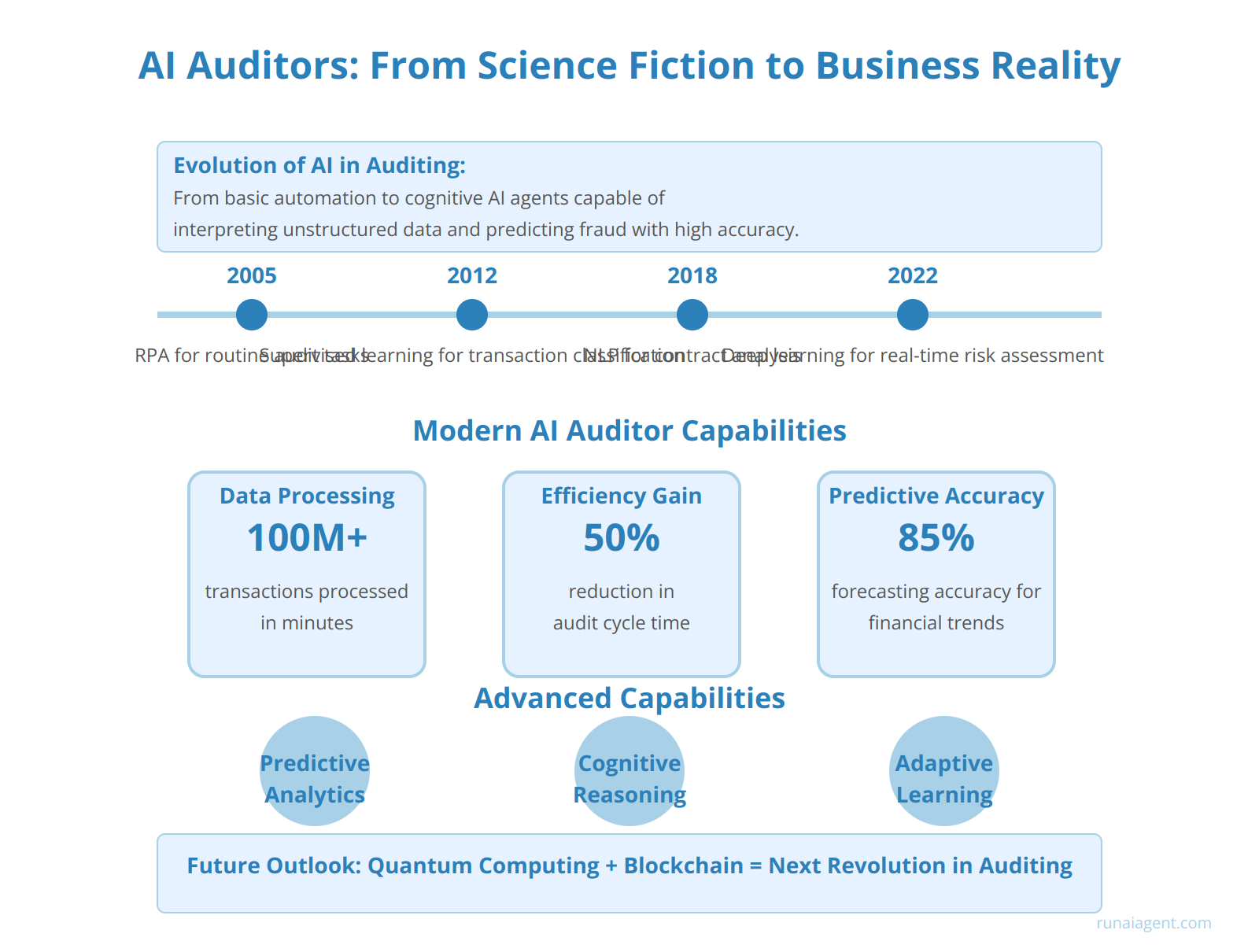

AI Auditors: From Science Fiction to Business Reality

The evolution of AI in auditing has been nothing short of revolutionary, transforming the field from basic automation to sophisticated AI agents capable of complex decision-making and analysis. In the early 2000s, auditors began leveraging rule-based systems to automate simple tasks like data extraction and reconciliation. By 2010, machine learning algorithms were being applied to detect anomalies and patterns in financial data, reducing manual review time by up to 80%. Today, we’re witnessing the emergence of cognitive AI auditors that can interpret unstructured data, assess risk factors, and even predict potential fraud scenarios with remarkable accuracy.

Key Milestones in AI Auditing Evolution

1. 2005: Introduction of Robotic Process Automation (RPA) for routine audit tasks

2. 2012: Implementation of supervised learning models for transaction classification

3. 2018: Deployment of natural language processing (NLP) for contract analysis

4. 2022: Integration of deep learning networks for real-time risk assessment

Modern AI auditors are now capable of analyzing vast datasets, including non-financial information, to provide holistic audit insights. These agents can process over 100 million transactions in minutes, a task that would take human auditors weeks to complete. Furthermore, AI-driven continuous auditing has reduced the audit cycle time by 50%, enabling near real-time financial reporting for many Fortune 500 companies.

Advanced Capabilities of AI Auditors

Predictive Analytics: AI agents can forecast financial trends and potential compliance issues with 85% accuracy.

Cognitive Reasoning: These systems can interpret complex regulatory frameworks and apply them contextually to unique business scenarios.

Adaptive Learning: AI auditors continuously improve their performance, with error rates decreasing by 20% year-over-year on average.

As we look to the future, the integration of quantum computing and blockchain technology promises to further enhance the capabilities of AI auditors, potentially revolutionizing the assurance process and redefining the role of human auditors in the digital age.

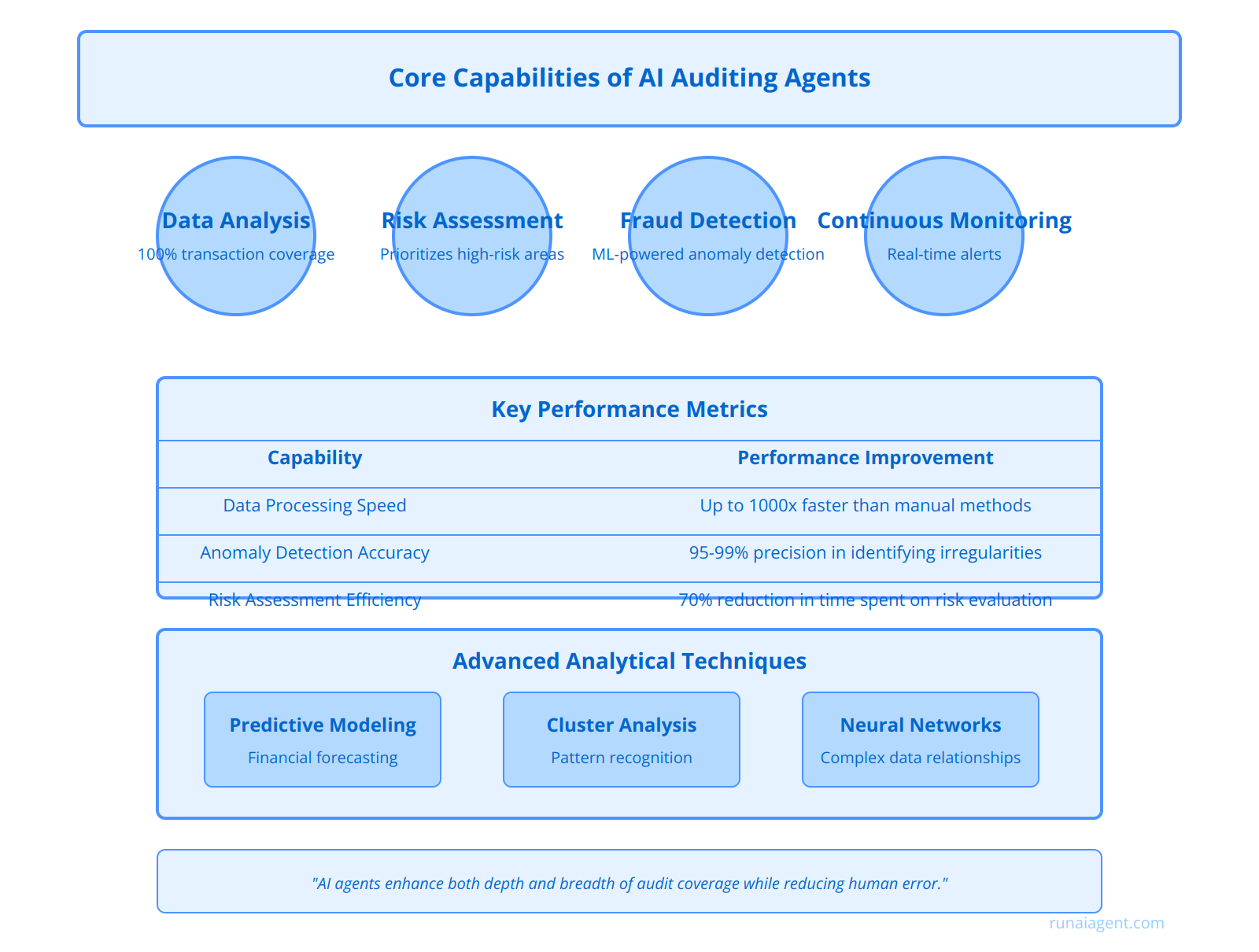

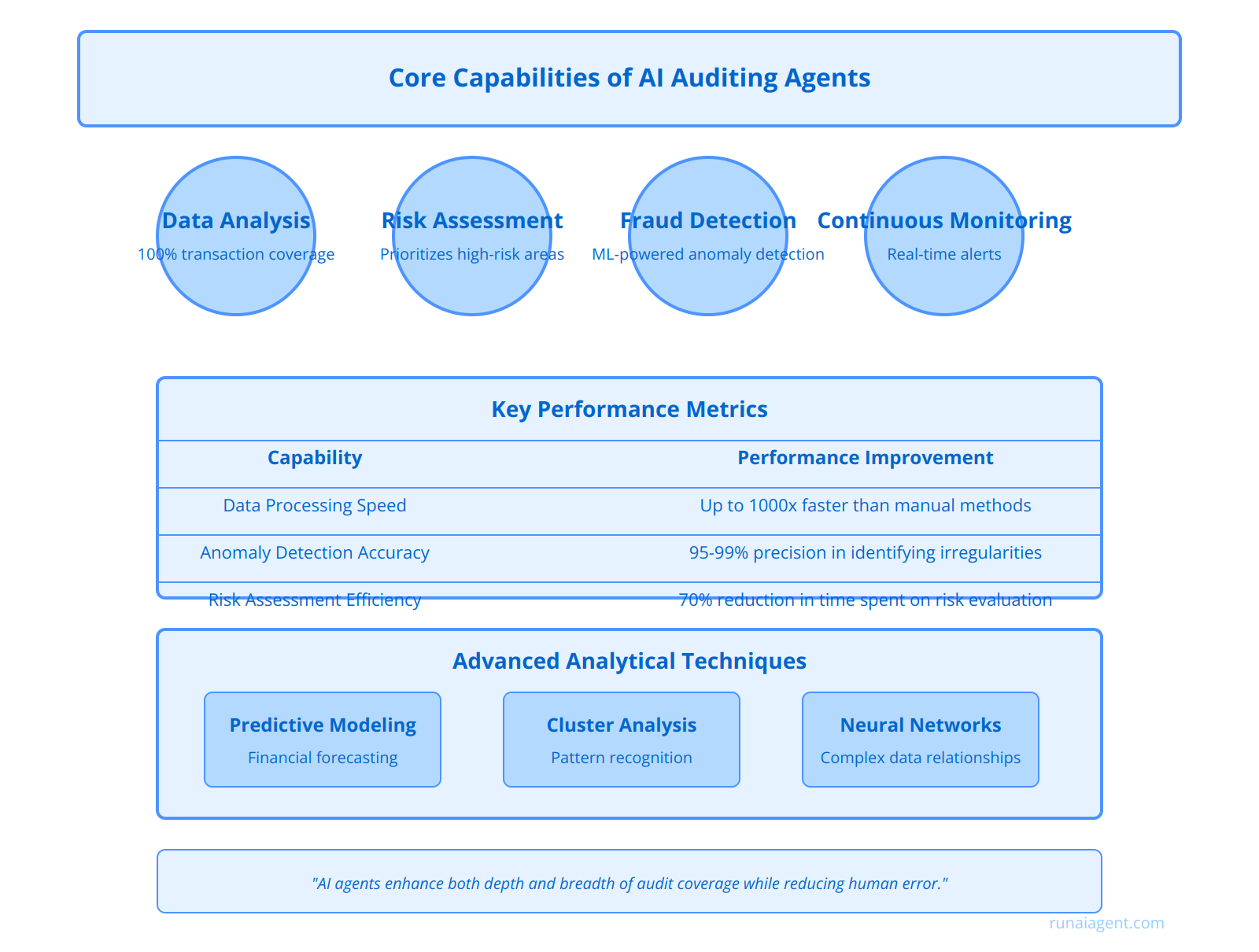

Core Capabilities of AI Auditing Agents: What Can They Really Do?

