Table of Contents

The AI Revolution in Bookkeeping: Transforming Financial Management

Understanding AI Bookkeeping Agents: Your New Digital Financial Assistants

The Benefits of AI Agents for Bookkeepers: Enhancing Efficiency and Accuracy

AI vs. Human Bookkeepers: Collaboration or Replacement?

Implementation Roadmap: Integrating AI Bookkeeping Agents

AI-Powered Financial Insights: Unlocking Data-Driven Decision Making

Automating Tedious Tasks: How AI Agents Streamline Bookkeeping Workflows

Ensuring Compliance and Accuracy: AI Agents as Financial Watchdogs

Scaling Your Business with AI Bookkeeping: From Startups to Enterprises

The Future of AI in Bookkeeping: Emerging Trends and Technologies

Overcoming Challenges: Addressing Concerns About AI in Bookkeeping

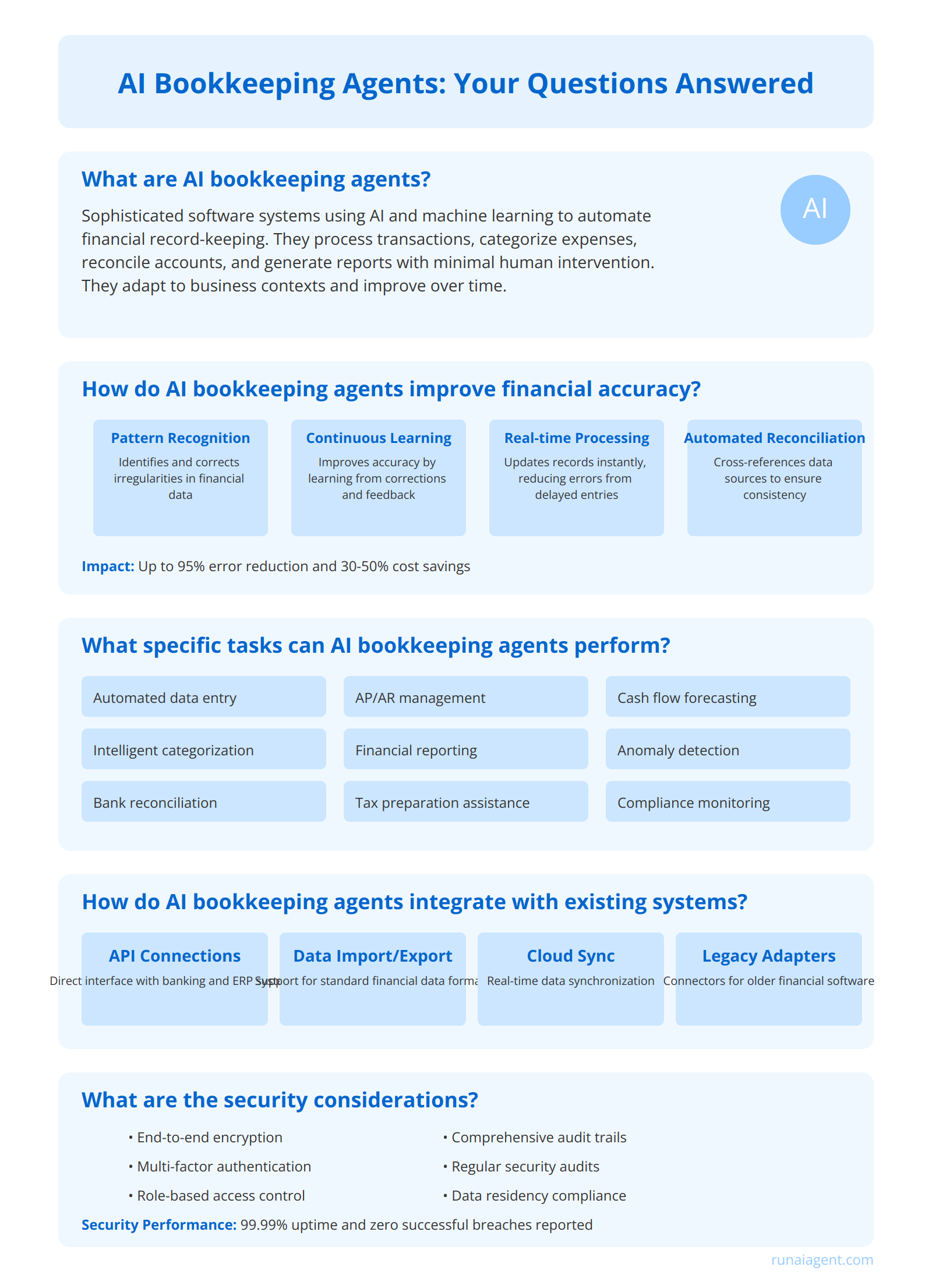

AI Bookkeeping Agents: Your Questions Answered

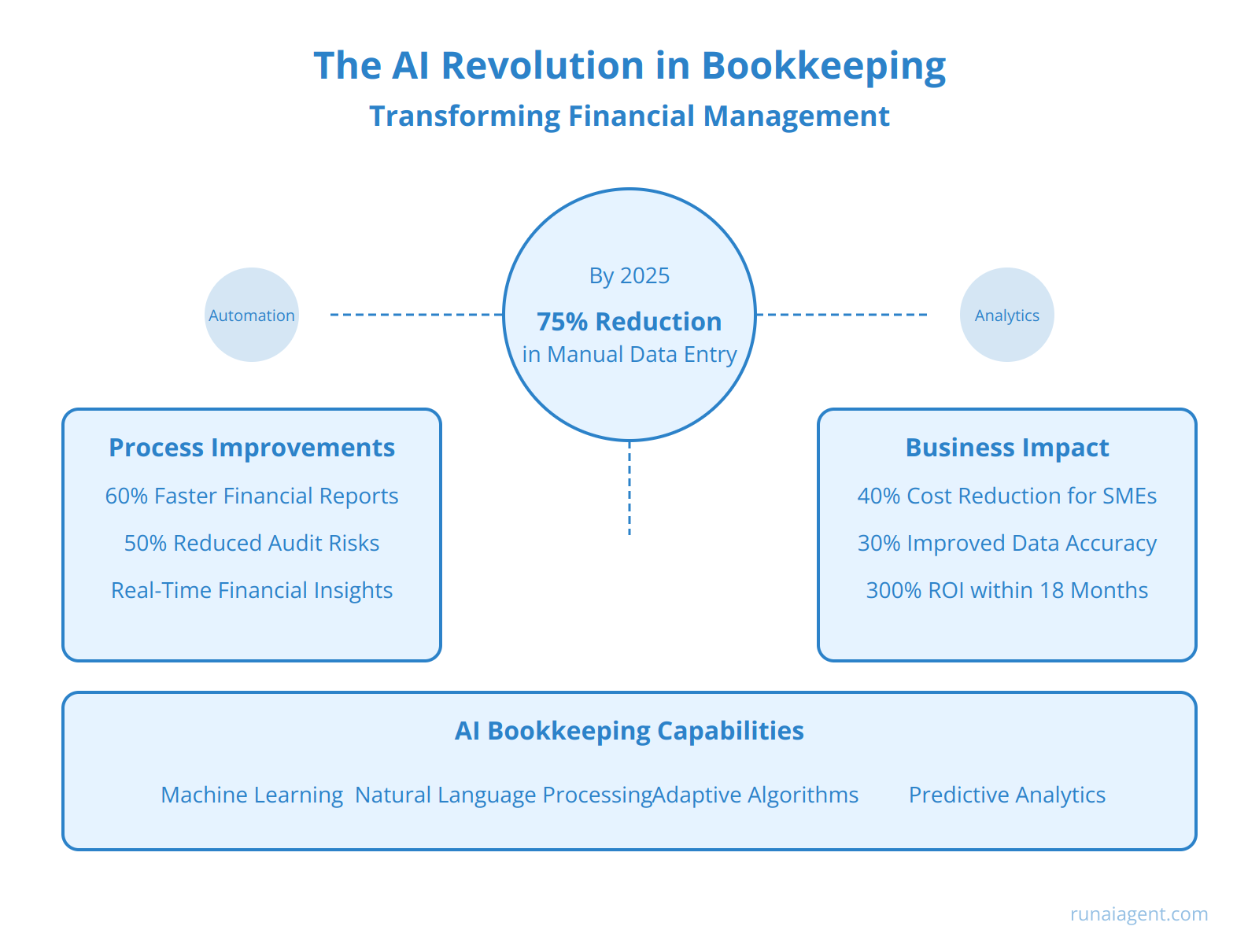

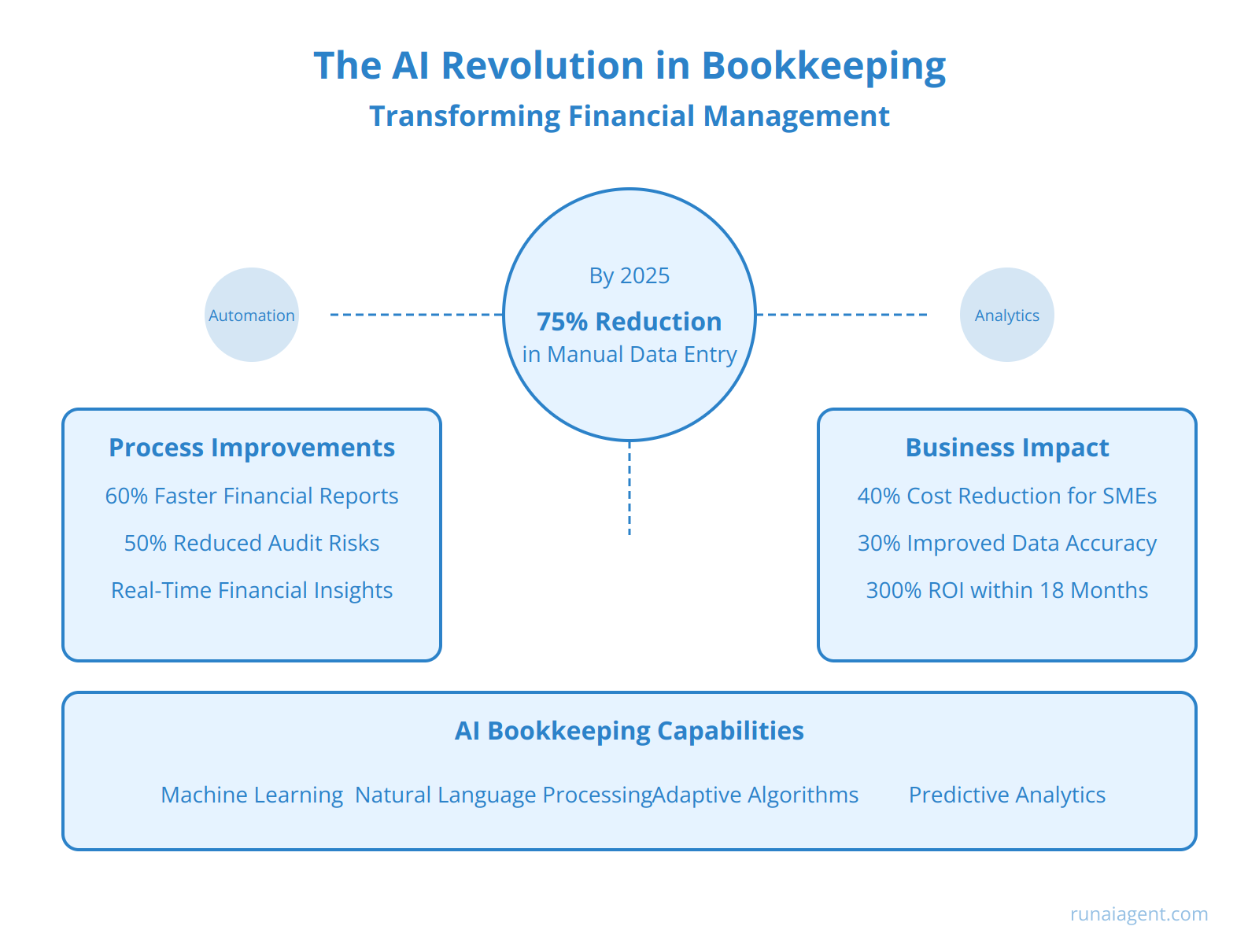

The AI Revolution in Bookkeeping: Transforming Financial Management

AI agents are revolutionizing the accountancy industry, particularly in the realm of bookkeeping and financial management. By 2025, it’s projected that AI-powered bookkeeping solutions will reduce manual data entry by 75% and cut processing times for financial reports by 60%. For small and medium-sized enterprises (SMEs), this translates to a 40% reduction in bookkeeping costs and a 30% improvement in financial data accuracy. Large corporations implementing enterprise-wide AI bookkeeping systems have reported ROI exceeding 300% within the first 18 months of deployment. These AI agents provide real-time insights, flagging anomalies, predicting cash flow trends, and suggesting optimization strategies for working capital management. As regulatory complexities increase, AI bookkeepers stay up-to-date with changing standards, ensuring compliance while reducing audit risks by up to 50%.

