Table of Contents

The AI Revolution in Accountancy: Transforming Financial Management

AI Agents vs. Human Accountants: Debunking the Replacement Myth

Automating the Mundane: How AI Agents Streamline Accounting Processes

Real-Time Financial Insights: AI-Powered Analytics for Strategic Decision-Making

Enhancing Accuracy and Compliance: AI’s Role in Error Detection and Fraud Prevention

Cost-Effective Accounting: The ROI of Implementing AI Agents in Your Business

Personalized Financial Advisory: How AI Agents Augment Human Expertise

Seamless Integration: Implementing AI Agents in Your Existing Accounting Ecosystem

The Future of Accountancy: Emerging AI Technologies and Their Potential Impact

Ethical Considerations: Navigating Privacy and Security Concerns with AI in Accounting

AI-Powered Accountancy: Frequently Asked Questions

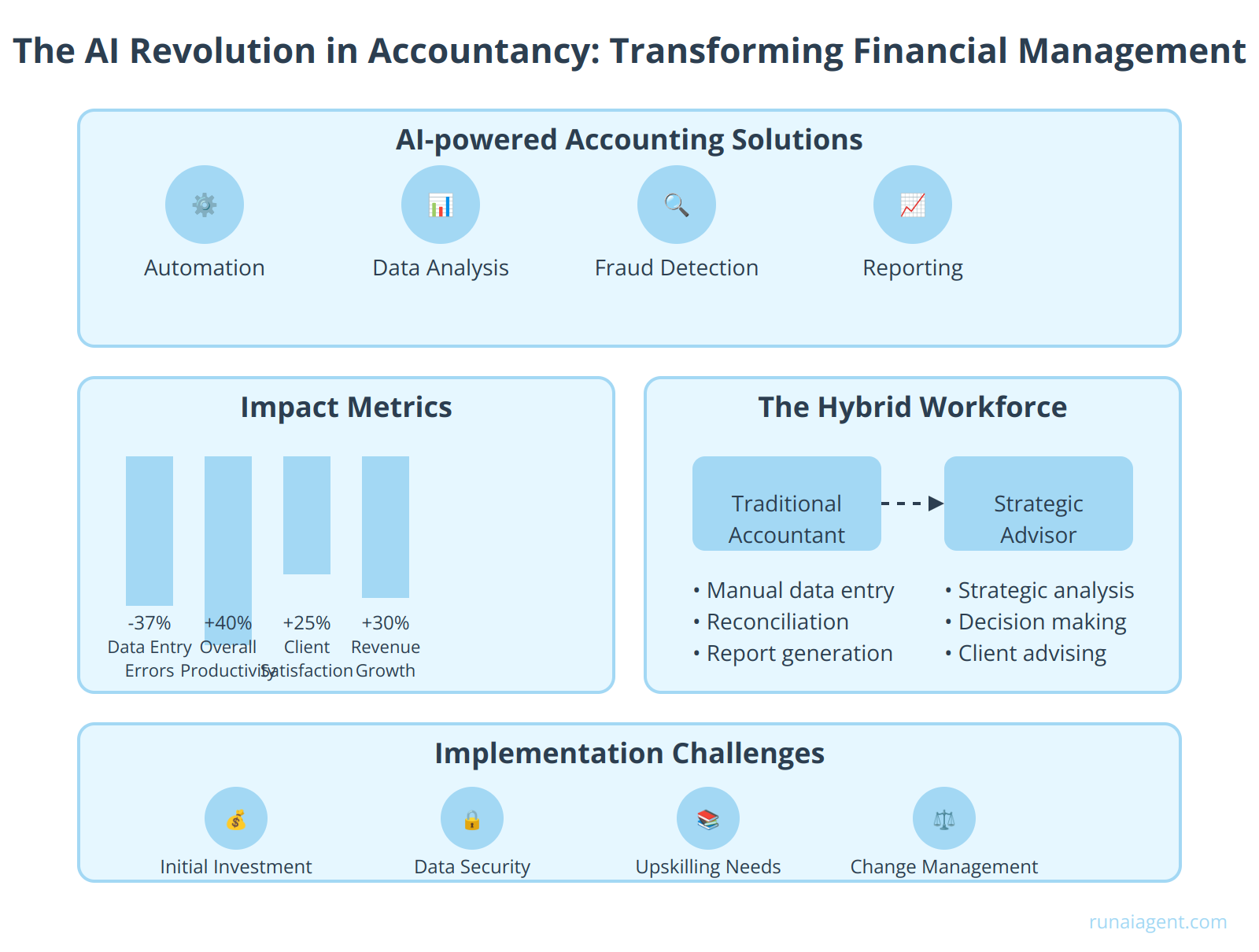

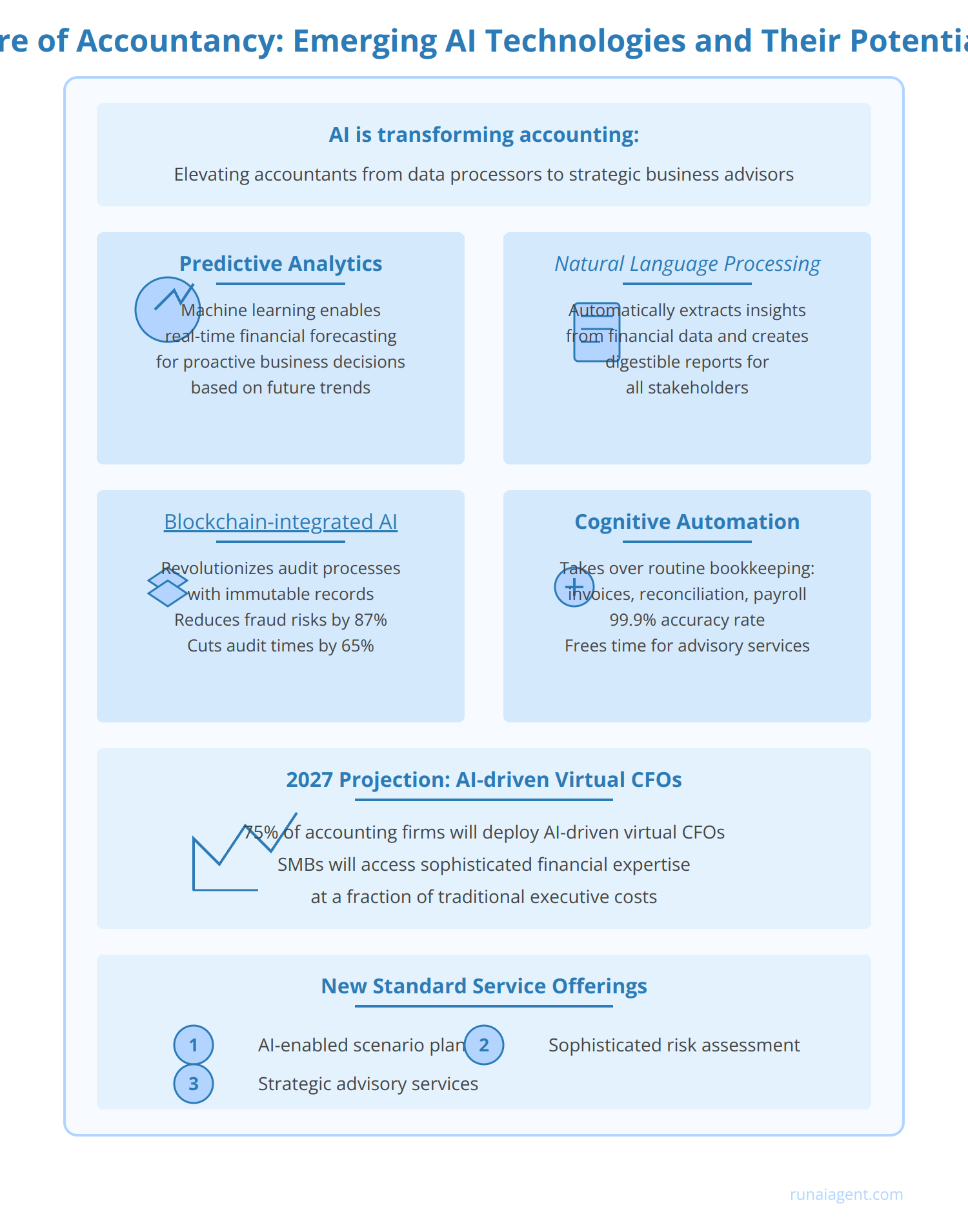

The AI Revolution in Accountancy: Transforming Financial Management

AI agents are fundamentally reshaping the accounting industry, ushering in a new era of efficiency, accuracy, and strategic financial management. These intelligent systems are automating routine tasks, reducing human error, and providing real-time insights that were previously unattainable. AI-powered accounting solutions can process vast amounts of financial data in seconds, perform complex reconciliations, and generate comprehensive reports with minimal human