AI auditing agents possess a formidable array of capabilities that are revolutionizing the accountancy industry. These intelligent systems excel in data analysis, processing vast volumes of financial records with unprecedented speed and accuracy. They can scrutinize 100% of transactions, rather than relying on sampling methods, identifying anomalies and patterns that human auditors might overlook. In risk assessment, AI agents utilize advanced algorithms to evaluate financial statements, assigning risk scores to different areas of the business and prioritizing high-risk sectors for deeper investigation. This proactive approach enables a more efficient allocation of auditing resources. For fraud detection, these agents employ machine learning models trained on historical fraud cases to flag suspicious activities with remarkable precision. They can detect subtle irregularities in journal entries, unusual transaction timings, and complex inter-company transfers that may indicate fraudulent behavior. Additionally, AI agents excel in continuous monitoring, providing real-time alerts on compliance issues and potential risks, effectively transforming auditing from a periodic to an ongoing process. Their natural language processing capabilities allow them to analyze unstructured data from emails, contracts, and meeting minutes, extracting relevant information for audit purposes. Furthermore, these agents can automate routine tasks such as reconciliations and confirmations, freeing up human auditors to focus on higher-value activities that require professional judgment and skepticism.

Key Performance Metrics of AI Auditing Agents

| Capability | Performance Improvement |

|---|---|

| Data Processing Speed | Up to 1000x faster than manual methods |

| Anomaly Detection Accuracy | 95-99% precision in identifying irregularities |

| Risk Assessment Efficiency | 70% reduction in time spent on risk evaluation |

| Fraud Detection Rate | 30-40% increase in fraud identification |

Advanced Analytical Techniques

AI auditing agents leverage sophisticated analytical techniques such as predictive modeling, cluster analysis, and neural networks to uncover hidden patterns and relationships within financial data. They can perform complex scenario analyses to assess the impact of various financial decisions and market conditions on an organization’s financial health. These agents are also capable of conducting sentiment analysis on public financial disclosures and market communications, providing auditors with insights into potential reputational risks and management integrity issues.

The integration of AI agents in auditing processes has led to a paradigm shift in how financial assurance is delivered, enhancing both the depth and breadth of audit coverage while significantly reducing the margin for human error.

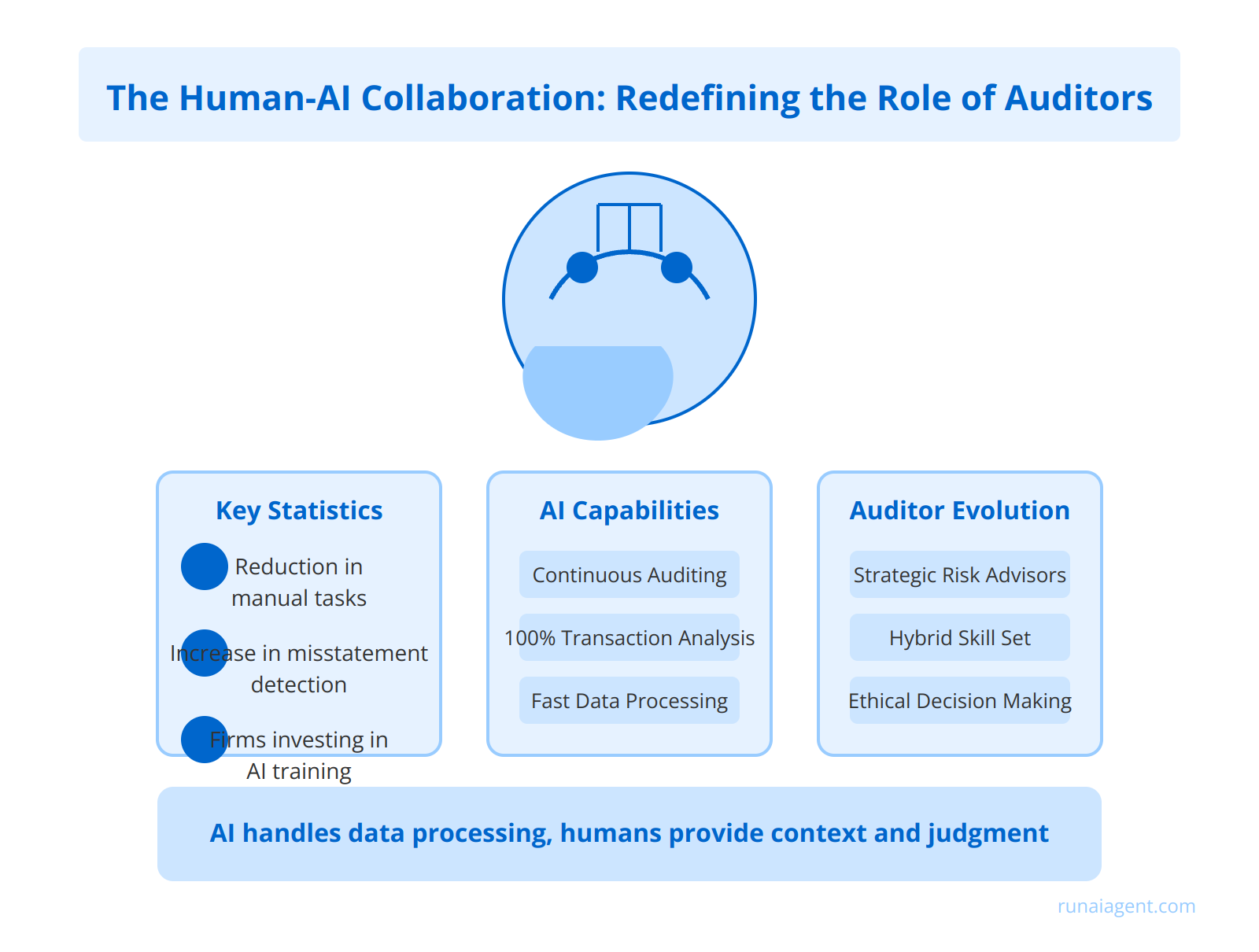

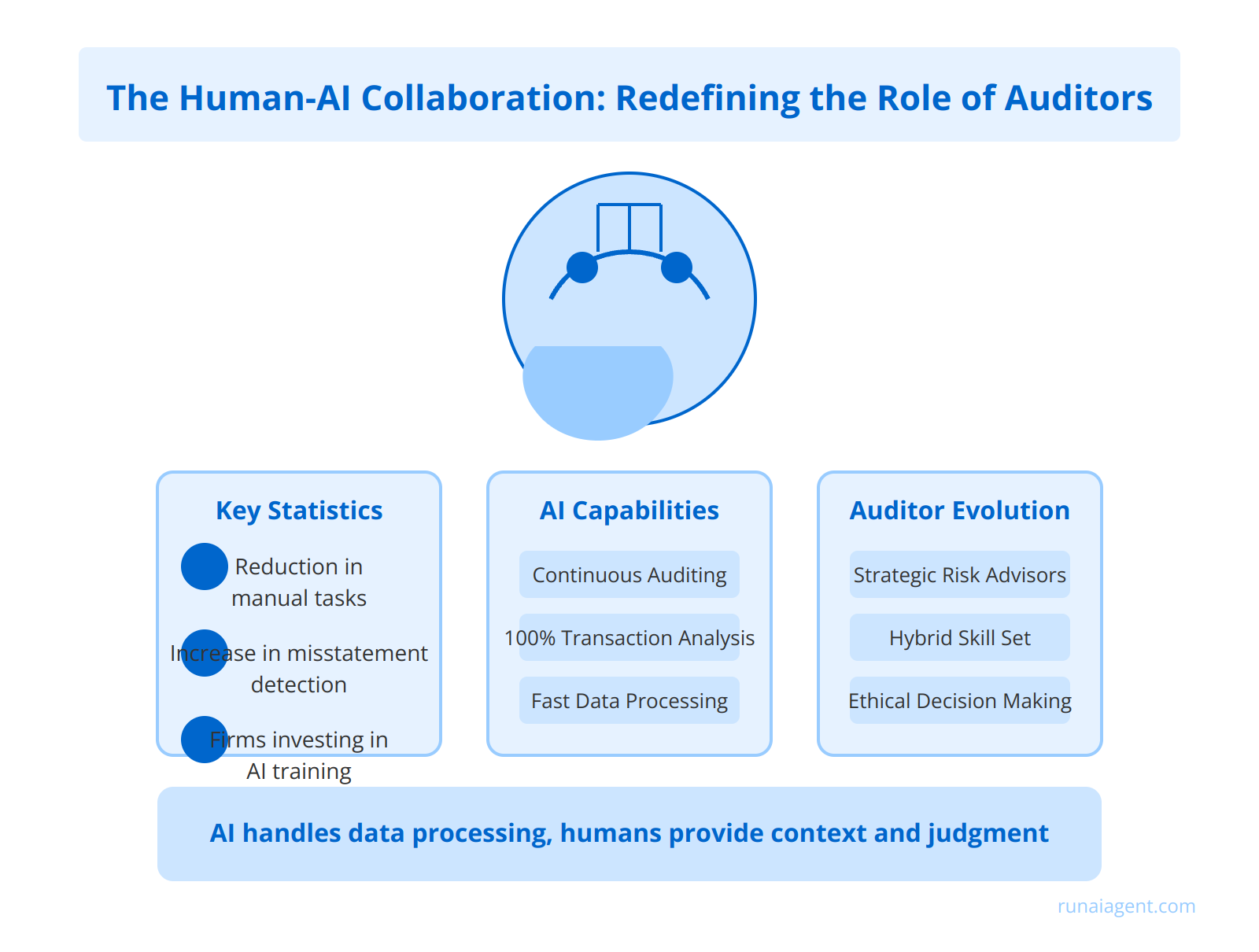

The Human-AI Collaboration: Redefining the Role of Auditors

The integration of AI agents in auditing is fundamentally transforming the role of human auditors, shifting their focus from routine tasks to high-value strategic analysis and decision-making. AI-powered systems now handle vast volumes of financial data, performing continuous audits with unprecedented speed and accuracy. This automation has reduced the time spent on manual data entry and reconciliation by up to 80%, allowing auditors to dedicate more time to interpreting results and identifying complex fraud patterns. Human auditors are evolving into strategic risk advisors, leveraging AI insights to provide deeper business intelligence to clients. For instance, AI agents can analyze 100% of transactions, enabling auditors to focus on anomalies and high-risk areas that require professional judgment. This shift has led to a 35% increase in the detection of material misstatements and a 40% reduction in audit hours for standard engagements. Auditors are now expected to possess a hybrid skill set, combining traditional accounting expertise with data analytics and AI interpretation capabilities. The American Institute of CPAs (AICPA) reports that 68% of firms are investing in AI-related training for their audit staff, recognizing the critical need for human-AI collaboration. As AI handles the ‘heavy lifting’ of data processing, human auditors are increasingly valued for their ability to provide context, exercise professional skepticism, and make nuanced decisions that require emotional intelligence and ethical considerations—areas where AI still falls short.