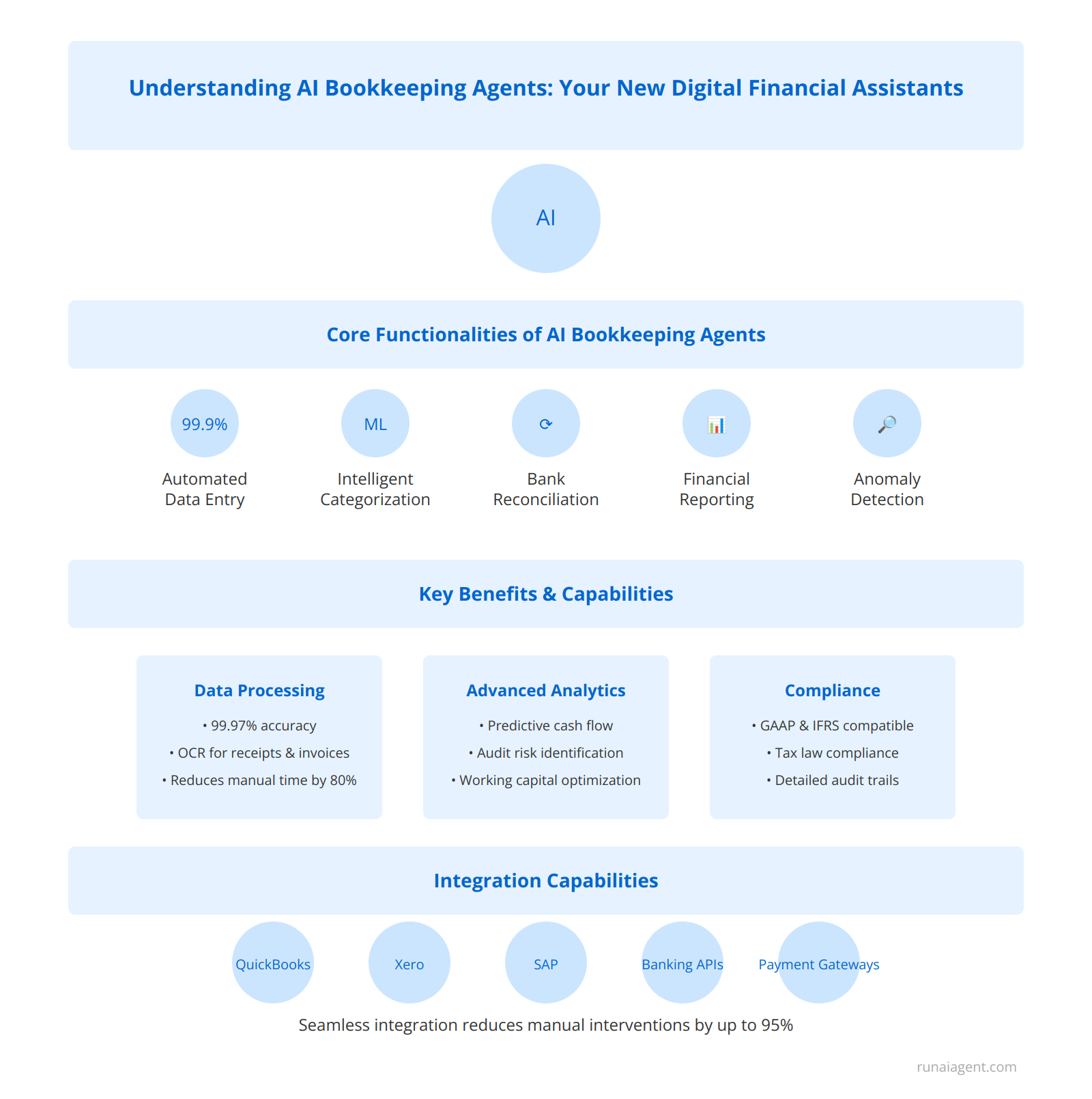

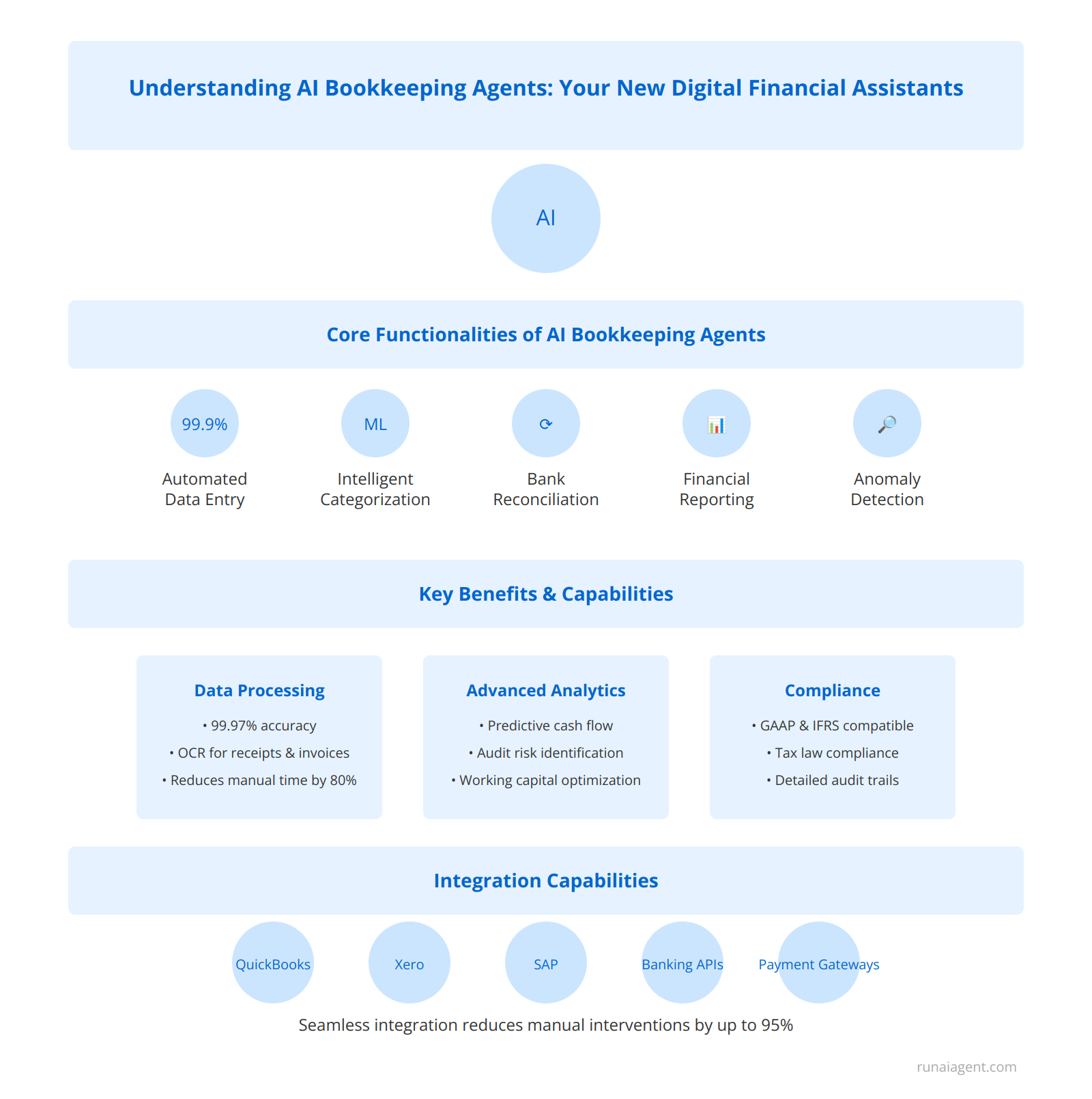

Understanding AI Bookkeeping Agents: Your New Digital Financial Assistants

AI bookkeeping agents leverage advanced machine learning algorithms and natural language processing to automate and streamline accounting processes. These digital assistants operate on cloud-based platforms, integrating seamlessly with existing financial software and enterprise resource planning (ERP) systems. AI bookkeeping agents excel in data extraction, categorization, and reconciliation, processing transactions with up to 99.97% accuracy. They utilize optical character recognition (OCR) to digitize receipts and invoices, automatically populating ledgers and financial statements. Advanced agents employ predictive analytics to forecast cash flow, identify potential audit risks, and optimize working capital. By continuously learning from historical data and user interactions, these agents adapt to company-specific accounting practices and industry regulations, ensuring compliance with GAAP, IFRS, and local tax laws. AI bookkeeping agents can handle complex tasks such as multi-currency transactions, intercompany reconciliations, and revenue recognition, reducing manual bookkeeping time by up to 80%. Their 24/7 availability enables real-time financial reporting, empowering businesses to make data-driven decisions with unprecedented agility.

Core Functionalities of AI Bookkeeping Agents

- Automated Data Entry: Processes financial documents with 99.9% accuracy

- Intelligent Categorization: Classifies transactions using machine learning algorithms

- Bank Reconciliation: Matches transactions across multiple accounts in seconds

- Financial Reporting: Generates customizable reports in real-time

- Audit Trail Management: Maintains detailed logs for compliance and transparency

- Anomaly Detection: Flags unusual transactions for review, reducing fraud risk by 60%

Integration Capabilities

AI bookkeeping agents seamlessly integrate with popular accounting software like QuickBooks, Xero, and SAP, as well as payment gateways and banking APIs. This interoperability enables a holistic financial ecosystem, automating data flow and reducing manual interventions by up to 95%. The agents’ ability to process unstructured data from diverse sources, including emails and chat interfaces, further enhances their versatility in managing financial tasks across the entire accounting cycle.