intervention. For instance, AI agents can now analyze millions of transactions to detect anomalies and potential fraud, a task that would take human accountants weeks to complete. The implementation of AI in accounting has led to a remarkable 37% reduction in manual data entry errors and a 40% increase in overall productivity for firms adopting these technologies. However, the integration of AI agents also presents challenges, including the need for significant upfront investment, data security concerns, and the requirement for accountants to upskill and adapt to new roles. As AI takes over routine tasks, accountants are evolving into strategic advisors, focusing on high-level financial analysis and decision-making. This shift is creating a hybrid workforce where human expertise is augmented by AI capabilities, leading to more informed financial strategies and improved business outcomes. Despite the initial hurdles, the long-term benefits of AI in accountancy are undeniable, with early adopters reporting a 25% increase in client satisfaction and a 30% boost in revenue growth within the first two years of implementation.

AI Agents vs. Human Accountants: Debunking the Replacement Myth

The integration of AI agents in accounting has sparked debates about the future of human accountants. However, the reality is far more nuanced than a simple replacement scenario. AI excels in data processing, pattern recognition, and routine task automation, handling vast amounts of financial data with unprecedented speed and accuracy. For instance, AI-powered systems can process 200 times more data than human accountants, reducing error rates by 37% in transactional accounting tasks. Yet, human accountants remain irreplaceable in areas requiring professional judgment, strategic decision-making, and ethical considerations. A study by the Association of Chartered Certified Accountants found that 89% of accountants believe AI will enhance their analytical capabilities rather than replace them. The symbiotic relationship between AI and human accountants is evident in complex financial modeling, where AI provides rapid scenario analysis, while humans interpret results within broader business contexts. In tax planning, AI agents can swiftly navigate intricate tax codes, but human accountants are crucial for developing tailored strategies that align with client goals and risk tolerances. Moreover, in audit processes, AI significantly reduces sampling errors and identifies anomalies, allowing human auditors to focus on high-risk areas and maintain professional skepticism. This complementary approach has led to a 40% increase in audit efficiency and a 25% improvement in fraud detection rates. As the accounting landscape evolves, the most successful firms will be those that strategically leverage AI to augment human expertise, creating a powerful synergy that drives innovation and value in financial services.