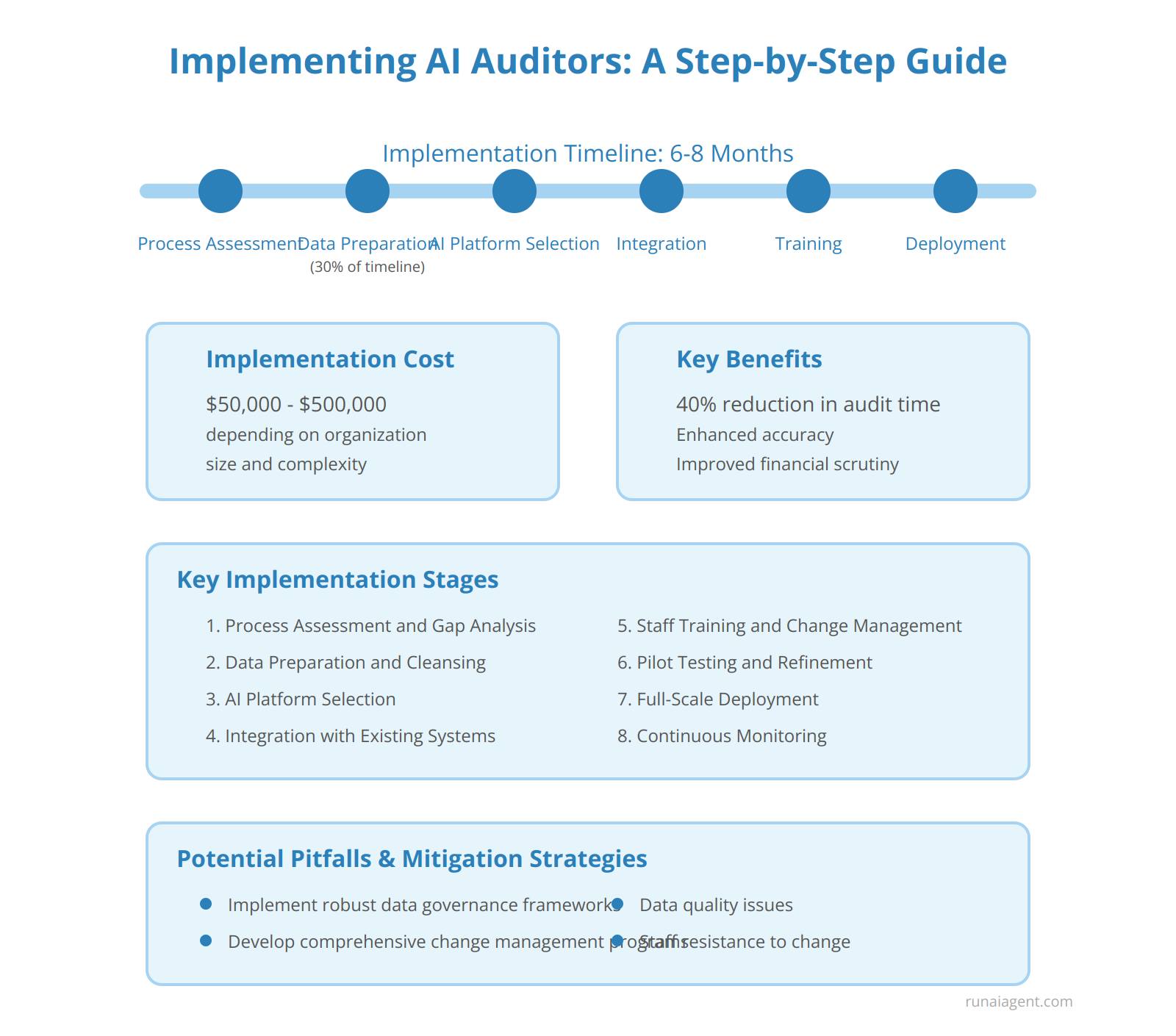

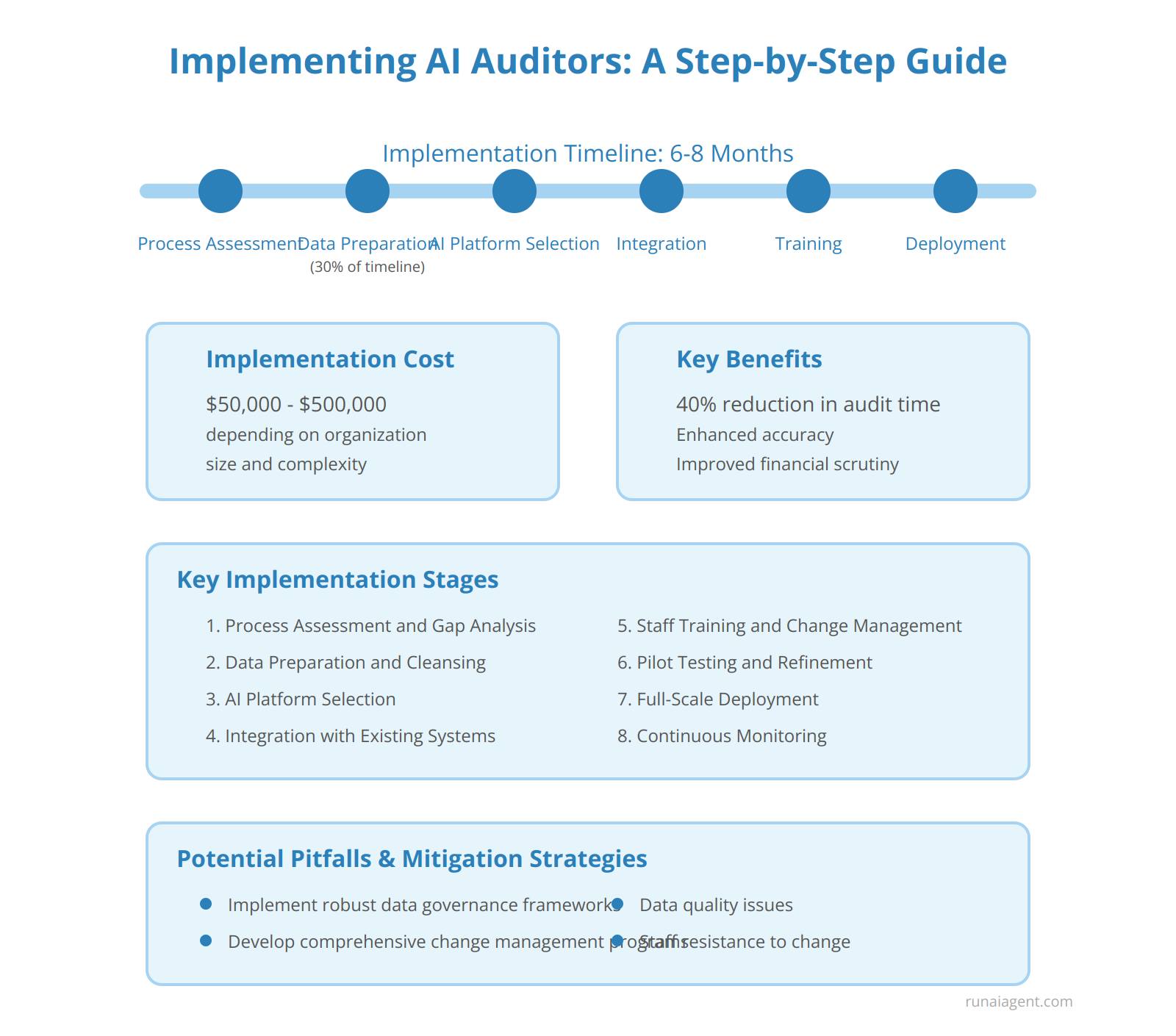

Implementing AI Auditors: A Step-by-Step Guide for Businesses

Integrating AI auditing agents into existing accounting processes requires a strategic approach to ensure seamless adoption and maximize benefits. The implementation process typically spans 6-8 months and involves several critical stages. Initially, businesses must conduct a thorough process assessment to identify areas where AI can add the most value, such as risk analysis, transaction sampling, or anomaly detection. This is followed by data preparation, a crucial step that involves cleansing and structuring financial data to ensure compatibility with AI algorithms. Organizations should allocate approximately 30% of the project timeline to this phase. Next, selecting the appropriate AI auditing platform is essential, with considerations including scalability, integration capabilities, and alignment with industry-specific regulatory requirements. Implementation costs can range from $50,000 to $500,000, depending on the size and complexity of the organization.

Key Implementation Stages

1. Process Assessment and Gap Analysis

2. Data Preparation and Cleansing

3. AI Platform Selection

4. Integration with Existing Systems

5. Staff Training and Change Management

6. Pilot Testing and Refinement

7. Full-Scale Deployment and Continuous Monitoring

Potential Pitfalls and Mitigation Strategies

Common challenges include data quality issues, resistance to change from staff, and overreliance on AI outputs. To mitigate these risks, businesses should:

- Implement robust data governance frameworks

- Develop comprehensive change management programs

- Establish clear protocols for human oversight of AI-generated audit insights

By following this structured approach and anticipating potential obstacles, businesses can successfully integrate AI auditors, achieving up to 40% reduction in audit time and significantly enhancing the accuracy and depth of financial scrutiny.