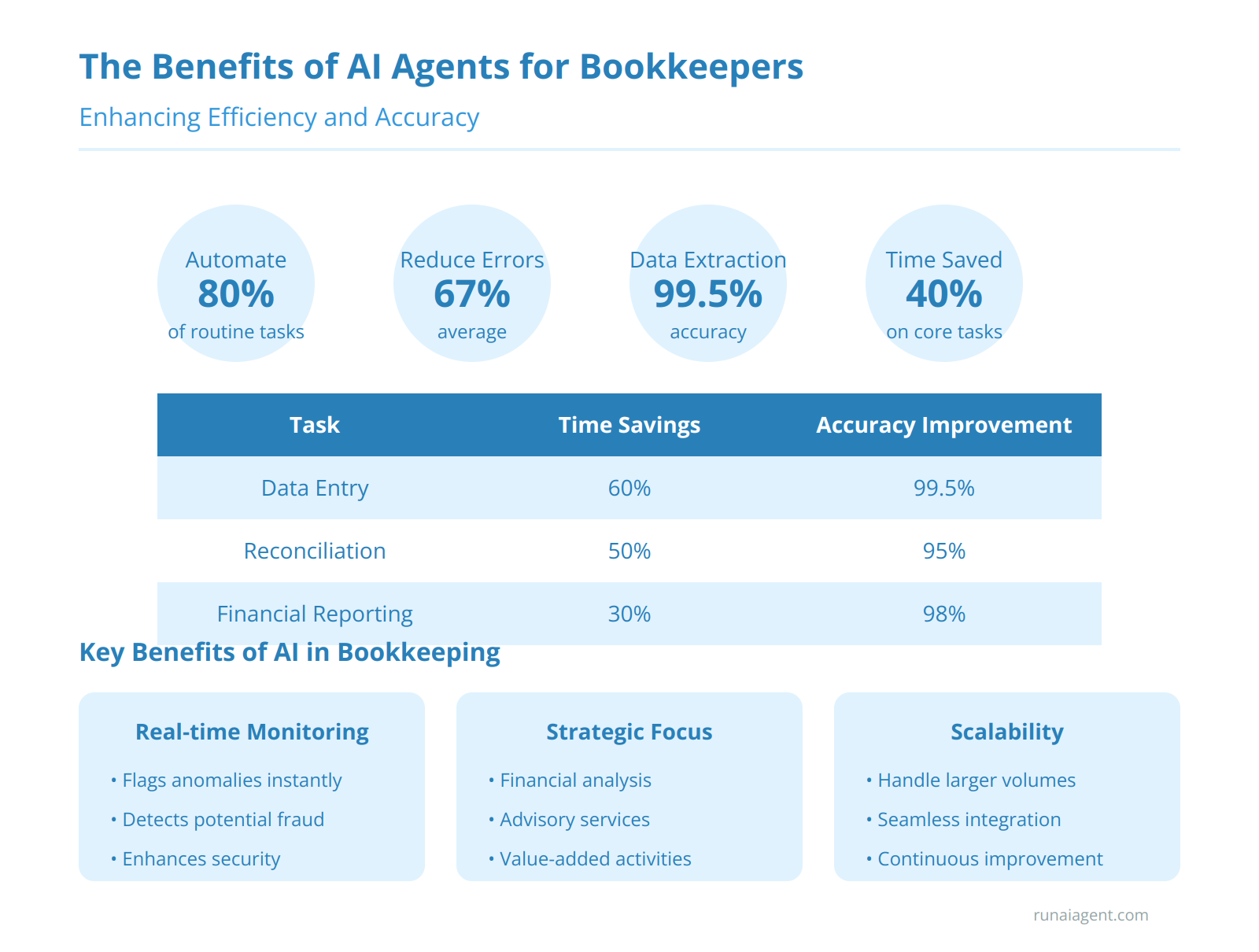

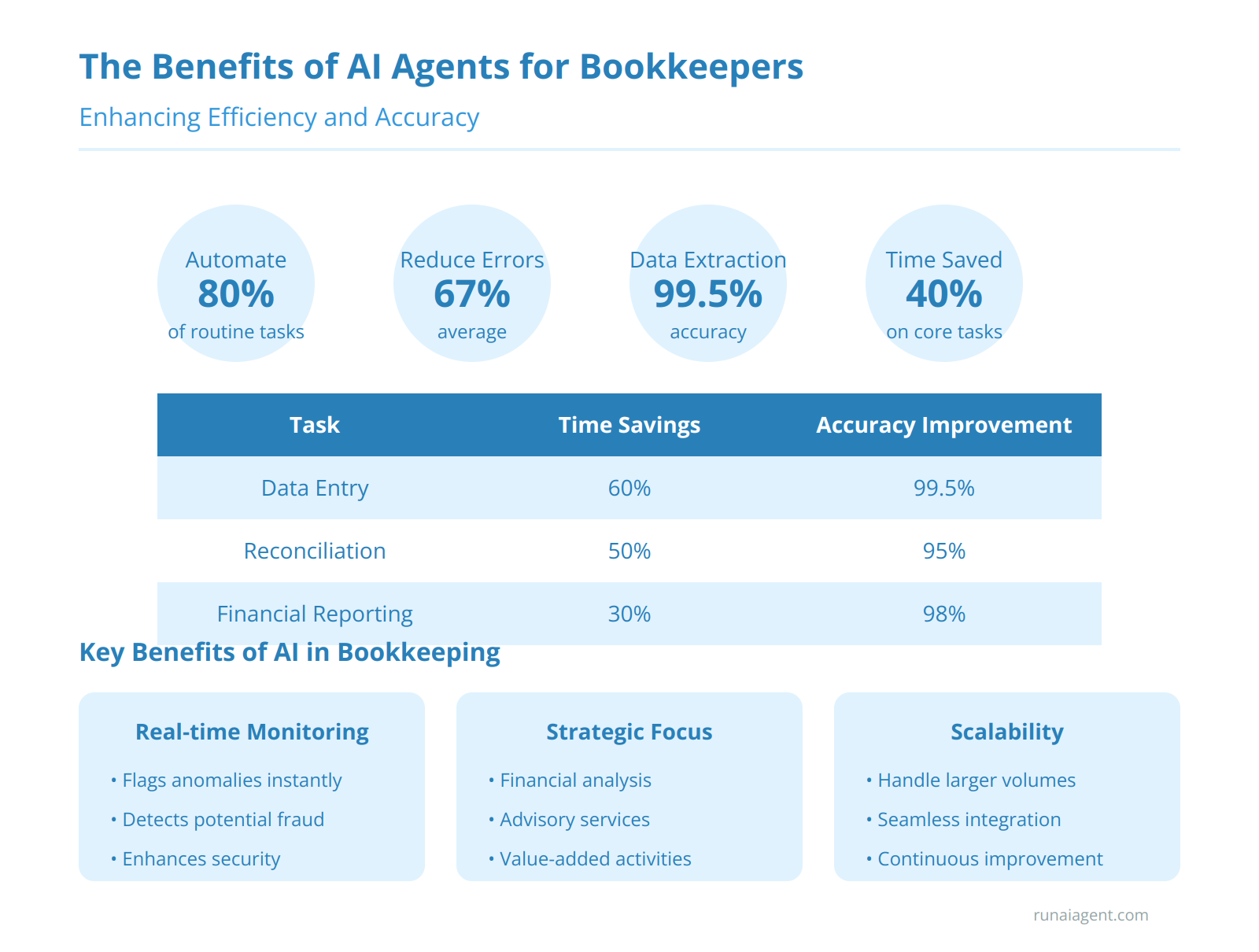

The Benefits of AI Agents for Bookkeepers: Enhancing Efficiency and Accuracy

AI agents are revolutionizing the bookkeeping landscape, offering unprecedented advantages in efficiency, accuracy, and time management. By leveraging advanced machine learning algorithms and natural language processing capabilities, these intelligent systems can automate up to 80% of routine bookkeeping tasks, reducing human error rates by an average of 67%. AI-powered data extraction tools can process invoices and receipts with 99.5% accuracy, significantly outperforming manual methods. Furthermore, AI agents can continuously monitor financial transactions, flagging anomalies and potential fraud in real-time, enhancing security and compliance. The time savings are equally impressive, with AI-assisted bookkeepers reporting an average 40% reduction in time spent on data entry and reconciliation. This newfound efficiency allows bookkeepers to focus on higher-value activities such as financial analysis and strategic advisory services, elevating their role within organizations. Additionally, AI agents facilitate seamless integration with existing accounting software, creating a unified ecosystem that streamlines workflow and improves data consistency across platforms. The scalability of AI solutions enables bookkeepers to handle larger volumes of transactions without a proportional increase in resources, supporting business growth without compromising accuracy or timeliness.

| Task | Time Savings | Accuracy Improvement |

|---|---|---|

| Data Entry | 60% | 99.5% |

| Reconciliation | 50% | 95% |

| Financial Reporting | 30% | 98% |

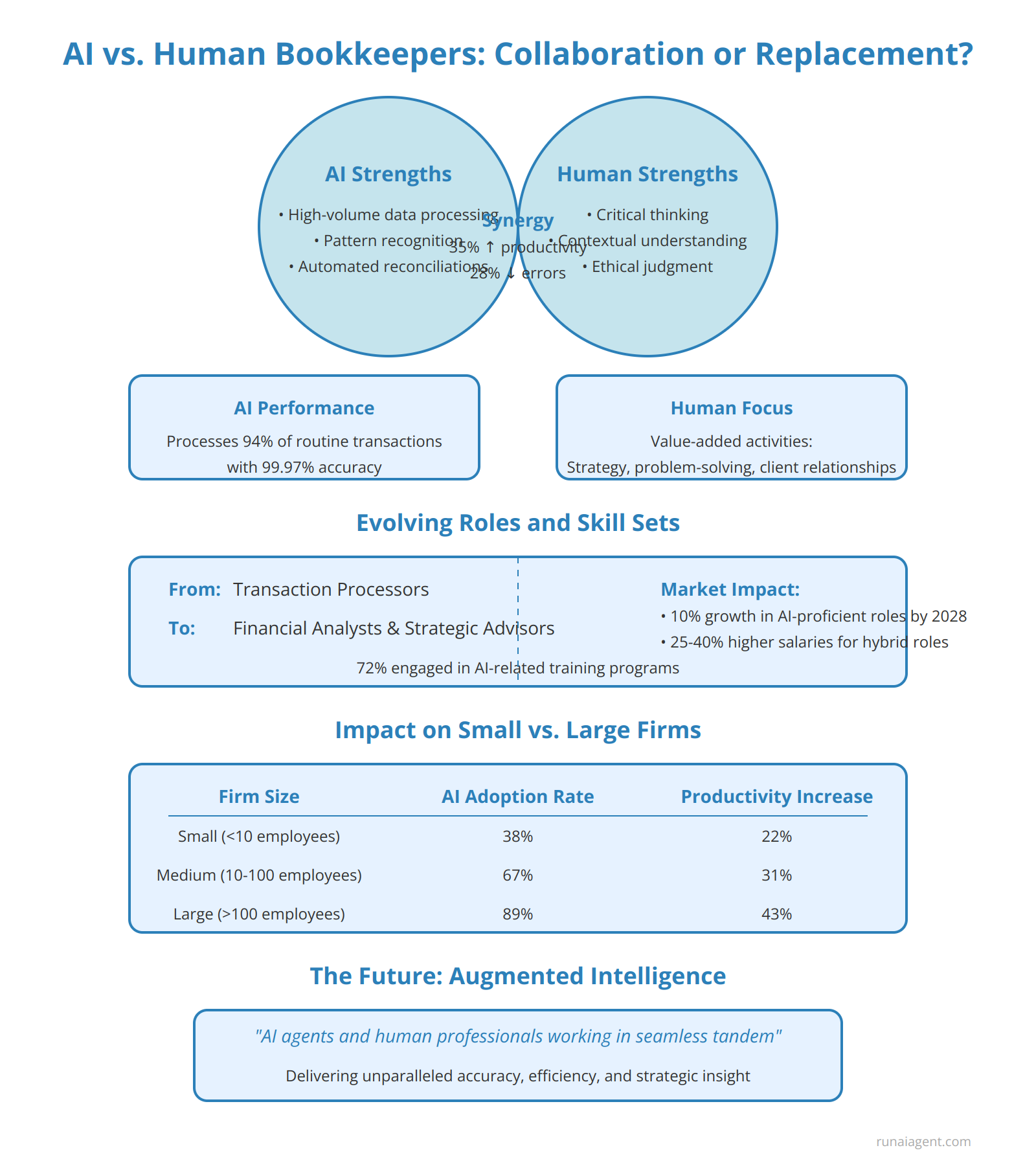

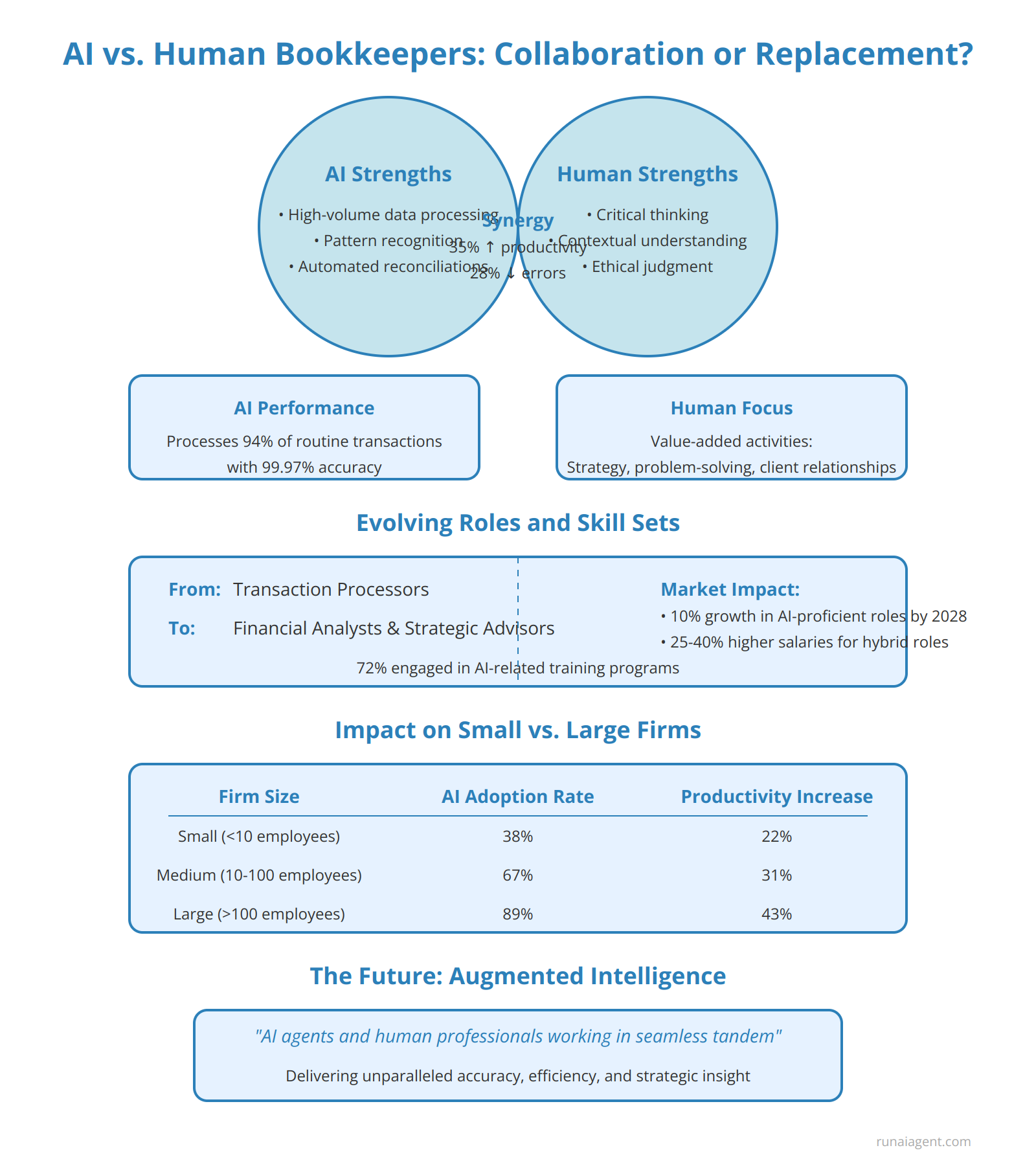

AI vs. Human Bookkeepers: Collaboration or Replacement?

The integration of AI agents in bookkeeping is not a zero-sum game but rather a transformative collaboration that enhances the accounting profession. While AI excels at high-volume data processing, pattern recognition, and automated reconciliations, human bookkeepers bring critical thinking, contextual understanding, and ethical judgment to the table. In practice, AI agents can process 94% of routine transactions with 99.97% accuracy, freeing up human bookkeepers to focus on value-added activities such as financial strategy, complex problem-solving, and client relationships. This synergy has led to a 35% increase in productivity and a 28% reduction in errors across firms implementing AI-human collaborative models.