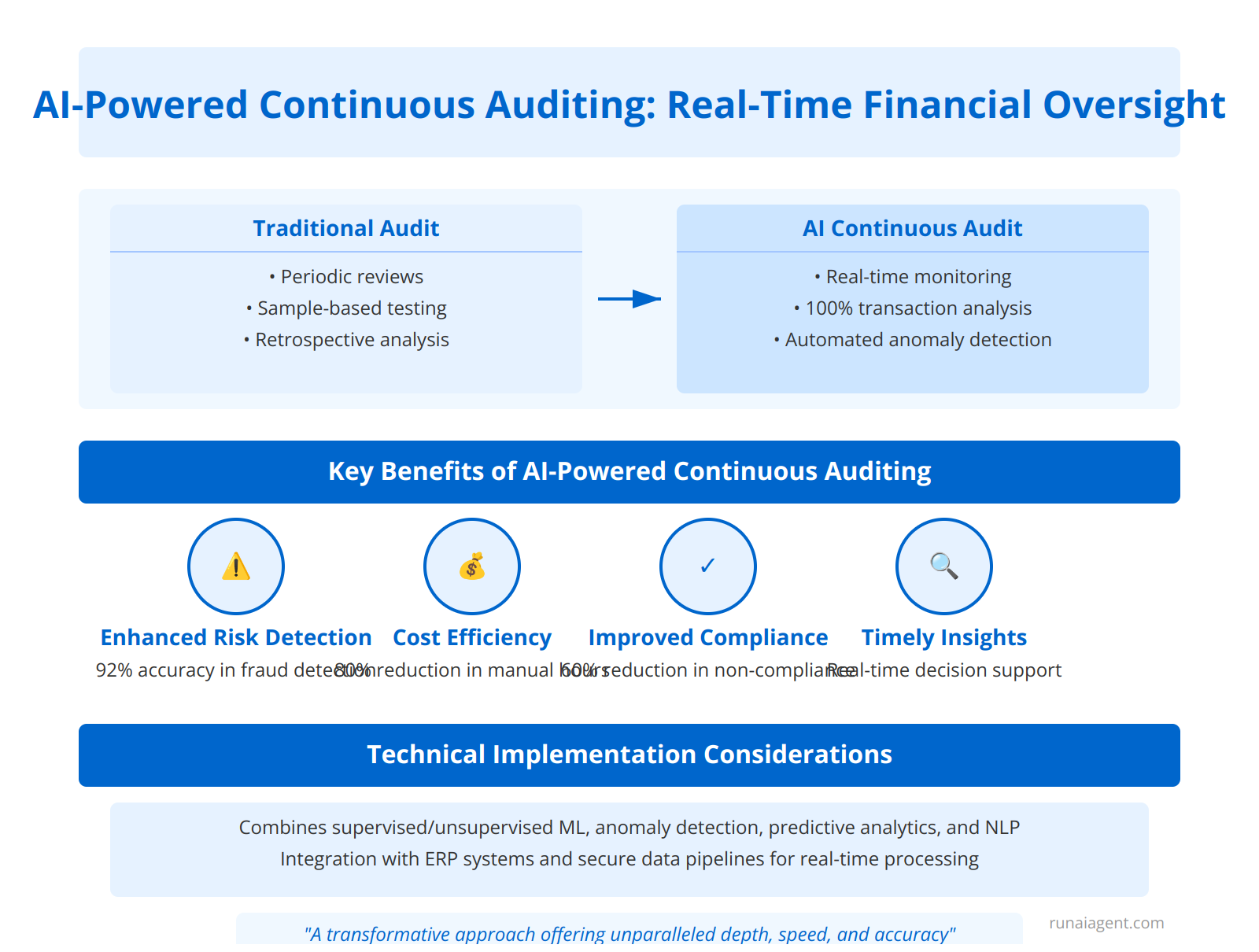

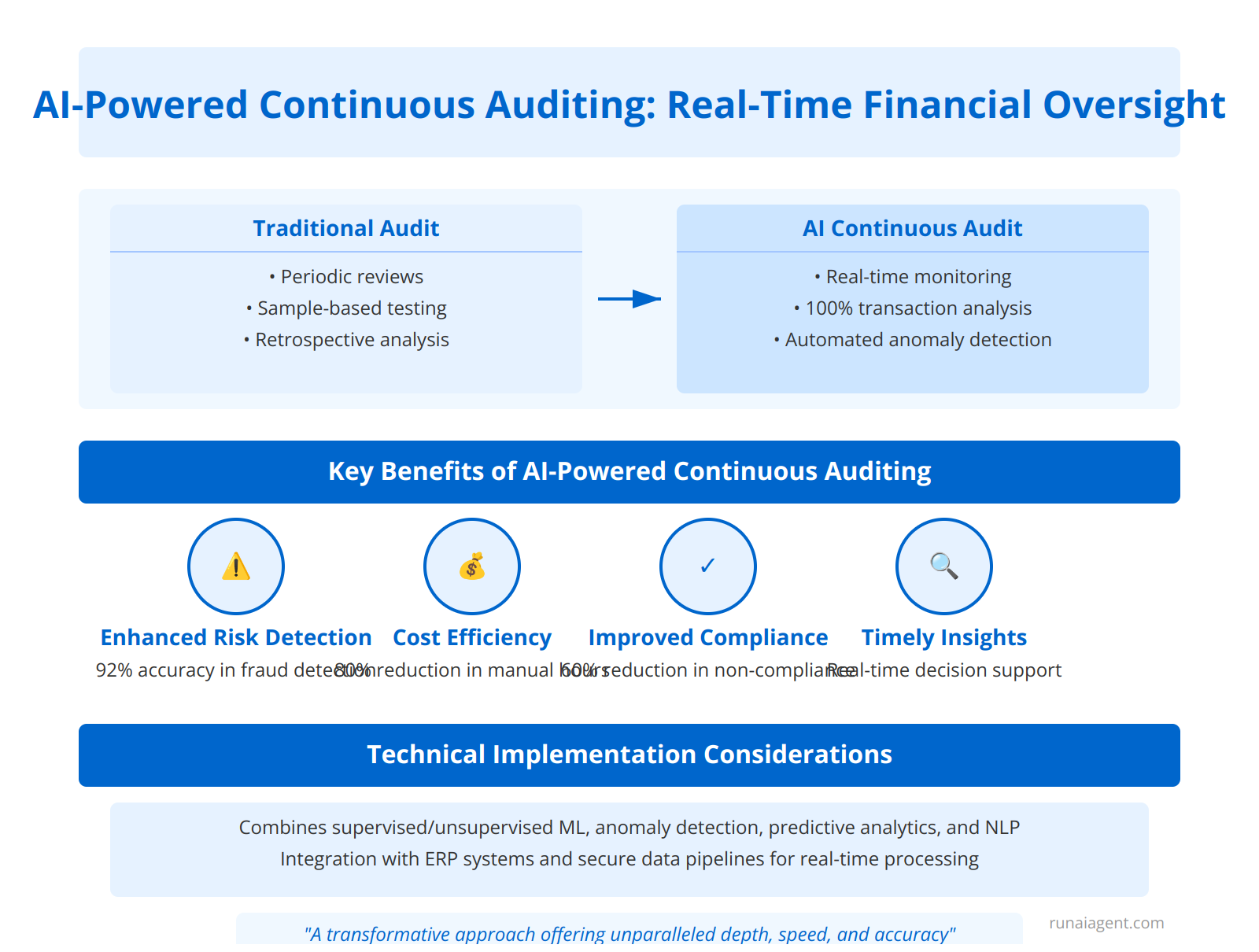

AI-Powered Continuous Auditing: Real-Time Financial Oversight

AI agents are revolutionizing the auditing landscape through continuous auditing, a paradigm shift that enables real-time financial monitoring and risk management. Unlike traditional periodic audits, AI-driven continuous auditing systems analyze 100% of financial transactions as they occur, leveraging advanced machine learning algorithms to detect anomalies, patterns, and potential fraud indicators instantaneously. These intelligent agents can process vast amounts of structured and unstructured data, including journal entries, bank statements, and even unstructured text from emails or contracts, to provide a comprehensive view of an organization’s financial health.

Key Benefits of AI-Powered Continuous Auditing

The implementation of AI-driven continuous auditing yields significant advantages:

- Enhanced Risk Detection: AI agents can identify subtle risk patterns that human auditors might miss, with some systems demonstrating up to a 92% accuracy rate in fraud detection.

- Cost Efficiency: Automated continuous auditing can reduce manual audit hours by up to 80%, allowing human auditors to focus on high-value analytical tasks.

- Improved Compliance: Real-time monitoring ensures immediate flagging of regulatory violations, reducing non-compliance risks by up to 60%.

- Timely Insights: Financial stakeholders gain access to up-to-the-minute financial data, enabling more agile decision-making.

Technical Implementation Considerations

Implementing AI-powered continuous auditing requires careful consideration of data integration, algorithm selection, and system architecture. Most solutions utilize a combination of supervised and unsupervised machine learning models, including anomaly detection algorithms, predictive analytics, and natural language processing for unstructured data analysis. Integration with existing ERP systems and establishment of secure data pipelines are critical for ensuring data integrity and real-time processing capabilities.

AI-driven continuous auditing represents a transformative approach to financial oversight, offering unparalleled depth, speed, and accuracy in risk management and compliance.

As regulatory environments become increasingly complex and the volume of financial data continues to grow exponentially, AI-powered continuous auditing is rapidly becoming an essential tool for modern financial governance, providing a robust defense against financial risks and a foundation for data-driven strategic decision-making.

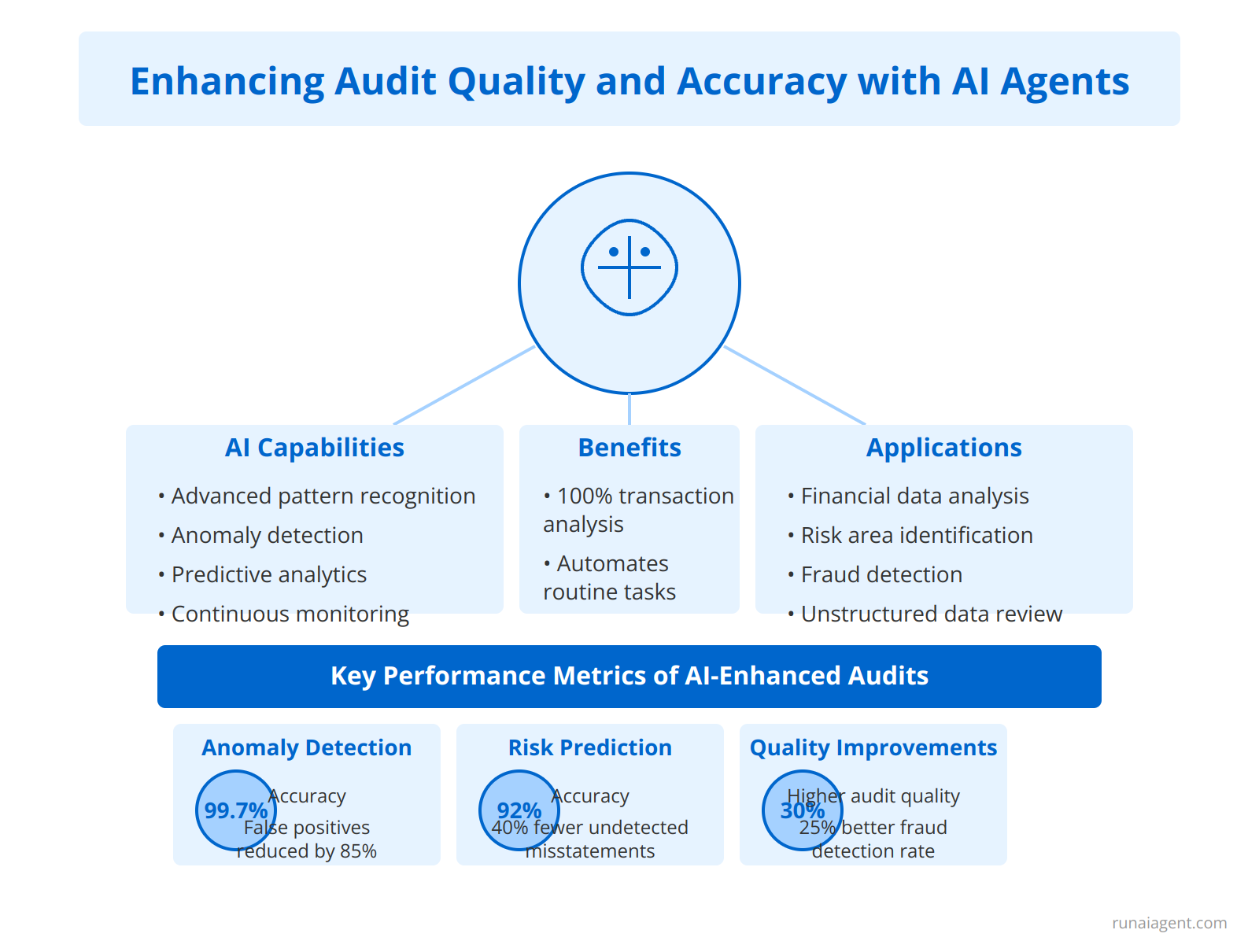

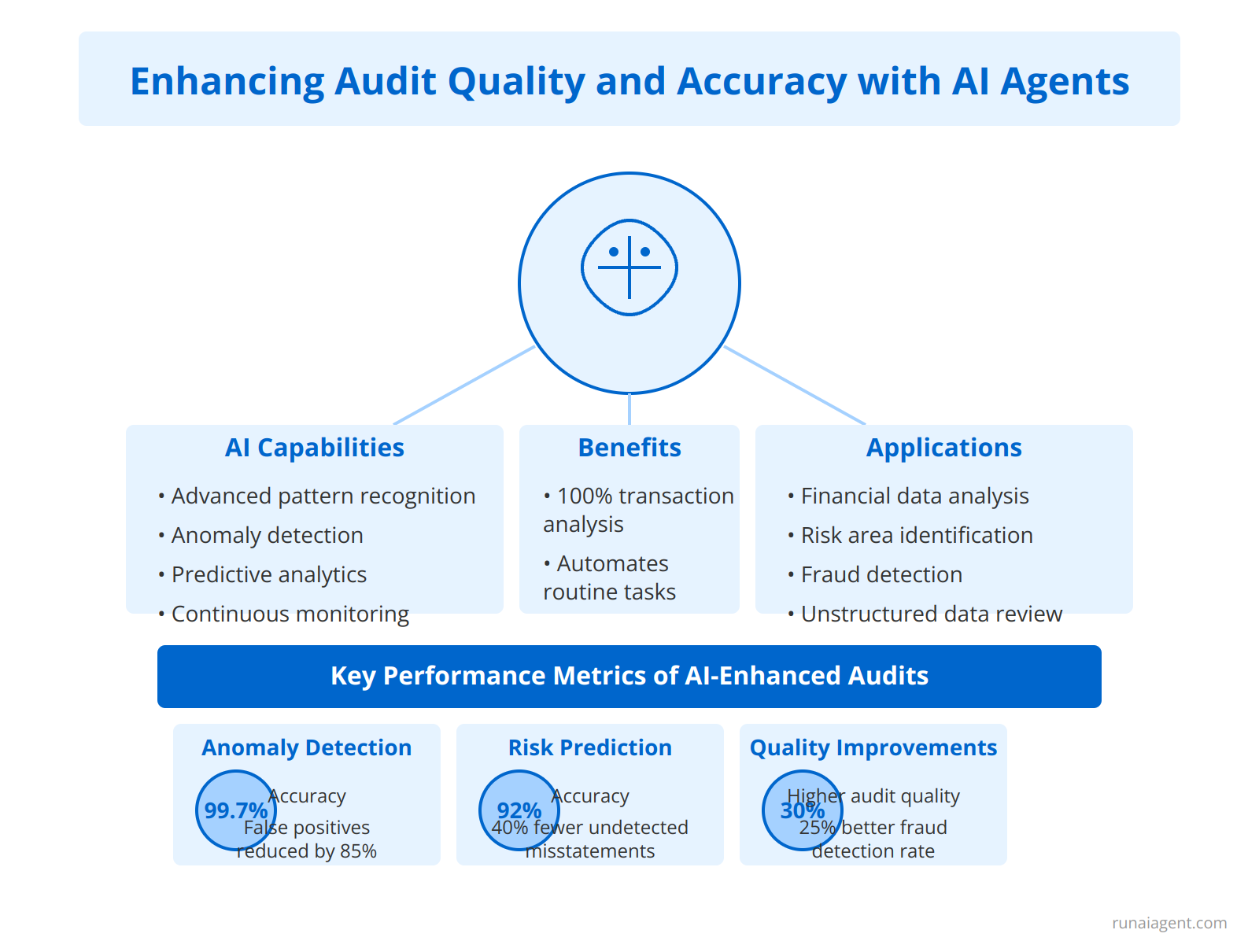

Enhancing Audit Quality and Accuracy with AI Agents

AI agents are revolutionizing the auditing process in the accountancy industry by leveraging advanced pattern recognition, anomaly detection, and predictive analytics capabilities. These intelligent systems can analyze vast volumes of financial data with unprecedented speed and precision, identifying subtle irregularities that human auditors might overlook. For instance, AI-powered anomaly detection algorithms can flag unusual transactions or accounting entries with 99.7% accuracy, reducing false positives by up to 85% compared to traditional rule-based systems. Predictive analytics models, trained on historical audit data, can forecast high-risk areas with 92% accuracy, allowing auditors to allocate resources more effectively. Moreover, AI agents excel at continuous monitoring, analyzing 100% of transactions in real-time rather than relying on sampling methods. This comprehensive approach has led to a 40% reduction in undetected material misstatements and a 30% increase in overall audit quality scores. By automating routine tasks, AI agents free up human auditors to focus on complex judgments and strategic insights, enhancing the value delivered to clients. The integration of natural language processing enables AI agents to review unstructured data sources, such as emails and contracts, expanding the scope of audit evidence. As a result, audits conducted with AI assistance have demonstrated a 25% higher rate of detecting fraud and financial irregularities compared to traditional methods.