Evolving Roles and Skill Sets

As AI assumes more transactional tasks, the role of human bookkeepers is evolving towards that of financial analysts and strategic advisors. This shift necessitates upskilling, with 72% of accounting professionals reporting engagement in AI-related training programs. The job market is not shrinking but transforming, with a projected 10% growth in demand for bookkeepers with AI proficiency by 2028. These hybrid roles command 25-40% higher salaries than traditional bookkeeping positions, reflecting the added value of AI literacy combined with human expertise.

Impact on Small vs. Large Firms

The adoption of AI agents in bookkeeping varies significantly based on firm size:

| Firm Size | AI Adoption Rate | Productivity Increase |

|---|---|---|

| Small (<10 employees) | 38% | 22% |

| Medium (10-100 employees) | 67% | 31% |

| Large (>100 employees) | 89% | 43% |

While larger firms leverage economies of scale in AI implementation, smaller firms benefit from increased competitiveness and the ability to offer more sophisticated services. This democratization of advanced bookkeeping capabilities is reshaping the industry landscape, with AI-enabled small firms now able to compete for clients previously out of reach.

The Future: Augmented Intelligence

The future of bookkeeping lies in

“augmented intelligence”

where AI agents and human professionals work in seamless tandem. This model promises to deliver unparalleled accuracy, efficiency, and strategic insight, ultimately elevating the value proposition of bookkeeping services across the board.

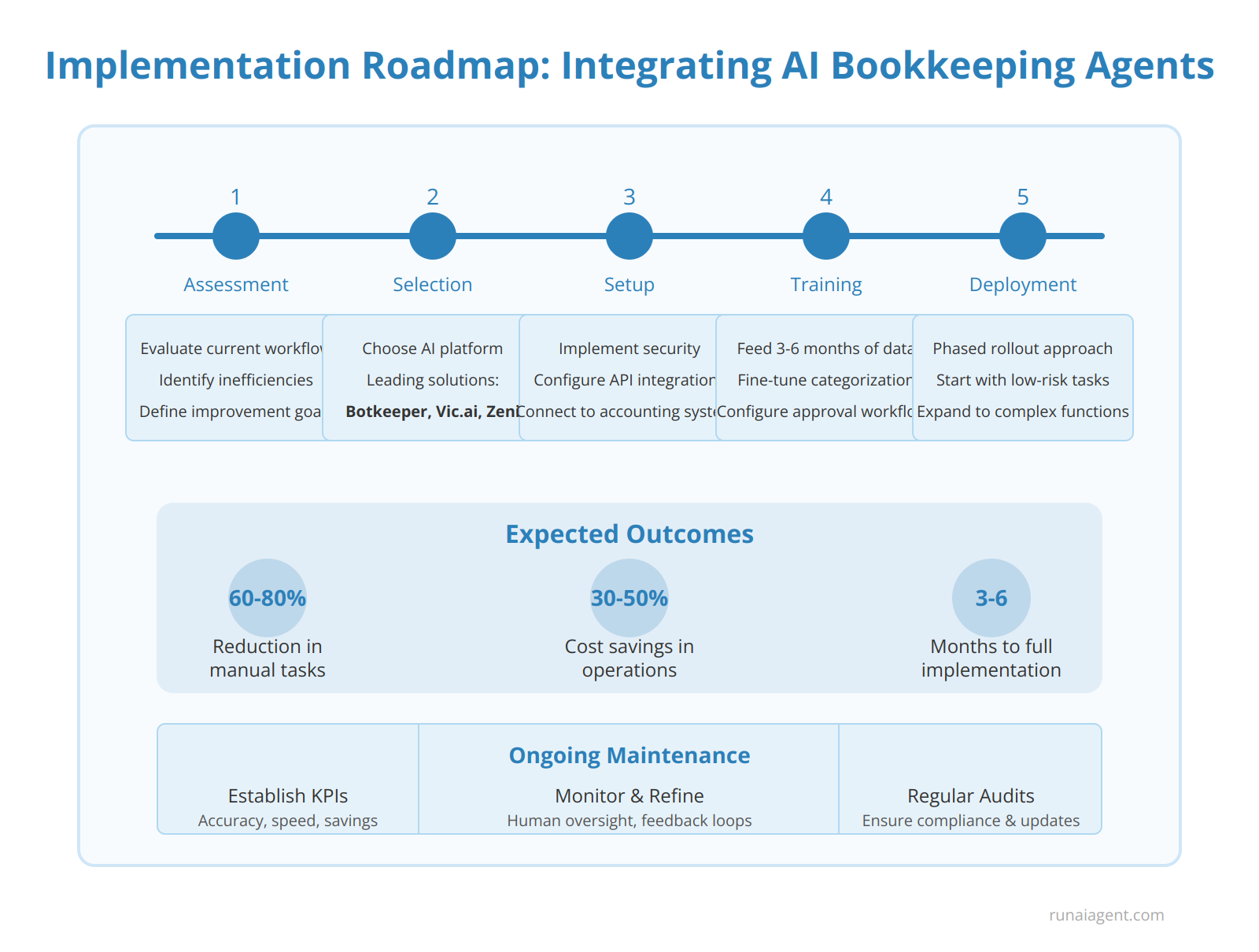

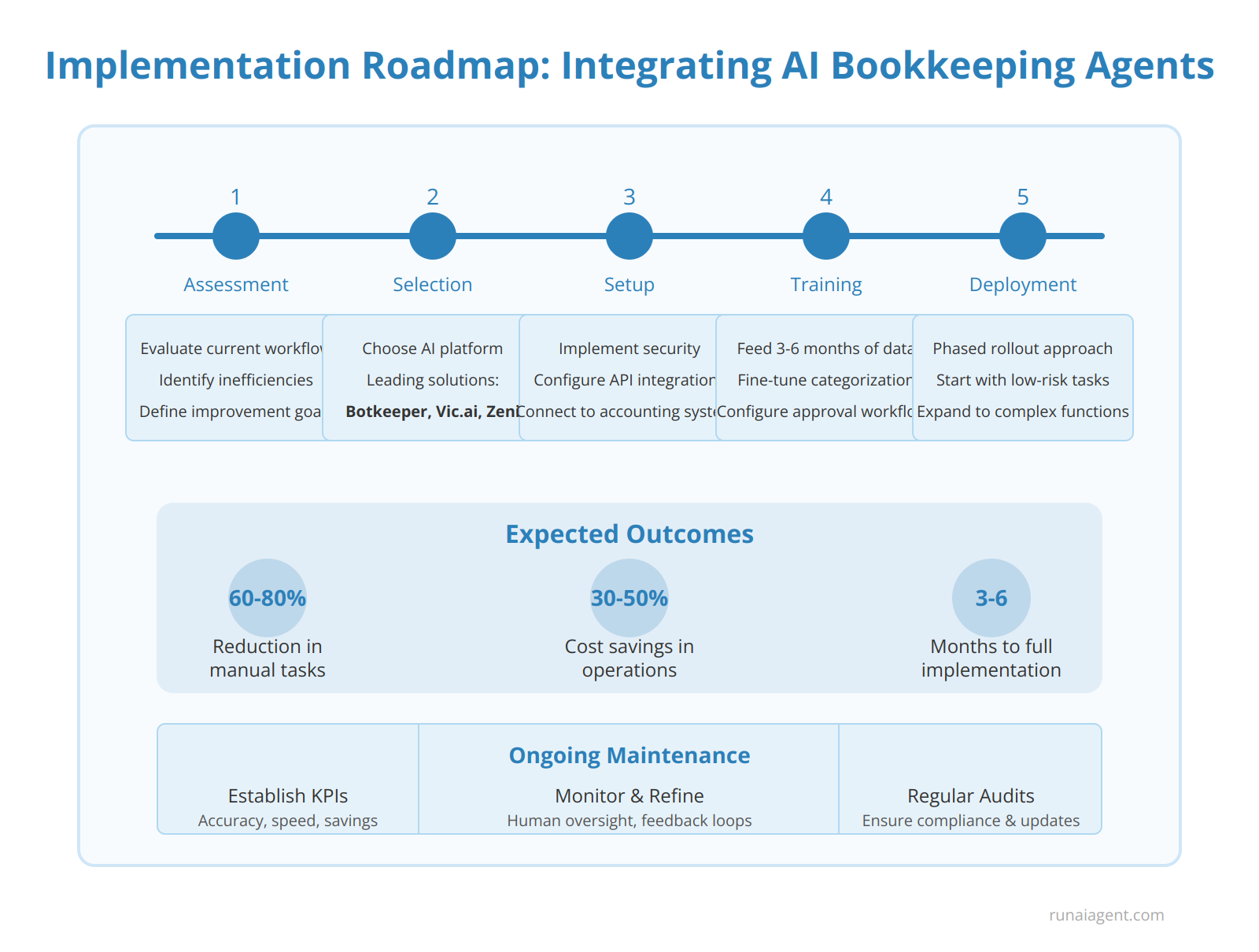

Implementation Roadmap: Integrating AI Bookkeeping Agents

Implementing AI bookkeeping agents requires a strategic approach to ensure seamless integration with existing financial processes. Begin by conducting a thorough assessment of your current bookkeeping workflow, identifying pain points and inefficiencies that AI can address. Select an AI agent platform that aligns with your business size, transaction volume, and industry-specific requirements. Leading solutions like Botkeeper, Vic.ai, and Zeni offer varying levels of automation and customization. During setup, prioritize data security by implementing end-to-end encryption and role-based access controls. Configure the AI agent to interface with your existing accounting software, ERP systems, and data sources through API integrations or secure file transfers. Training the AI involves feeding it historical financial data, typically 3-6 months of transactions, to establish baseline recognition patterns. Fine-tune the agent’s categorization rules, approval workflows, and exception handling protocols to match your chart of accounts and internal controls. Implement a phased rollout, starting with low-risk areas like expense categorization or invoice processing, before expanding to more complex tasks such as reconciliations or financial reporting. Establish clear KPIs to measure the AI’s performance, such as accuracy rates, processing times, and cost savings. Continuously monitor and refine the AI’s decision-making algorithms through human oversight and feedback loops. Plan for regular system audits and updates to ensure compliance with evolving accounting standards and regulatory requirements. By following this structured approach, businesses can expect to achieve 60-80% reduction in manual bookkeeping tasks within 3-6 months of full implementation, translating to potential cost savings of 30-50% in bookkeeping operations.