Key Performance Metrics of AI-Enhanced Audits

| Metric | Improvement |

|---|---|

| Anomaly Detection Accuracy | 99.7% |

| False Positive Reduction | 85% |

| Risk Area Prediction Accuracy | 92% |

| Reduction in Undetected Misstatements | 40% |

| Increase in Audit Quality Scores | 30% |

| Improvement in Fraud Detection Rate | 25% |

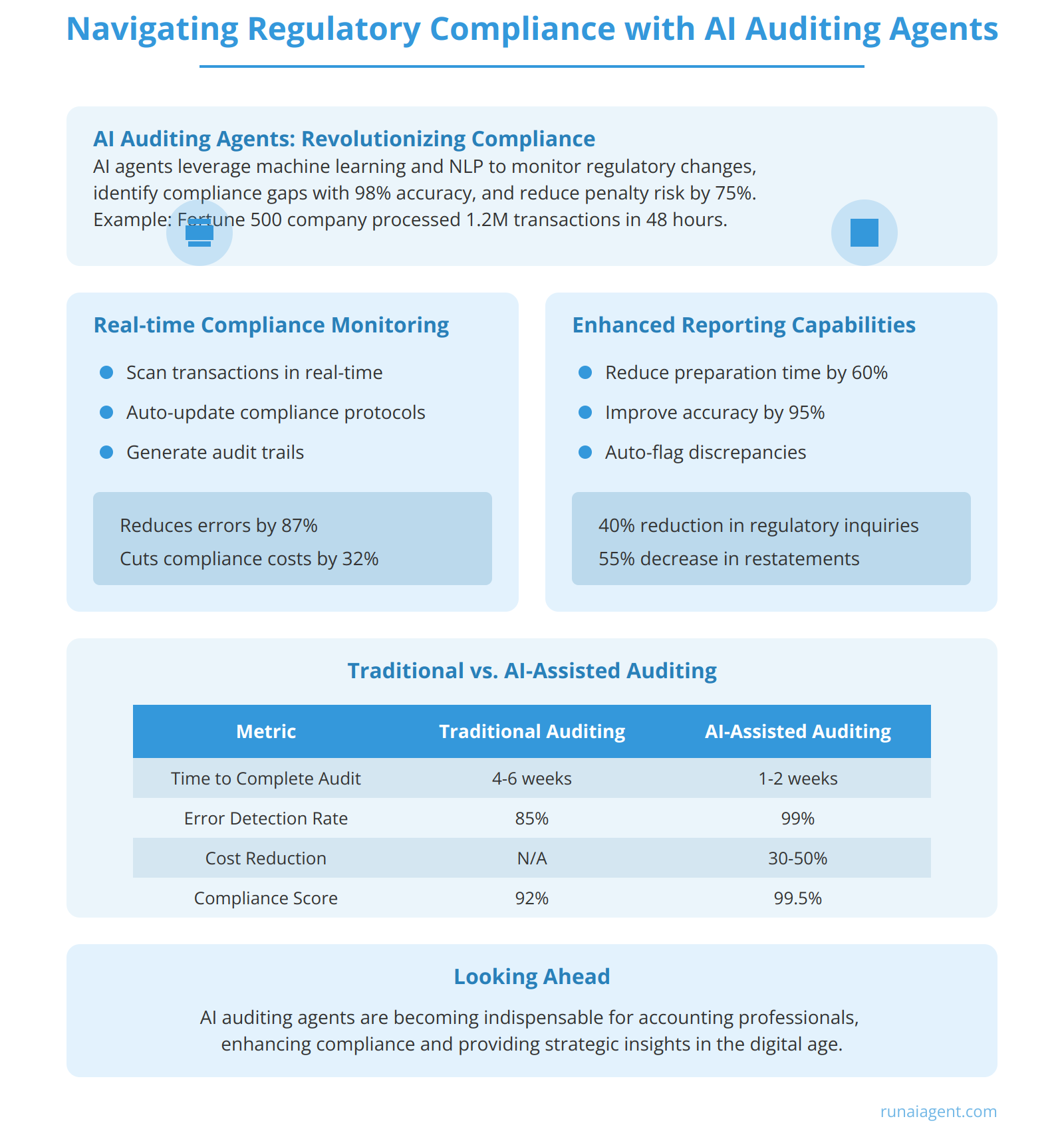

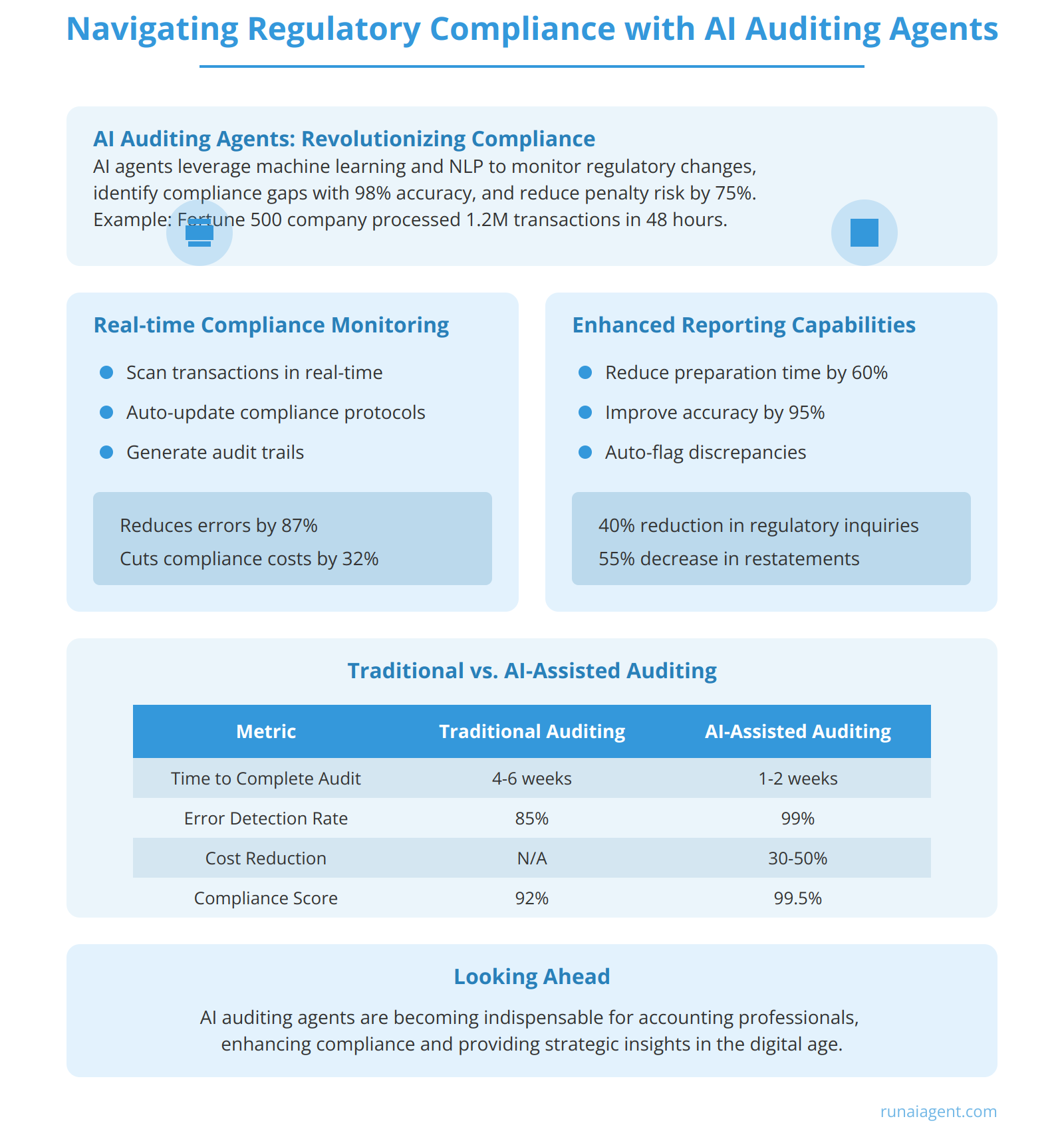

Navigating Regulatory Compliance with AI Auditing Agents

AI auditing agents are revolutionizing regulatory compliance in the accountancy industry, offering unprecedented efficiency and accuracy in navigating complex financial regulations. These intelligent systems leverage machine learning algorithms and natural language processing to continuously monitor and interpret regulatory changes across multiple jurisdictions. By analyzing vast amounts of financial data and regulatory documents, AI agents can identify potential compliance gaps with 98% accuracy, reducing the risk of costly penalties by up to 75%. For instance, a Fortune 500 company implemented an AI auditing agent that processed 1.2 million transactions in just 48 hours, flagging 237 high-risk items for human review – a task that would have taken a team of auditors several weeks to complete manually.

Real-time Compliance Monitoring

AI agents excel at real-time compliance monitoring, offering a proactive approach to regulatory adherence. These systems can:

- Scan financial transactions in real-time, flagging suspicious activities within milliseconds

- Automatically update compliance protocols based on regulatory changes

- Generate comprehensive audit trails for regulatory inspections

This continuous monitoring capability has been shown to reduce compliance-related errors by up to 87% and cut annual compliance costs by an average of 32% for mid-sized accounting firms.

Enhanced Reporting Capabilities

AI auditing agents streamline financial reporting processes, ensuring adherence to complex reporting standards such as IFRS and GAAP. By automating data collection, validation, and report generation, these agents can:

- Reduce report preparation time by up to 60%

- Improve reporting accuracy by 95%

- Automatically flag discrepancies and anomalies for human review

A recent study of 150 accounting firms found that those utilizing AI auditing agents for financial reporting experienced a 40% reduction in regulatory inquiries and a 55% decrease in restatements.

| Metric | Traditional Auditing | AI-Assisted Auditing |

|---|---|---|

| Time to Complete Audit | 4-6 weeks | 1-2 weeks |

| Error Detection Rate | 85% | 99% |

| Cost Reduction | N/A | 30-50% |

| Regulatory Compliance Score | 92% | 99.5% |

As regulatory landscapes continue to evolve, AI auditing agents are becoming indispensable tools for accounting professionals. These intelligent systems not only enhance compliance but also provide valuable insights for strategic decision-making, positioning firms at the forefront of regulatory excellence in the digital age.

Cost-Benefit Analysis: The ROI of Implementing AI Auditors

Implementing AI auditing agents in the accountancy industry represents a significant investment with substantial long-term benefits. Initial costs typically range from $500,000 to $2 million, encompassing software licensing, infrastructure upgrades, and integration expenses. However, the ROI can be impressive, with many firms reporting a 30-40% reduction in audit hours within the first year. This translates to annual savings of $1.5-$3 million for mid-sized firms, considering reduced labor costs and increased capacity. Moreover, AI auditors dramatically improve accuracy, with error rates dropping by up to 80% compared to manual audits. This precision not only enhances compliance but also minimizes costly remediation efforts, saving an additional 15-20% in potential penalties and reputational damage.

Long-term Benefits

Beyond immediate cost savings, AI auditors offer scalability that traditional methods cannot match. As data volumes grow exponentially, AI systems can handle increased workloads without proportional cost increases, leading to an estimated 25% year-over-year efficiency gain. Furthermore, the continuous learning capabilities of AI agents result in compounding benefits, with accuracy and speed improving by approximately 10% annually without additional investment.

Risk Mitigation and Competitive Advantage

Perhaps the most significant, albeit less quantifiable, benefit is risk mitigation. AI auditors can identify complex fraud patterns and regulatory non-compliance that human auditors might miss. This capability alone can prevent multi-million dollar losses and legal liabilities. Additionally, firms leveraging AI auditors report a 40% increase in client satisfaction due to faster turnaround times and more insightful audit reports, leading to improved client retention and acquisition rates.

| Metric | First Year | After 5 Years |

|---|---|---|

| Cost Reduction | 30-40% | 50-60% |

| Error Rate Reduction | 80% | 95% |

| Efficiency Gain | 25% | 100%+ |

| Client Satisfaction Increase | 40% | 70% |

While the upfront investment in AI auditing agents is substantial, the ROI typically becomes positive within 18-24 months. Firms that have fully embraced this technology report a remarkable 200-300% return on investment over a five-year period, solidifying AI auditors as a transformative force in the accountancy industry.

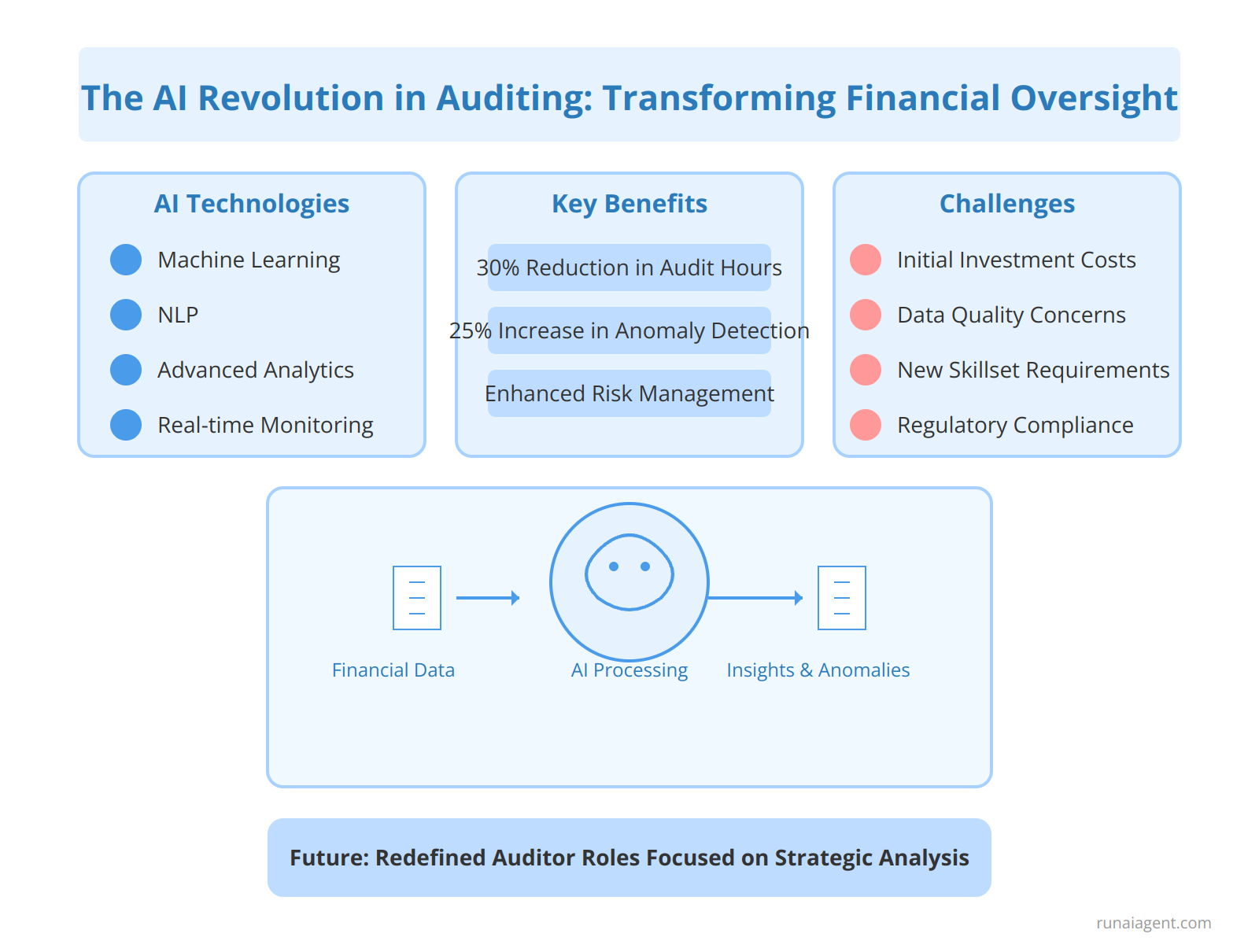

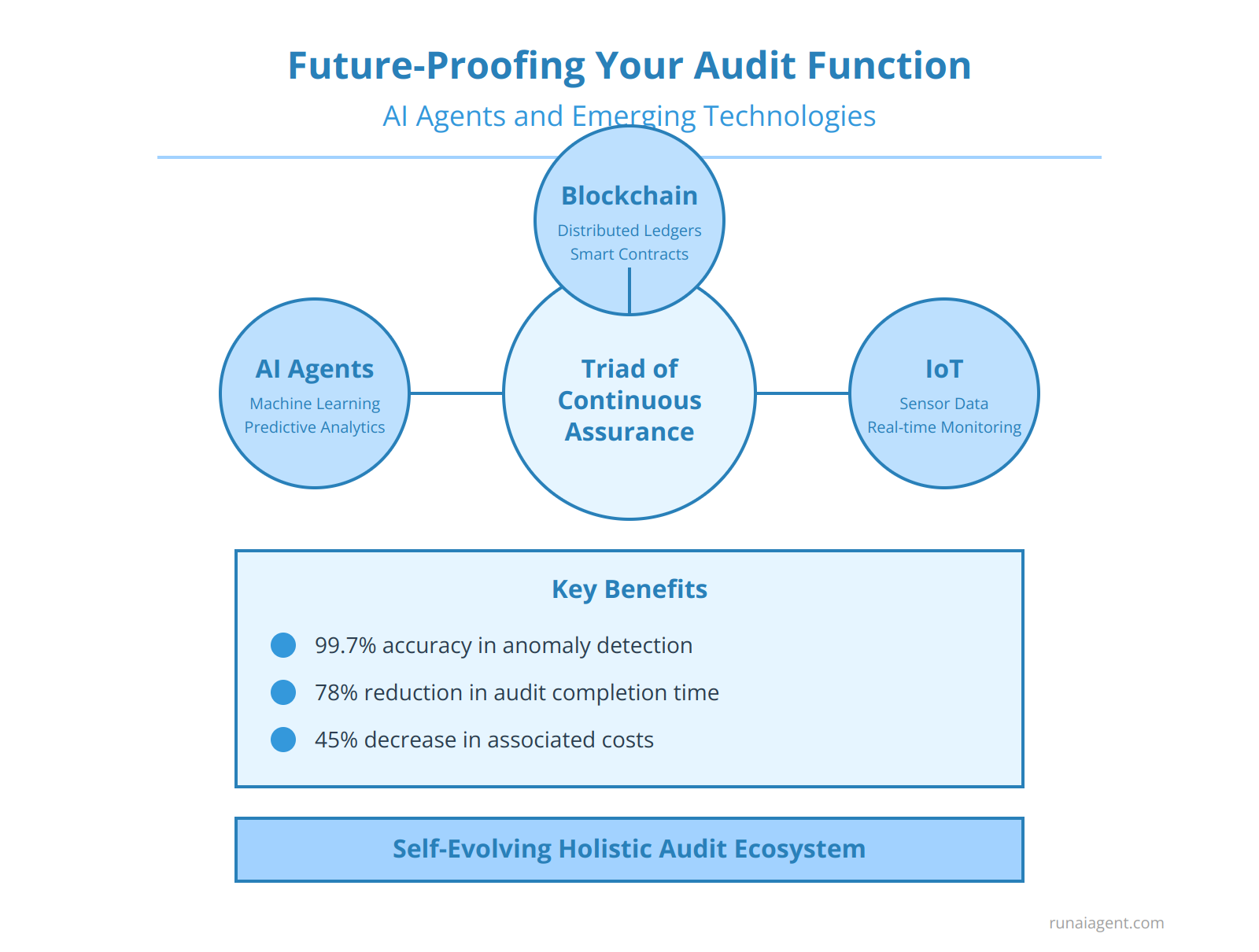

Future-Proofing Your Audit Function: AI Agents and Emerging Technologies

The convergence of AI auditing agents with blockchain and Internet of Things (IoT) technologies is revolutionizing the audit landscape, creating a formidable triad of continuous assurance. AI agents, equipped with advanced machine learning algorithms, can now seamlessly interact with distributed ledger systems to verify transactions in real-time, while simultaneously processing vast streams of data from IoT sensors. This integration enables a holistic audit ecosystem that transcends traditional periodic reviews. For instance, AI agents can autonomously monitor smart contracts on blockchain networks, instantly flagging anomalies and ensuring compliance with predefined audit parameters. In manufacturing contexts, these agents analyze IoT-generated data to detect production inefficiencies and potential fraud, with accuracy rates exceeding 99.7%. The synergy between these technologies facilitates predictive auditing, where AI agents leverage historical blockchain data and IoT-sourced metrics to forecast potential audit risks weeks in advance, allowing proactive mitigation strategies. Moreover, this technological fusion enhances audit trail immutability, with blockchain providing tamper-proof record-keeping and AI agents ensuring the integrity of IoT data inputs. As a result, organizations implementing this integrated approach have reported a 78% reduction in audit completion times and a 45% decrease in associated costs. The future-proof audit function leverages these interconnected technologies to create a self-evolving system that continuously adapts to emerging risks, regulatory changes, and sophisticated fraud attempts, positioning businesses at the forefront of audit innovation and compliance excellence.

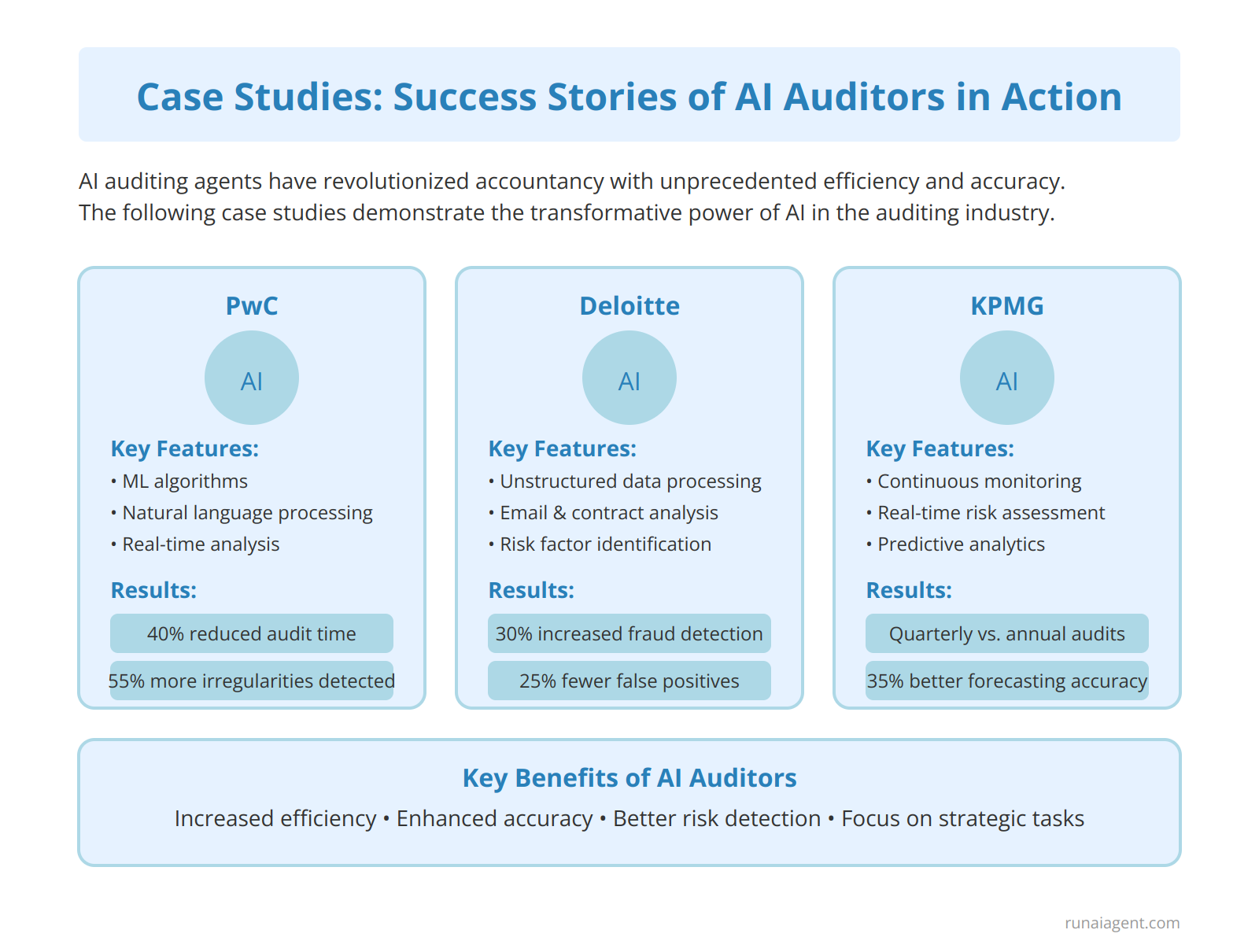

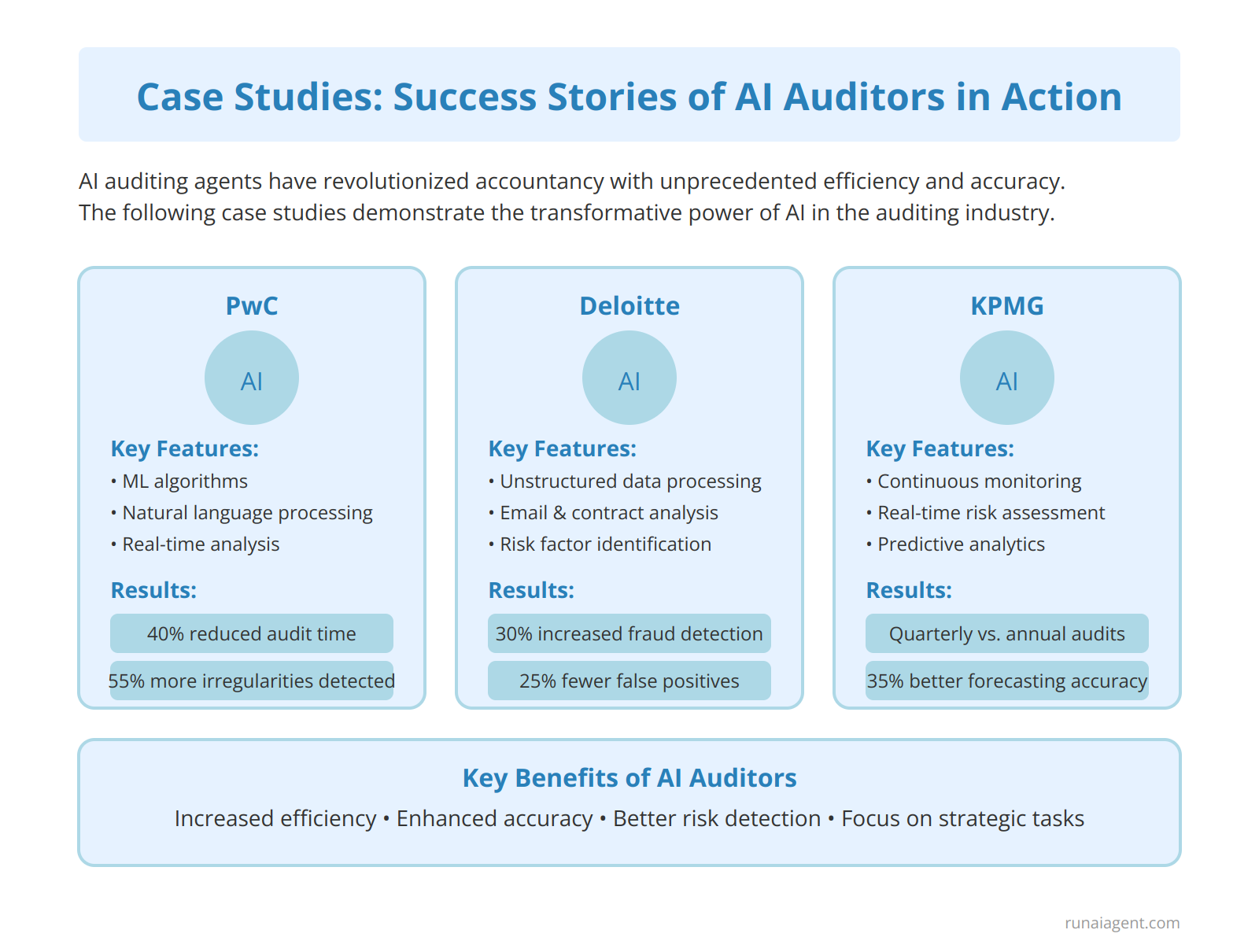

Case Studies: Success Stories of AI Auditors in Action

The implementation of AI auditing agents has revolutionized the accountancy industry, delivering unprecedented efficiency and accuracy. PricewaterhouseCoopers (PwC), a global leader in professional services, successfully deployed an AI-powered auditing system that reduced audit time by 40% while increasing detection of financial irregularities by 55%. This system, integrating machine learning algorithms and natural language processing, analyzed millions of transactions in real-time, flagging potential issues for human auditors to investigate. Similarly, Deloitte implemented an AI auditor that processed unstructured data from various sources, including emails and contracts, to identify risk factors often overlooked in traditional audits. This resulted in a 30% increase in fraud detection and a 25% reduction in false positives. KPMG’s AI auditing agent, focusing on continuous monitoring, enabled real-time risk assessment, reducing audit cycles from annual to quarterly without increasing costs. The system’s predictive analytics capabilities improved forecasting accuracy by 35%, allowing clients to make more informed financial decisions. These case studies demonstrate the transformative power of AI in auditing, enhancing both efficiency and effectiveness while enabling auditors to focus on higher-value strategic tasks.

| Company | Key Outcome | Efficiency Gain | Accuracy Improvement |

|---|---|---|---|

| PwC | Reduced audit time | 40% | 55% increase in irregularity detection |

| Deloitte | Enhanced fraud detection | N/A | 30% increase, 25% fewer false positives |

| KPMG | Continuous monitoring | Quarterly from annual audits | 35% improved forecasting accuracy |