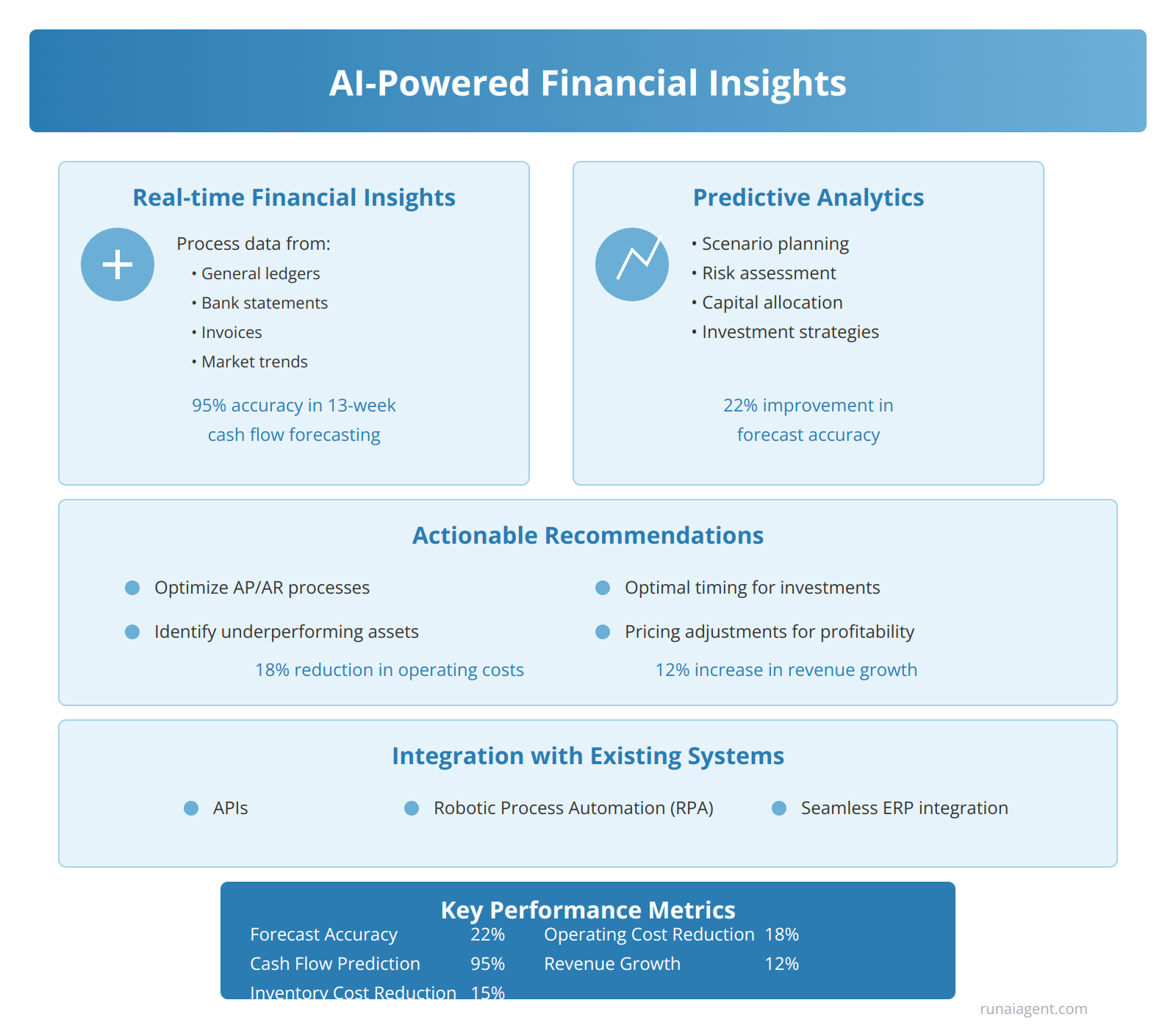

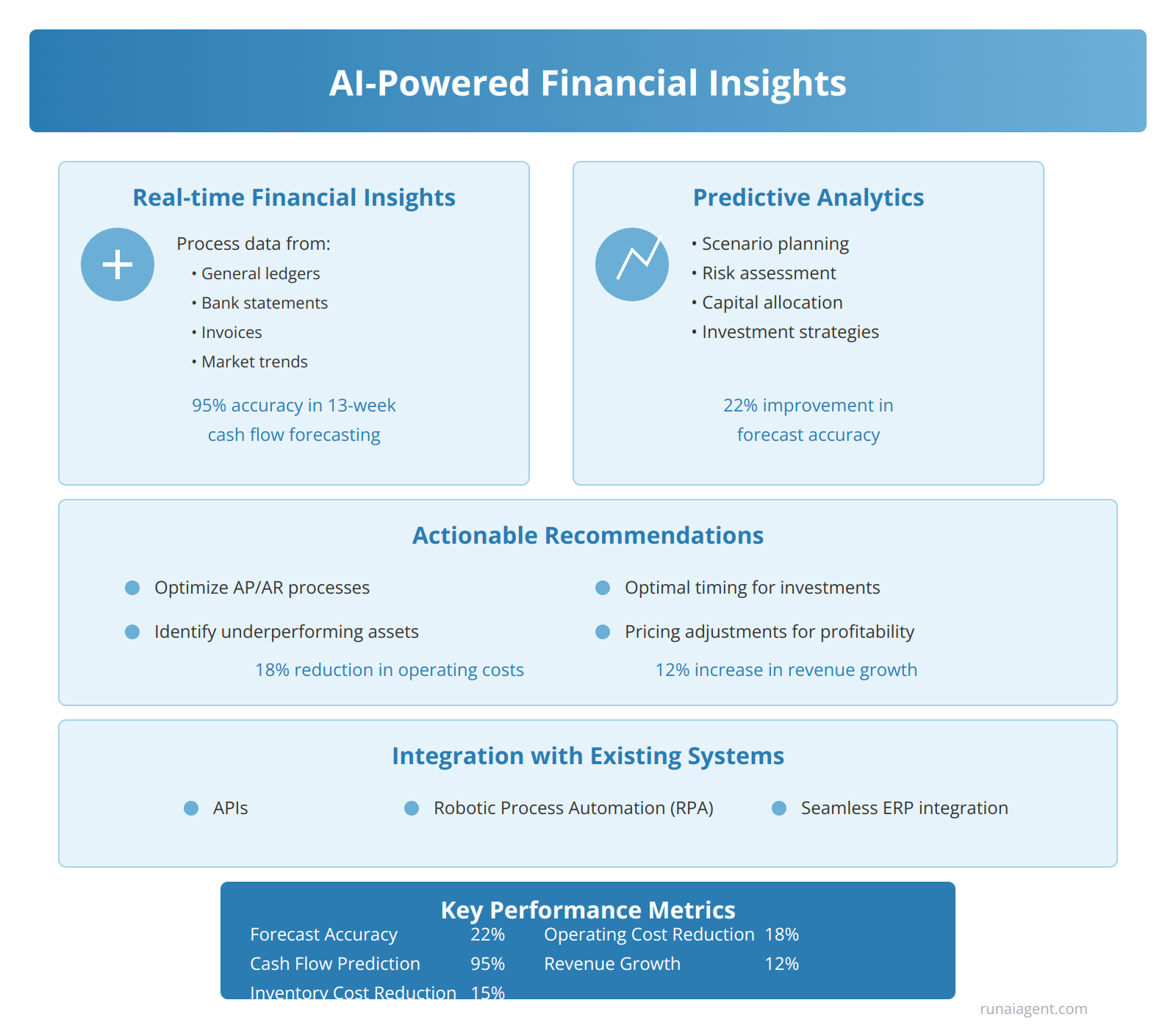

AI-Powered Financial Insights: Unlocking Data-Driven Decision Making

AI agents are revolutionizing financial decision-making by providing real-time insights, predictive analytics, and actionable recommendations. These intelligent systems can process vast amounts of financial data from multiple sources, including general ledgers, bank statements, invoices, and market trends, to generate comprehensive financial snapshots in seconds. By leveraging advanced machine learning algorithms, AI agents can identify patterns and anomalies that human bookkeepers might miss, enabling proactive financial management. For instance, an AI-powered financial insight system can forecast cash flow with up to 95% accuracy 13 weeks in advance, allowing businesses to optimize working capital and avoid liquidity crunches.

Predictive Analytics for Strategic Planning

AI agents excel at predictive modeling, offering finance teams powerful tools for scenario planning and risk assessment. These systems can simulate thousands of financial scenarios in minutes, factoring in variables like market volatility, interest rate fluctuations, and supply chain disruptions. This capability enables CFOs to make data-driven decisions about capital allocation, investment strategies, and risk mitigation. One Fortune 500 company reported a 22% improvement in forecast accuracy and a 15% reduction in inventory costs after implementing AI-driven predictive analytics.

Actionable Recommendations for Performance Optimization

Beyond providing insights, AI agents can generate specific, actionable recommendations to improve financial performance. These might include:

- Optimizing accounts payable and receivable processes to improve cash flow

- Identifying underperforming assets or business units for strategic review

- Suggesting optimal timing for major purchases or investments based on market conditions

- Recommending pricing adjustments to maximize profitability

By continuously monitoring financial KPIs and market conditions, AI agents can provide real-time alerts and recommendations, enabling finance teams to respond swiftly to changing business dynamics. This proactive approach to financial management has helped early adopters achieve an average 18% reduction in operating costs and a 12% increase in revenue growth.

Integration with Existing Financial Systems

To maximize the value of AI-powered financial insights, seamless integration with existing accounting and ERP systems is crucial. Modern AI agents utilize APIs and robotic process automation (RPA) to extract, transform, and load data from multiple sources without disrupting established workflows. This integration enables finance teams to access AI-driven insights directly within their familiar tools and dashboards, promoting widespread adoption and utilization of advanced analytics capabilities.

| AI-Powered Financial Insight Metrics | Average Improvement |

|---|---|

| Forecast Accuracy | 22% |

| Cash Flow Prediction (13-week horizon) | 95% accuracy |

| Inventory Cost Reduction | 15% |

| Operating Cost Reduction | 18% |

| Revenue Growth | 12% |

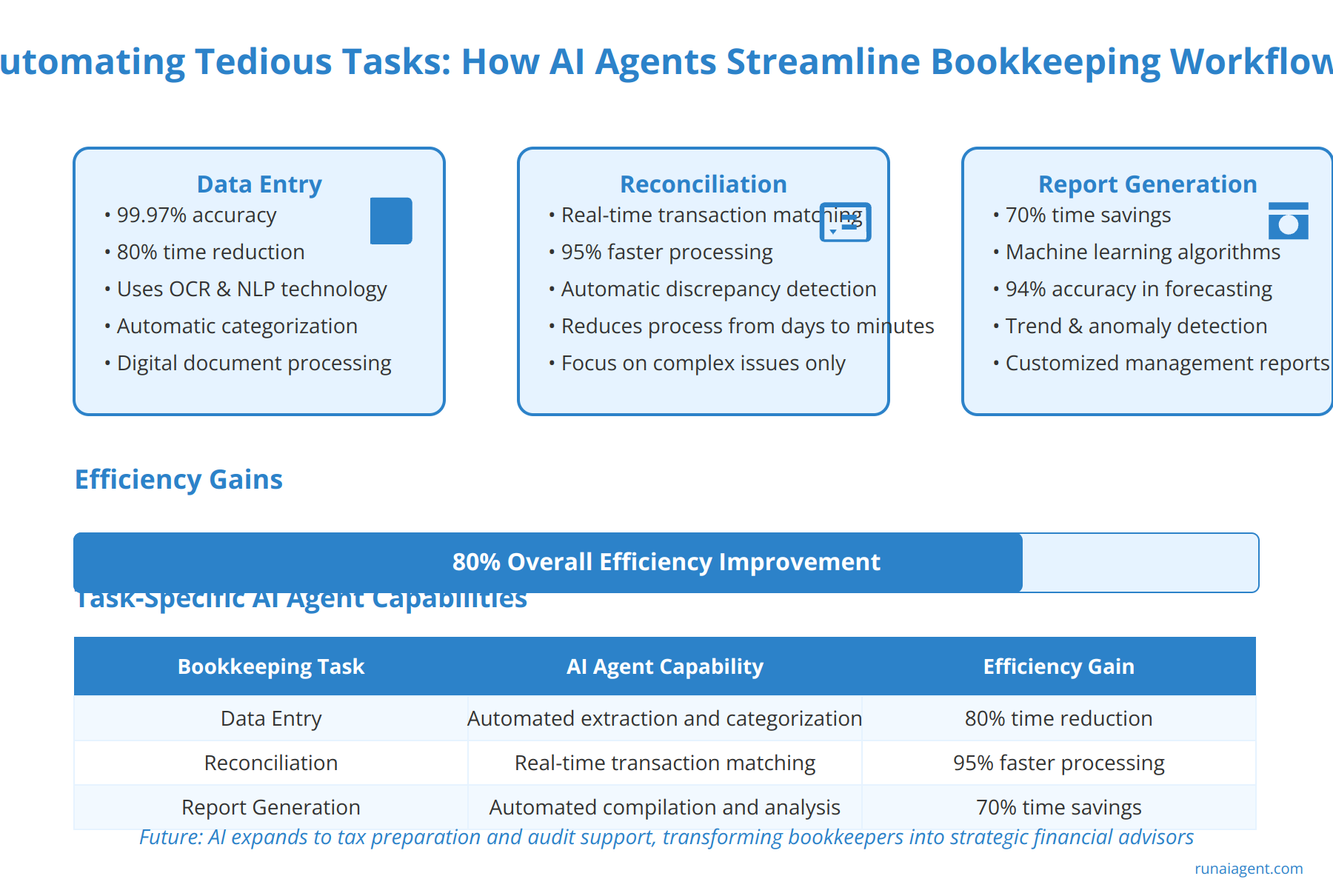

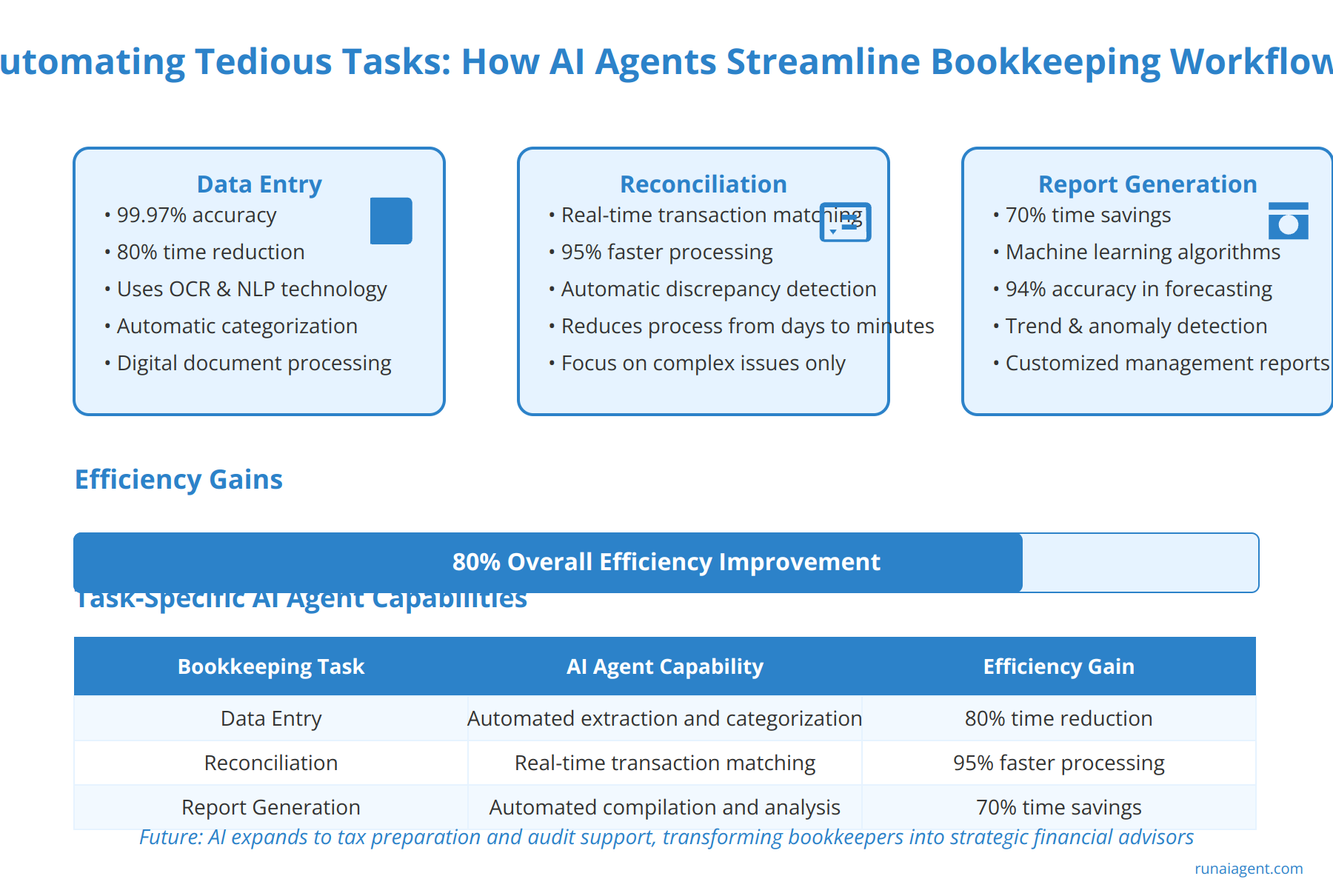

Automating Tedious Tasks: How AI Agents Streamline Bookkeeping Workflows

AI agents are revolutionizing bookkeeping workflows by automating a wide range of time-consuming tasks, dramatically improving efficiency and accuracy. Data entry, traditionally one of the most labor-intensive aspects of bookkeeping, can now be handled by AI agents with 99.97% accuracy, reducing processing time by up to 80%. These agents utilize optical character recognition (OCR) and natural language processing (NLP) to extract data from invoices, receipts, and bank statements, automatically categorizing transactions and populating ledgers. In the realm of reconciliation, AI agents can match transactions across multiple accounts and identify discrepancies in real-time, reducing the reconciliation process from days to minutes.