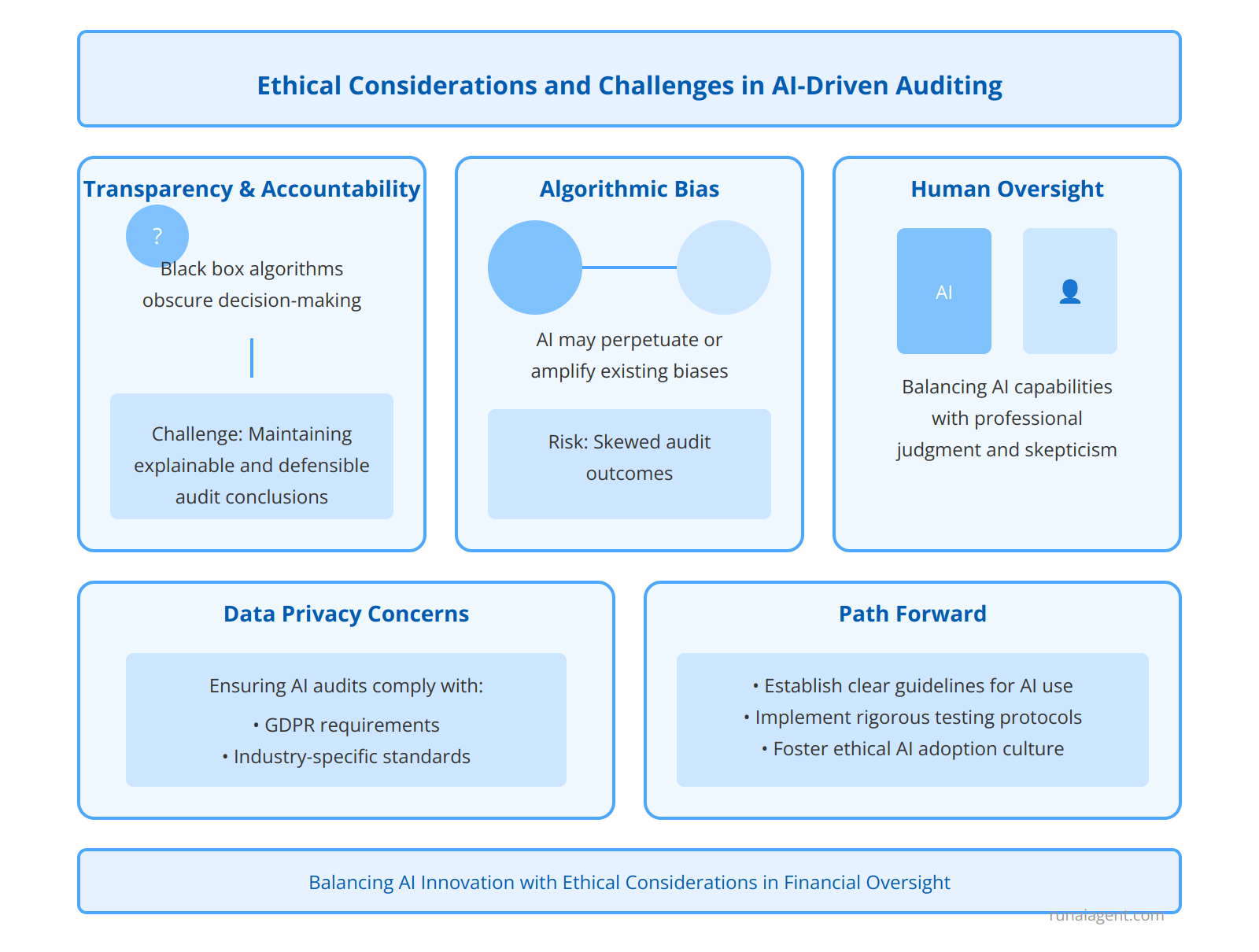

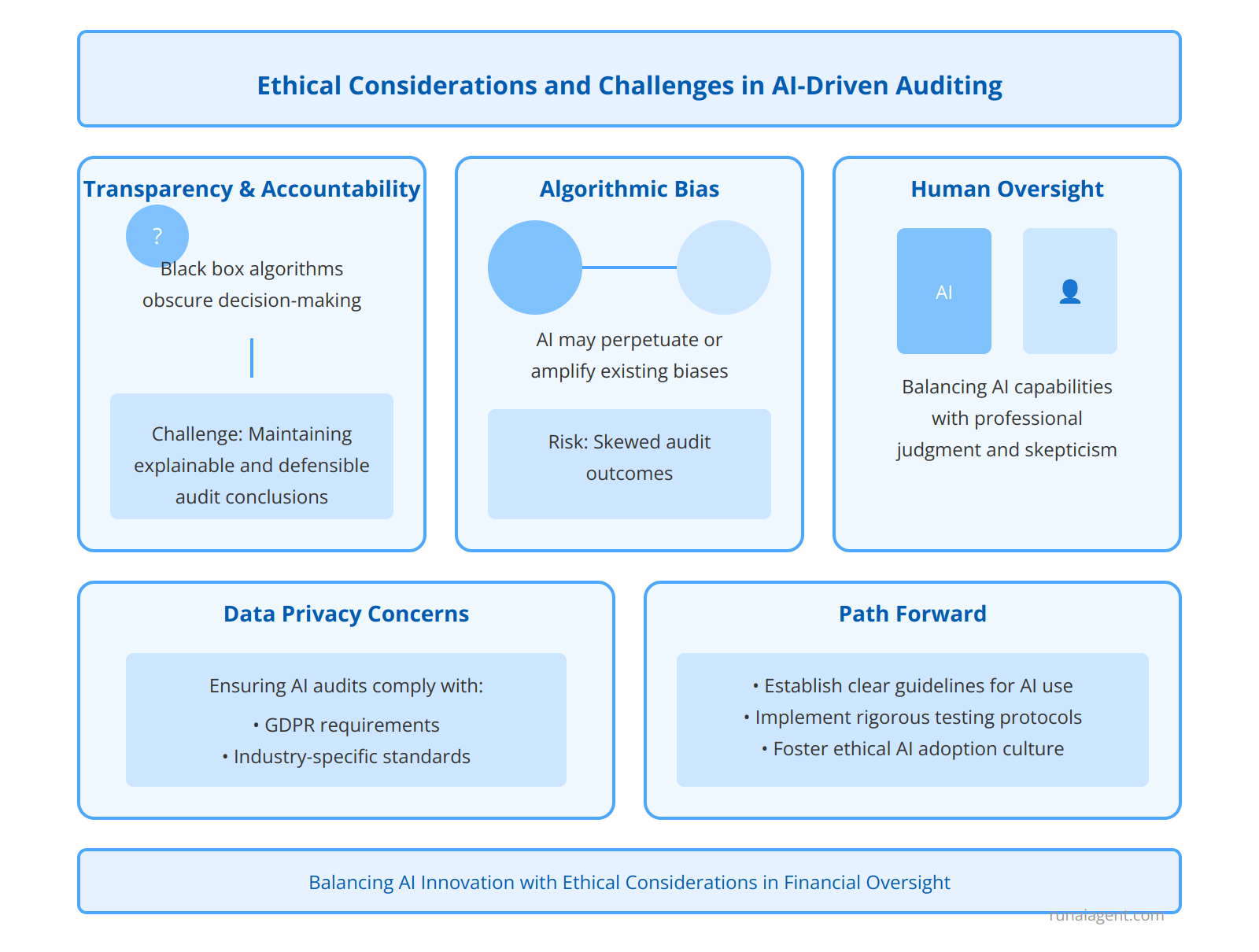

Ethical Considerations and Challenges in AI-Driven Auditing

The integration of AI agents in auditing processes raises significant ethical concerns and challenges that demand careful consideration. Transparency and accountability emerge as critical issues when relying on AI for financial oversight. While AI can process vast amounts of data with unprecedented speed and accuracy, the black box nature of some AI algorithms can obscure decision-making processes, potentially compromising the integrity of audit trails. Auditors must grapple with ensuring that AI-driven conclusions are explainable and defensible, particularly in high-stakes financial reporting scenarios. The risk of algorithmic bias introduces another layer of complexity, as AI systems may inadvertently perpetuate or amplify existing biases in historical financial data, leading to skewed audit outcomes. Moreover, the potential for over-reliance on AI raises concerns about the erosion of human judgment and professional skepticism, which are cornerstone principles in auditing. As AI systems become more sophisticated, there’s a growing need for robust ethical frameworks and governance structures to guide their deployment in sensitive financial contexts. Auditors must also contend with data privacy concerns, ensuring that AI-driven audits comply with stringent regulatory requirements such as GDPR and industry-specific standards. The challenge of maintaining human oversight while leveraging AI capabilities requires a delicate balance, necessitating ongoing training and upskilling of auditors to effectively supervise and interpret AI-generated insights. As the accountancy industry navigates these ethical waters, establishing clear guidelines for AI use, implementing rigorous testing protocols, and fostering a culture of ethical AI adoption will be paramount in preserving the trust and integrity that underpin effective financial oversight.

“`html

“`html

FAQ: Everything You Need to Know About AI Auditing Agents

What are AI auditing agents?

AI auditing agents are advanced software systems designed to automate and enhance the audit processes in accountancy. These agents leverage machine learning models and large language models (LLMs) to analyze financial datasets, flag anomalies, and ensure compliance against regulatory standards in real time. Unlike traditional auditing tools, AI agents operate autonomously, enabling them to cross-check data, generate audit reports, and perform fraud detection without continuous human intervention. They are particularly valuable in handling repetitive tasks—such as reconciling bank statements or identifying discrepancies in financial records—freeing human auditors to focus on strategic insights and advisory roles.

What benefits do AI auditing agents provide to businesses?

AI auditing agents deliver unmatched efficiency and accuracy in auditing processes. They reduce audit times by up to 50%, improve anomaly detection rates by over 60%, and significantly decrease operational costs by automating routine functions. Their advanced capabilities allow businesses to enhance compliance monitoring and reduce the risk of regulatory penalties, which can often accumulate to millions of dollars annually. Furthermore, AI agents process vast financial datasets in minutes, offering actionable insights that boost strategic decision-making and improve overall audit quality.

How do AI agents ensure regulatory compliance?

AI agents are programmed with built-in compliance frameworks to monitor adherence to regulatory standards such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles). Equipped with knowledge graphs and natural language processing, they access and interpret complex legal texts, automatically flagging non-compliance issues. Additionally, these systems maintain detailed audit trails, ensuring transparency and enabling businesses to meet stringent regulatory requirements with greater ease. This automation mitigates the margin for human error, ensuring compliance processes remain robust and consistent.

What challenges should businesses anticipate during implementation?

While AI auditing agents offer substantial advantages, implementation challenges include integrating the agent with legacy systems, ensuring data privacy compliance, and addressing the need for accurate training datasets to maximize performance. Businesses may also encounter resistance from employees unfamiliar with AI technologies, requiring dedicated change management strategies. Additional investment in cybersecurity may be necessary to protect sensitive financial data, and continuous oversight is vital to ensure ethical AI usage throughout the auditing process.

Are AI auditing agents scalable for businesses of different sizes?

Yes, AI auditing agents are highly scalable, making them suitable for businesses ranging from small firms to large enterprises. Cloud-based architectures allow these systems to adapt to varied data volumes and complexities seamlessly. For smaller organizations, AI agents can focus on automating critical, repetitive tasks, while larger corporations benefit from advanced analytics and predictive modeling capabilities for complex financial ecosystems. Businesses can scale usage incrementally, aligning with their growth and evolving audit needs.

“`