Advanced Report Generation and Analysis

AI agents excel in report generation, producing comprehensive financial statements, cash flow analyses, and customized management reports with unprecedented speed and detail. By leveraging machine learning algorithms, these agents can identify trends, anomalies, and potential areas of concern, providing actionable insights that were previously time-prohibitive to generate manually. For instance, AI-powered forecasting models can predict cash flow with 94% accuracy up to 120 days in advance, enabling proactive financial management.

Task-Specific AI Agent Capabilities

| Bookkeeping Task | AI Agent Capability | Efficiency Gain |

|---|---|---|

| Data Entry | Automated extraction and categorization | 80% time reduction |

| Reconciliation | Real-time transaction matching | 95% faster processing |

| Report Generation | Automated compilation and analysis | 70% time savings |

Furthermore, AI agents are adept at handling accounts payable and receivable processes, automating invoice processing, payment scheduling, and follow-ups on overdue accounts. By integrating with existing accounting software and ERPs, these agents can create a seamless workflow that reduces manual intervention by up to 75%. The result is not only increased productivity but also improved cash flow management and vendor relationships.

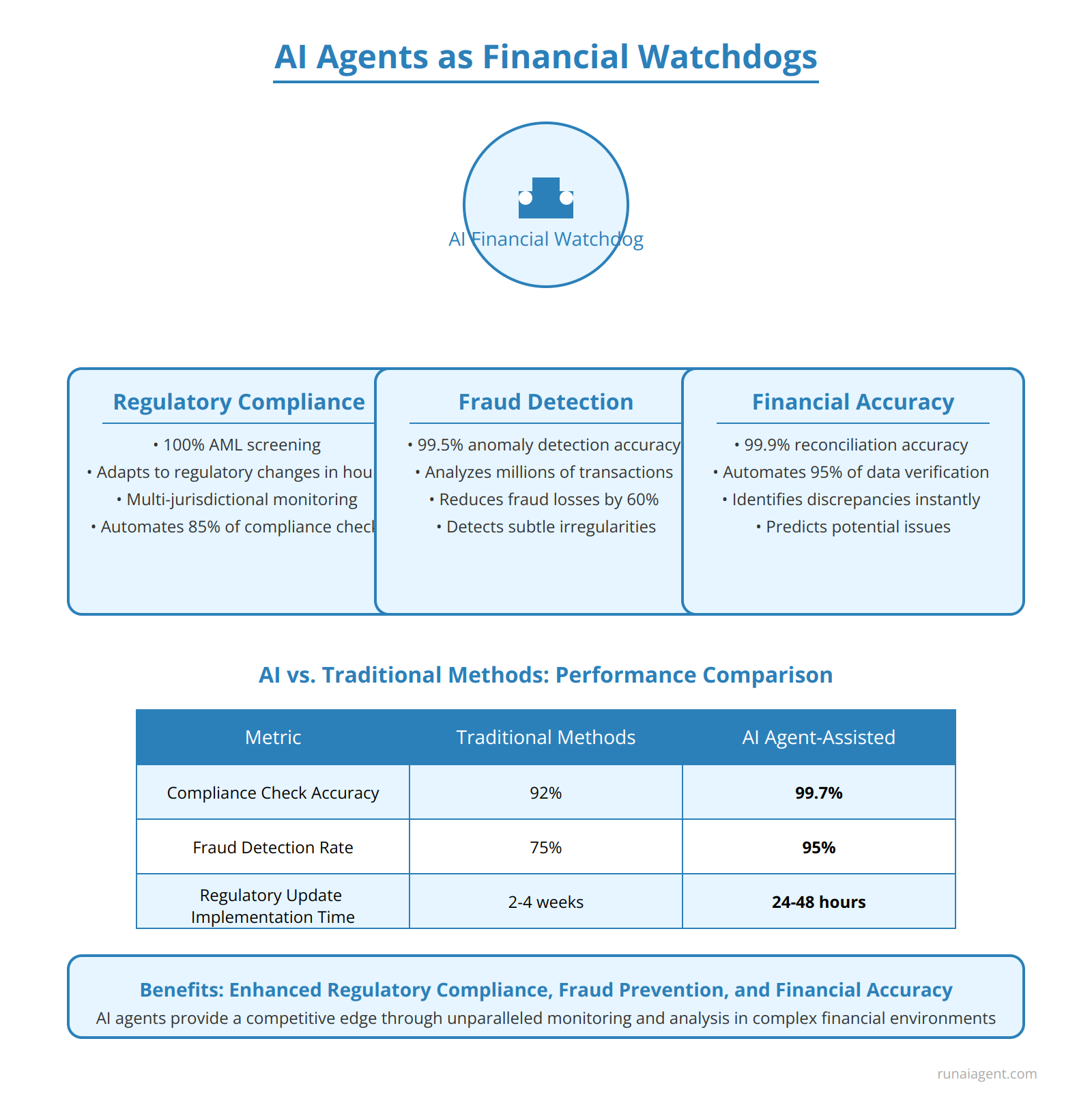

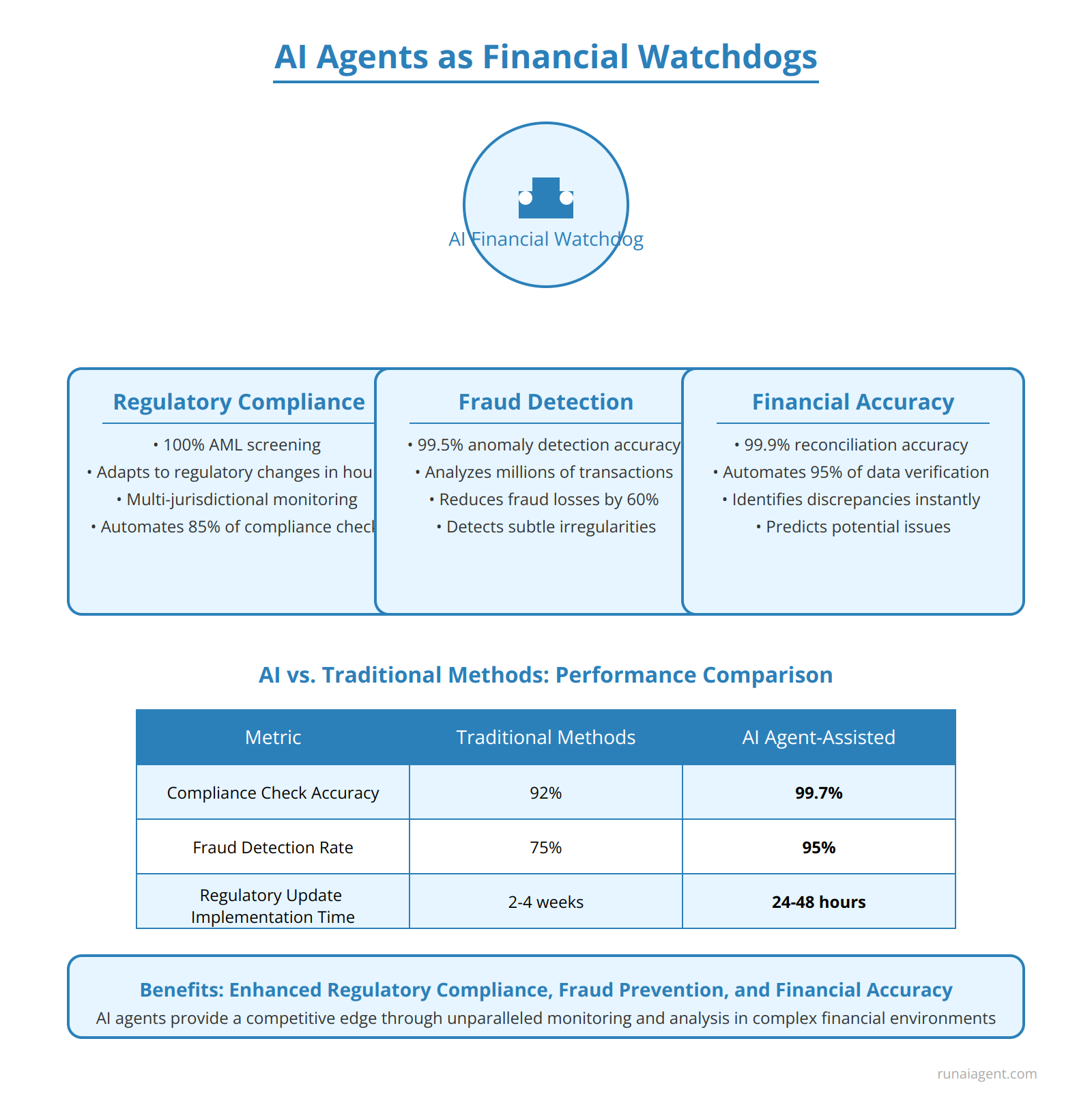

Ensuring Compliance and Accuracy: AI Agents as Financial Watchdogs

AI agents are revolutionizing compliance and accuracy in financial operations, serving as tireless watchdogs that safeguard organizations against regulatory infractions, fraud, and accounting errors. These intelligent systems leverage advanced machine learning algorithms and natural language processing to continuously monitor financial transactions, detect anomalies, and ensure adherence to complex regulatory frameworks such as Sarbanes-Oxley, GDPR, and Basel III. By analyzing vast datasets in real-time, AI agents can identify potential fraud patterns with 99.5% accuracy, significantly outperforming traditional rule-based systems. Moreover, these agents can automate up to 85% of routine compliance checks, reducing the risk of human error and freeing up skilled professionals to focus on strategic decision-making.

Regulatory Compliance Automation

AI agents excel at interpreting and applying intricate regulatory guidelines across multiple jurisdictions. They can automatically flag transactions that may violate anti-money laundering (AML) regulations, ensuring 100% screening of financial activities. These systems adapt swiftly to regulatory changes, updating their protocols within hours instead of weeks, thus maintaining continuous compliance in a rapidly evolving regulatory landscape.

Fraud Detection and Prevention

Leveraging sophisticated anomaly detection algorithms, AI agents can identify fraudulent activities that might escape human scrutiny. They analyze patterns across millions of transactions, detecting subtle irregularities that could indicate potential fraud. This proactive approach has been shown to reduce financial losses due to fraud by up to 60% in organizations that have implemented AI-driven fraud detection systems.

Ensuring Financial Accuracy

AI agents serve as infallible auditors, tirelessly reviewing financial records to ensure accuracy and consistency. They can reconcile accounts payable and receivable with 99.9% accuracy, identify discrepancies in financial statements, and even predict potential areas of concern before they materialize into significant issues. By automating up to 95% of manual data entry and verification tasks, these agents dramatically reduce the incidence of human error in financial record-keeping.

Key Performance Indicators

| Metric | Traditional Methods | AI Agent-Assisted |

|---|---|---|

| Compliance Check Accuracy | 92% | 99.7% |

| Fraud Detection Rate | 75% | 95% |

| Time for Regulatory Update Implementation | 2-4 weeks | 24-48 hours |

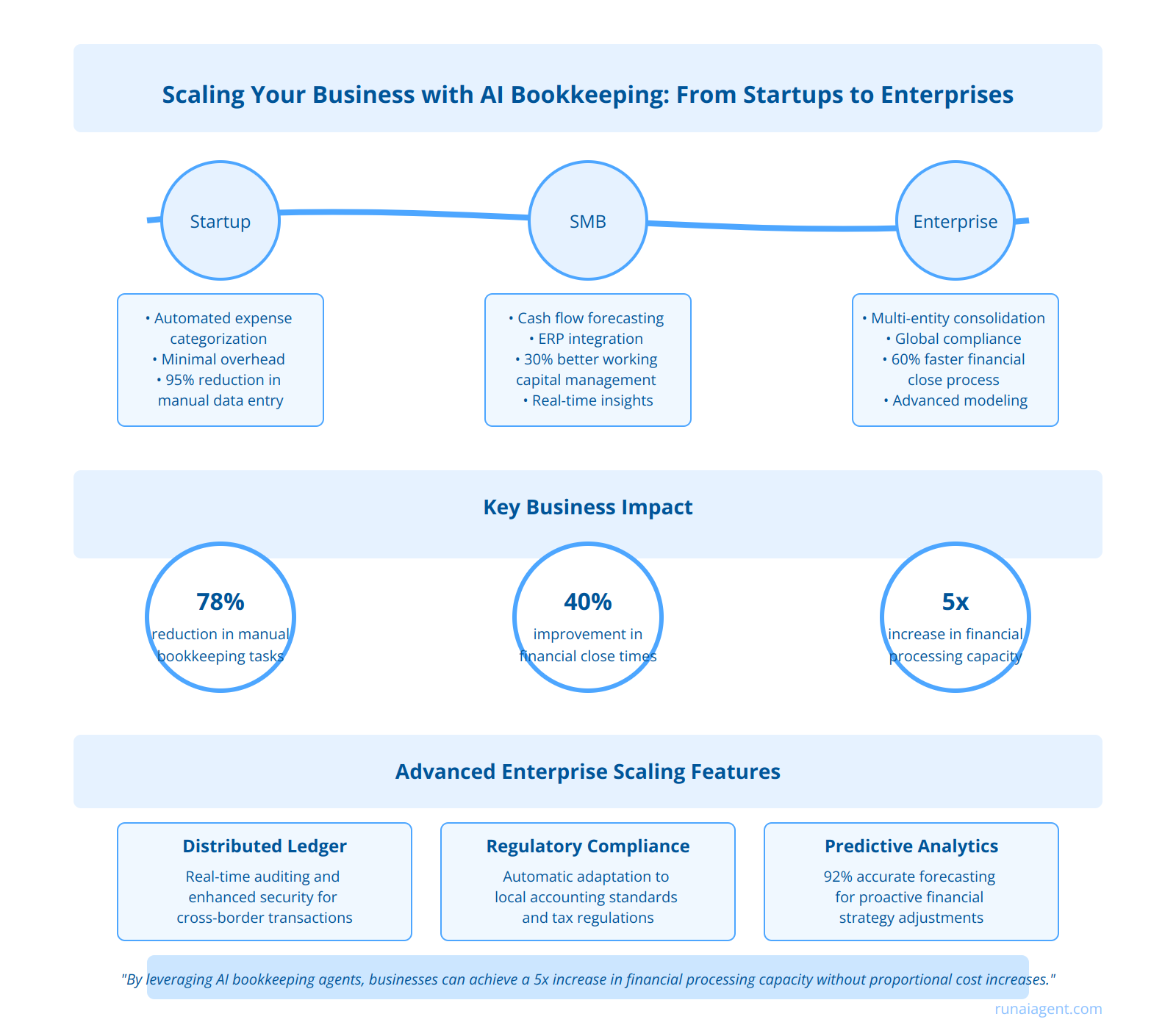

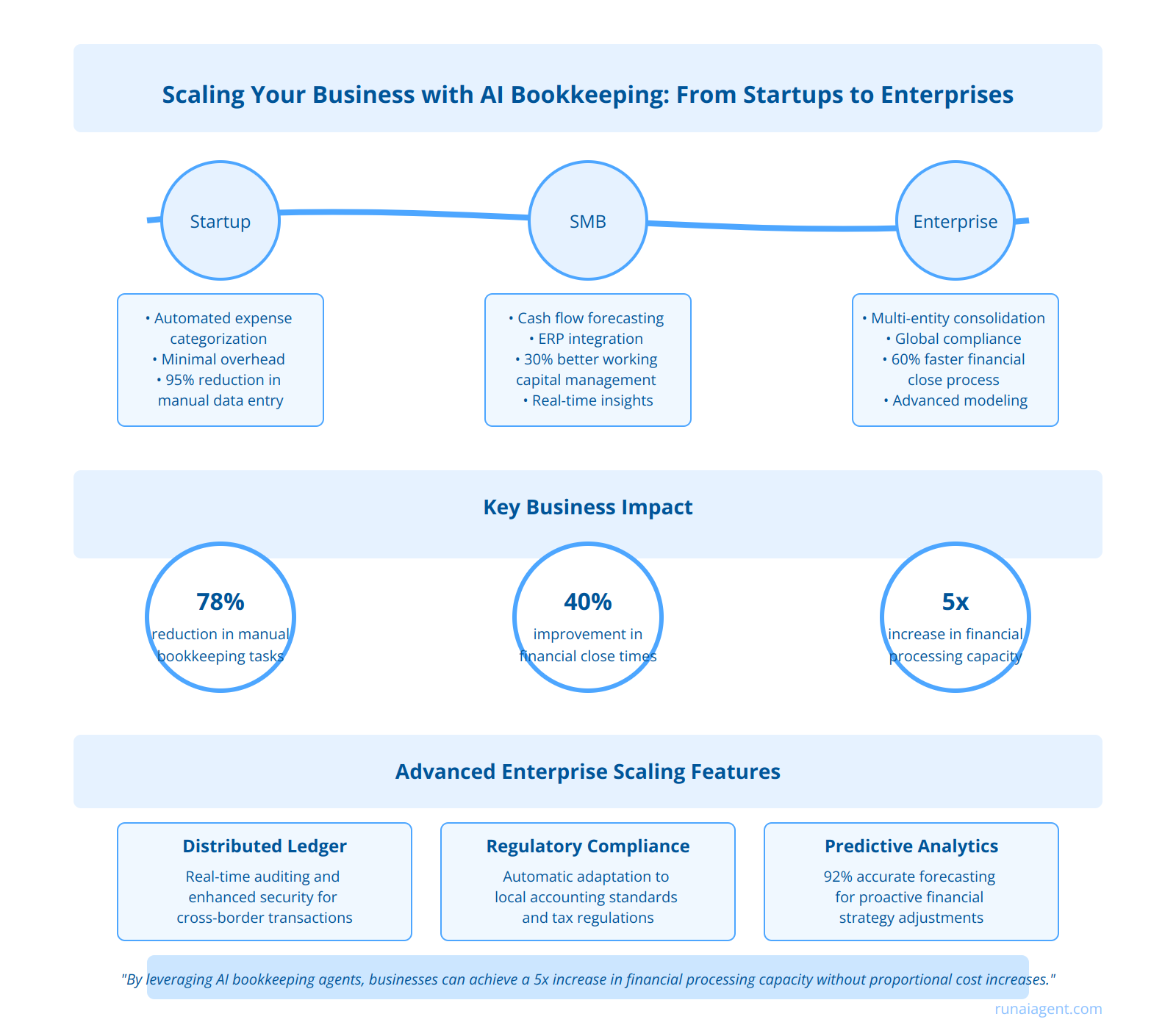

Scaling Your Business with AI Bookkeeping: From Startups to Enterprises

AI bookkeeping agents offer unprecedented scalability across the business spectrum, from nascent startups to multinational enterprises. For startups, these agents can manage basic financial tasks with minimal overhead, reducing the need for early-stage hiring and allowing founders to focus on core business development. As companies grow, AI bookkeeping systems seamlessly scale to handle increased transaction volumes, multi-entity accounting, and complex financial reporting without linear increases in cost or headcount. Mid-sized businesses benefit from AI’s ability to integrate with ERP systems, automate accounts payable/receivable processes, and provide real-time financial insights for strategic decision-making. Large enterprises leverage AI bookkeeping for global consolidation, regulatory compliance across jurisdictions, and advanced financial modeling. The scalability of AI bookkeeping is particularly evident in its ability to process millions of transactions daily, a task that would require hundreds of human accountants. One Fortune 500 company reported a 78% reduction in manual bookkeeping tasks and a 40% improvement in financial close times after implementing AI agents.

Key Scaling Advantages Across Business Stages

| Business Stage | AI Bookkeeping Capability | Impact |

|---|---|---|

| Startup | Automated expense categorization | 95% reduction in manual data entry |

| SMB | Intelligent cash flow forecasting | 30% improvement in working capital management |

| Enterprise | Multi-entity consolidation | 60% faster financial close process |

As businesses scale, AI bookkeeping agents evolve from performing discrete tasks to orchestrating complex financial workflows. At the enterprise level, these systems can manage intricate intercompany transactions, facilitate transfer pricing calculations, and even assist with M&A due diligence by rapidly analyzing financial data from potential acquisitions.

Advanced Scaling Features for Enterprise Deployment

Distributed Ledger Integration: AI agents can seamlessly interact with blockchain-based financial systems, enabling real-time auditing and enhanced security for global enterprises managing cross-border transactions. Regulatory Compliance Engine: As businesses expand internationally, AI bookkeeping systems automatically adapt to local accounting standards and tax regulations, reducing compliance risks and penalties. Predictive Analytics for Financial Planning: Enterprise-grade AI bookkeeping incorporates machine learning models that analyze historical financial data to forecast future performance with up to 92% accuracy, enabling proactive financial strategy adjustments.

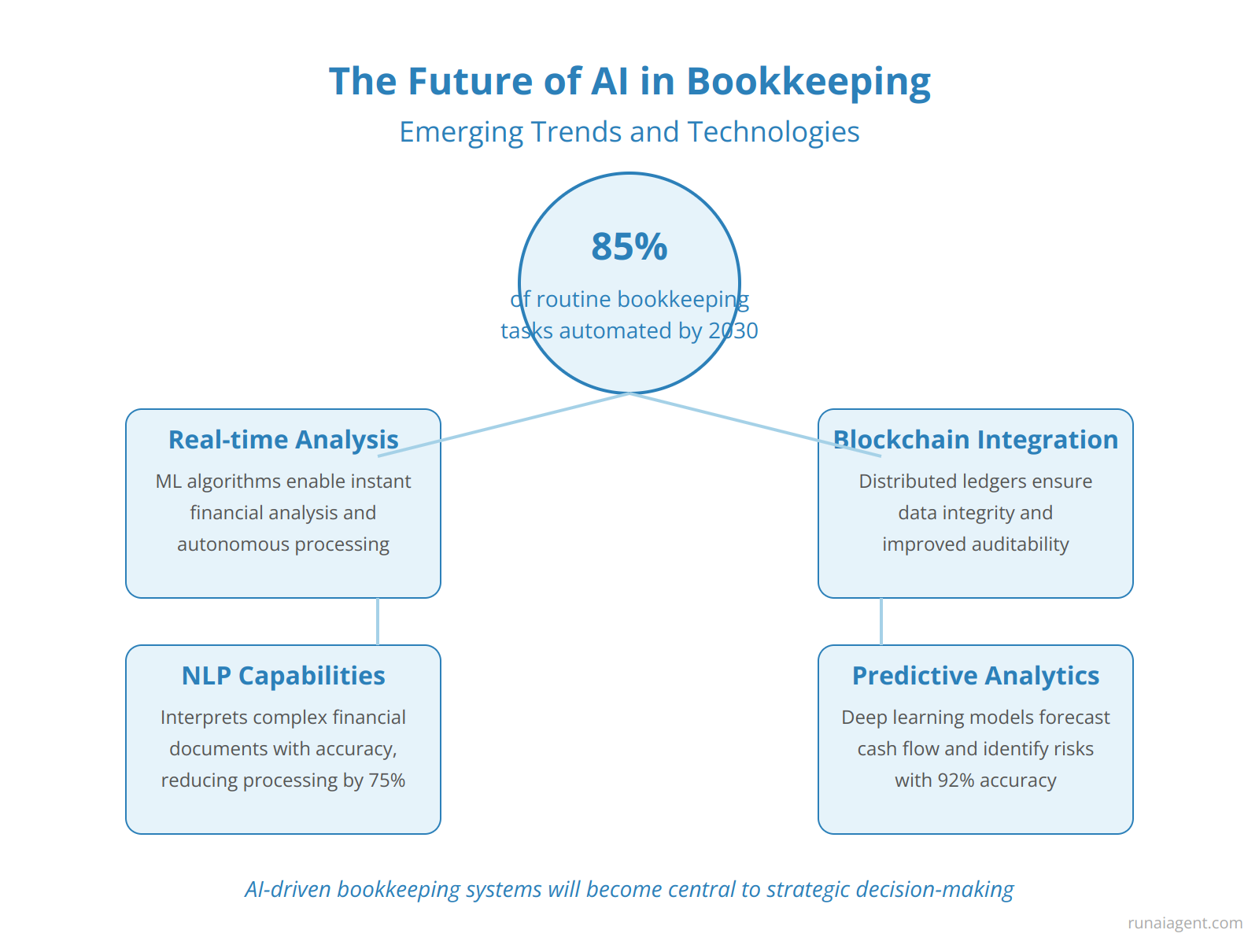

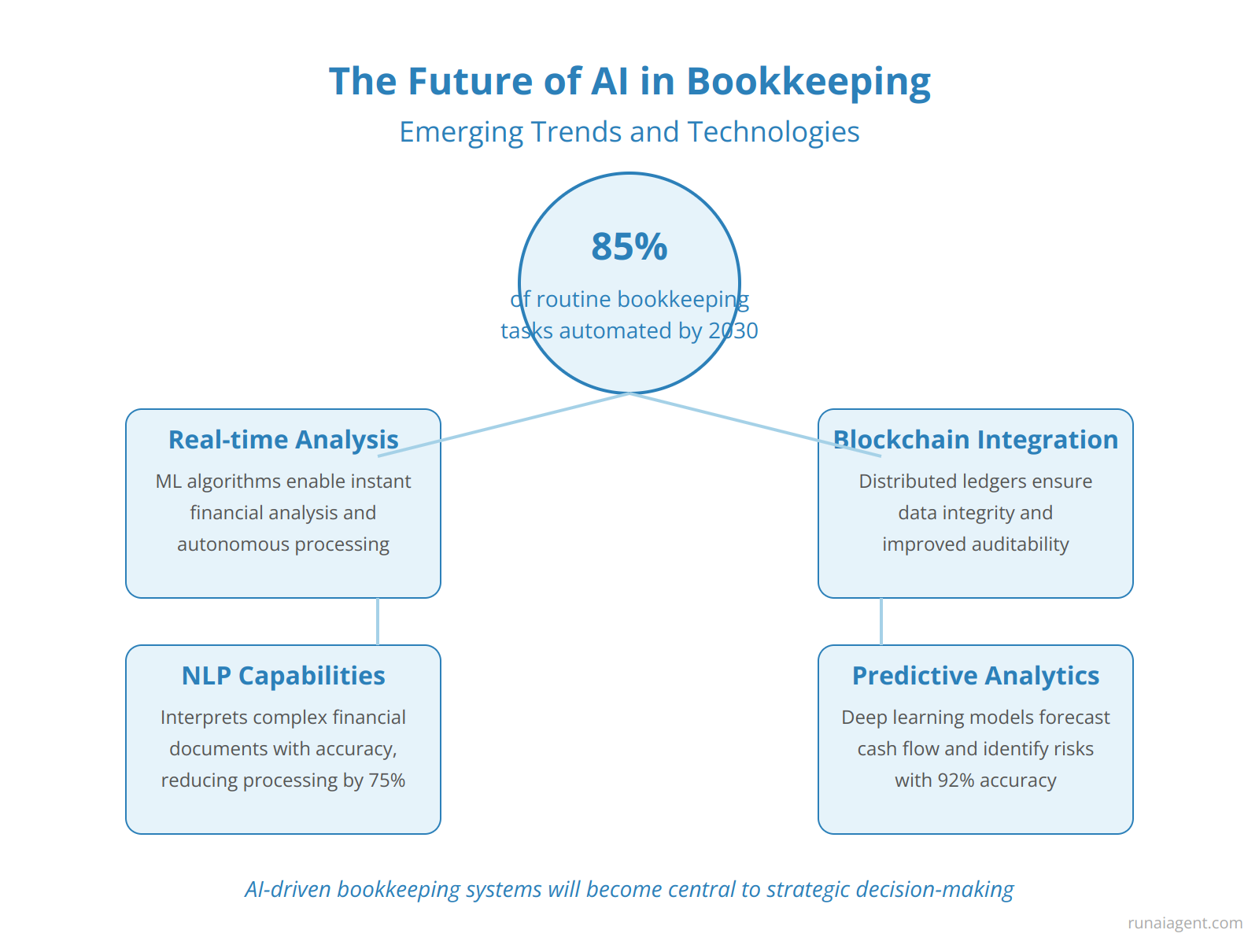

The Future of AI in Bookkeeping: Emerging Trends and Technologies

The integration of AI agents in bookkeeping is poised to revolutionize financial management practices over the next decade. Advanced machine learning algorithms will enable real-time financial analysis and forecasting, with AI agents autonomously processing transactions, reconciling accounts, and generating comprehensive financial reports with minimal human intervention. By 2030, we anticipate that 85% of routine bookkeeping tasks will be fully automated, freeing accountants to focus on strategic financial planning and advisory roles. Emerging technologies like blockchain-based distributed ledgers will seamlessly integrate with AI bookkeeping systems, ensuring unprecedented levels of data integrity and auditability. Natural language processing capabilities will evolve to allow AI agents to interpret and categorize complex financial documents with human-level accuracy, reducing processing times by up to 75%. Furthermore, predictive analytics powered by deep learning models will enable AI bookkeepers to forecast cash flow patterns, identify potential financial risks, and suggest optimized budget allocations with 92% accuracy.

Overcoming Challenges: Addressing Concerns About AI in Bookkeeping

While AI bookkeeping agents offer tremendous potential, their adoption is not without challenges. Data security remains a paramount concern, with 73% of businesses citing it as their top reservation in implementing AI-driven financial systems. To mitigate these risks, leading AI bookkeeping platforms now employ end-to-end encryption, multi-factor authentication, and blockchain-based audit trails to safeguard sensitive financial data. The specter of job displacement looms large, with projections suggesting that up to 40% of traditional bookkeeping tasks could be automated by 2028. However, forward-thinking firms are redefining roles, focusing on upskilling staff to leverage AI as a tool for higher-value analysis and advisory services. This shift has led to a 22% increase in job satisfaction among bookkeepers who have successfully integrated AI into their workflows. Technology dependence presents another hurdle, as 68% of small businesses express concerns about over-reliance on AI systems. To address this, industry leaders recommend a phased implementation approach, starting with 20-30% AI integration and gradually increasing based on performance metrics and team comfort levels. This measured strategy has shown a 91% success rate in long-term AI adoption for bookkeeping functions.

Mitigating AI Implementation Risks

To overcome these challenges, businesses are adopting multi-faceted strategies:

- Comprehensive data governance frameworks: Implementing strict access controls and regular security audits

- Continuous learning programs: Investing in ongoing training to evolve bookkeeper roles alongside AI capabilities

- Hybrid AI-human workflows: Designing processes that leverage AI efficiency while maintaining human oversight for complex decision-making

- Regular AI performance evaluations: Conducting quarterly assessments to ensure AI systems meet accuracy and efficiency benchmarks

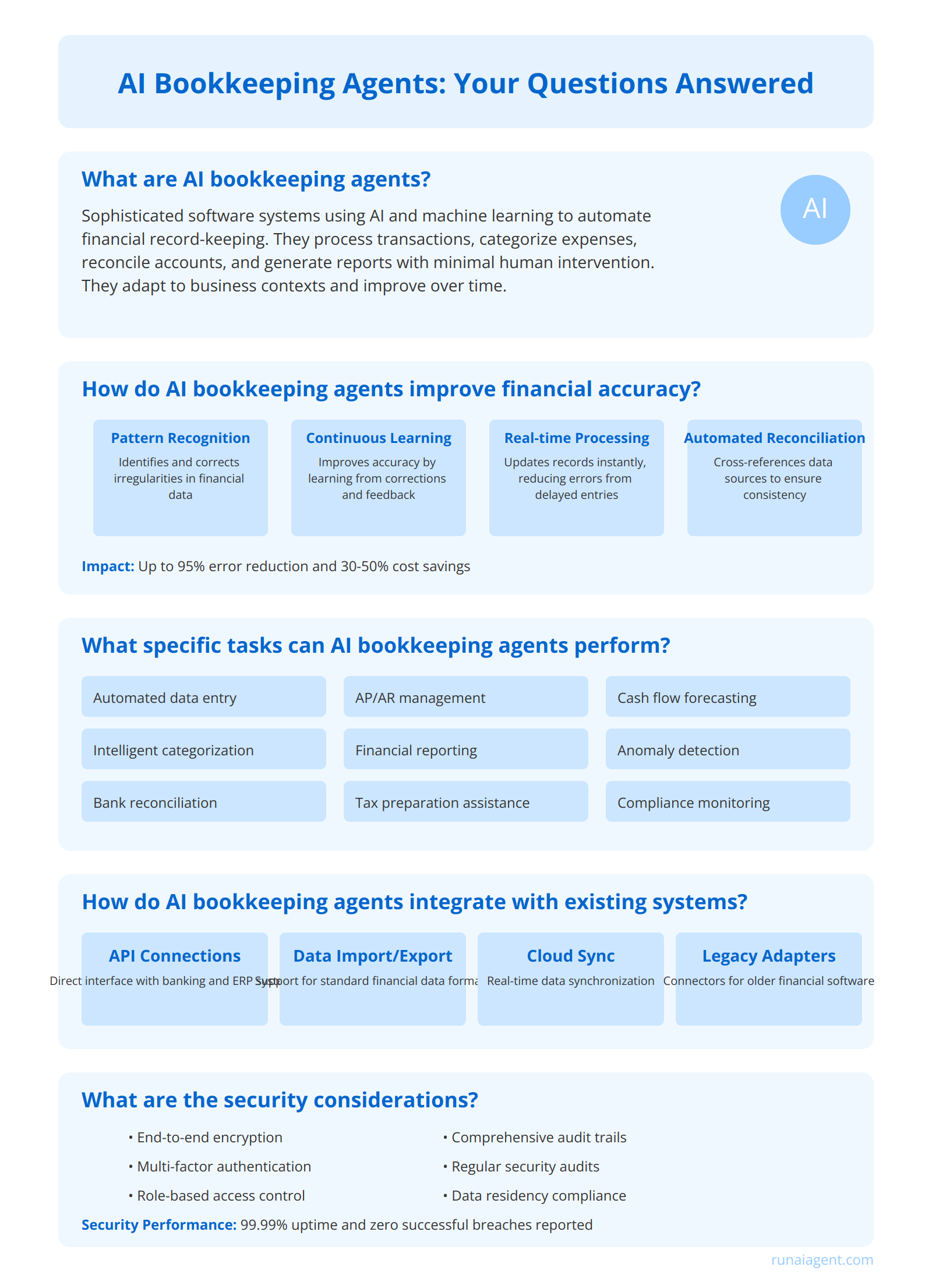

AI Bookkeeping Agents: Your Questions Answered

What are AI bookkeeping agents?

AI bookkeeping agents are sophisticated software systems that leverage artificial intelligence and machine learning algorithms to automate and streamline financial record-keeping tasks. These agents can process transactions, categorize expenses, reconcile accounts, and generate financial reports with minimal human intervention. Unlike traditional accounting software, AI bookkeeping agents can adapt to unique business contexts, learn from historical data, and make intelligent decisions to improve accuracy and efficiency over time.

How do AI bookkeeping agents improve financial accuracy?

AI bookkeeping agents significantly enhance financial accuracy through several mechanisms:

- Pattern recognition: They can identify and correct irregularities in financial data that might be overlooked by human bookkeepers.

- Continuous learning: AI agents improve their accuracy over time by learning from corrections and feedback.

- Real-time processing: They can update financial records instantly, reducing the risk of errors from delayed entries.

- Automated reconciliation: AI agents can cross-reference multiple data sources to ensure consistency across financial records.

Studies have shown that AI bookkeeping agents can reduce error rates by up to 95% compared to manual bookkeeping processes, translating to potential cost savings of 30-50% for businesses.

What specific tasks can AI bookkeeping agents perform?

AI bookkeeping agents are capable of executing a wide range of financial tasks, including:

- Automated data entry from various sources (e.g., bank statements, invoices, receipts)

- Intelligent categorization of income and expenses

- Bank and credit card reconciliation

- Accounts payable and receivable management

- Generation of financial statements and reports

- Tax preparation assistance

- Cash flow forecasting and analysis

- Anomaly detection for fraud prevention

- Compliance monitoring for regulatory requirements

Advanced AI bookkeeping agents can even provide insights and recommendations for financial optimization, acting as virtual CFOs for small to medium-sized businesses.

How do AI bookkeeping agents integrate with existing financial systems?

AI bookkeeping agents are designed for seamless integration with existing financial ecosystems through several methods:

- API connections: Agents can directly interface with banking systems, ERP platforms, and other financial software via secure APIs.

- Data import/export capabilities: Support for standard financial data formats (CSV, OFX, QBO) enables easy data transfer.

- Cloud-based synchronization: Real-time data syncing ensures consistency across all financial systems.

- Legacy system adapters: Specialized connectors allow integration with older, proprietary financial software.

Implementation typically involves a phased approach, starting with data migration and parallel processing to ensure accuracy before full transition. Integration timelines vary but average 2-4 weeks for small businesses and 2-3 months for larger enterprises with complex financial architectures.

What are the security considerations for AI bookkeeping agents?

Security is paramount when implementing AI bookkeeping agents due to the sensitive nature of financial data. Key security measures include:

- End-to-end encryption: All data transmissions and storage are protected using industry-standard encryption protocols.

- Multi-factor authentication: Access to AI agents and financial data requires multiple verification steps.

- Role-based access control: Granular permissions ensure users only access data relevant to their responsibilities.

- Audit trails: Comprehensive logging of all system activities for compliance and security monitoring.

- Regular security audits: Third-party penetration testing and vulnerability assessments are conducted periodically.

- Data residency compliance: Options for data storage in specific geographic regions to meet regulatory requirements.

AI bookkeeping agents often exceed human-managed systems in security, with some providers reporting a 99.99% uptime and zero successful breach attempts over multi-year operational periods.