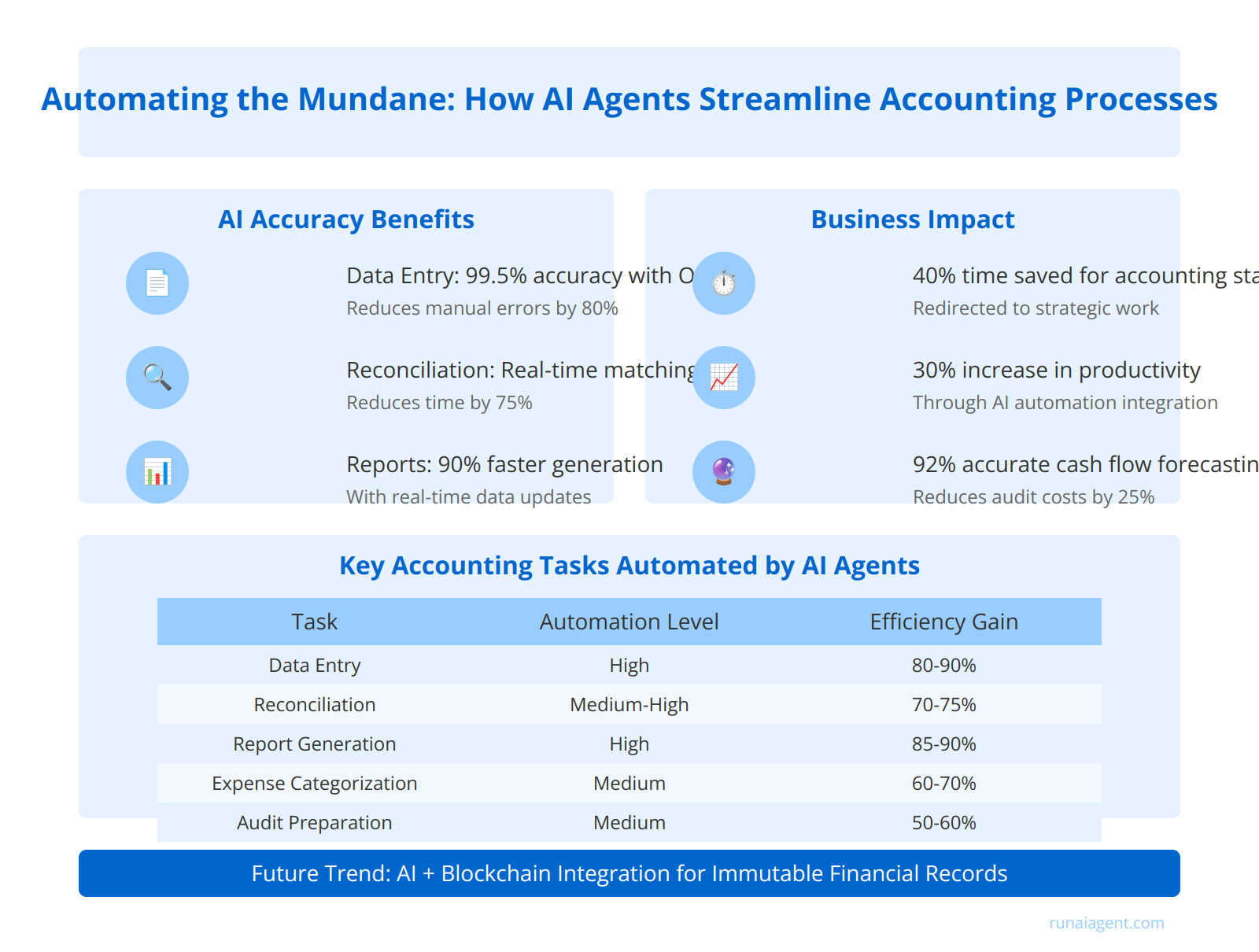

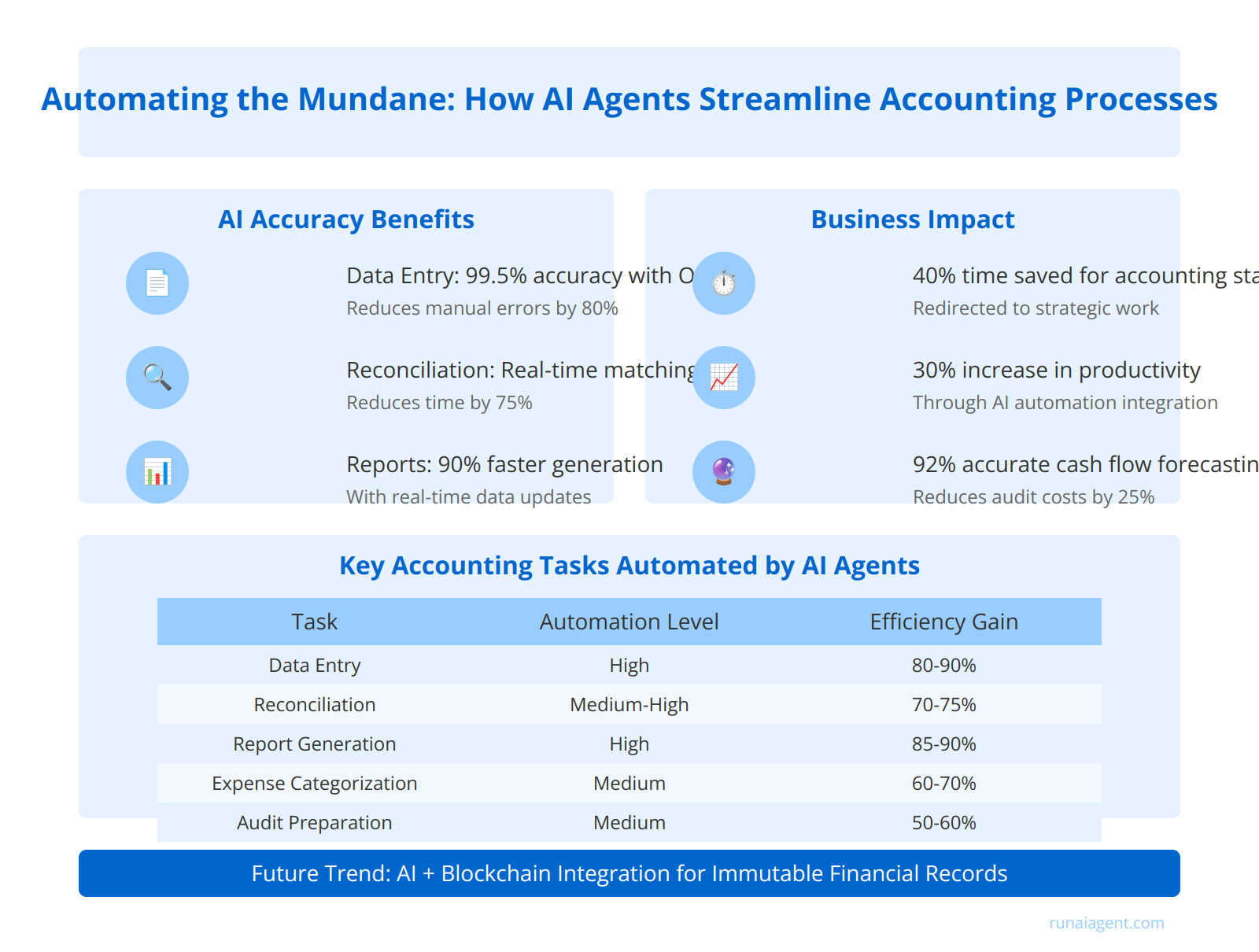

Automating the Mundane: How AI Agents Streamline Accounting Processes

AI agents are revolutionizing accounting processes by automating time-consuming, repetitive tasks with unprecedented accuracy and efficiency. In data entry, AI-powered optical character recognition (OCR) systems can extract information from invoices, receipts, and financial statements with 99.5% accuracy, reducing manual input errors by up to 80%. For reconciliation, AI agents can match transactions across multiple accounts and systems in real-time, flagging discrepancies for human review and reducing reconciliation time by 75%. Report generation, once a labor-intensive process, is now streamlined through natural language processing (NLP) algorithms that can compile, analyze, and present financial data in customizable formats. These AI-driven reports can be generated 90% faster than traditional methods, with the ability to incorporate real-time data updates. Furthermore, AI agents excel in complex tasks such as expense categorization, applying machine learning to accurately classify transactions with 95% precision, significantly outperforming rule-based systems. By automating these core accounting functions, businesses can reallocate up to 40% of their accounting staff’s time to higher-value activities such as financial strategy and advisory services, driving a 30% increase in overall departmental productivity.

Key Accounting Tasks Automated by AI Agents:

| Task | Automation Level | Efficiency Gain |

|---|---|---|

| Data Entry | High | 80-90% |

| Reconciliation | Medium-High | 70-75% |

| Report Generation | High | 85-90% |

| Expense Categorization | Medium | 60-70% |

| Audit Preparation | Medium | 50-60% |

Advanced AI agents are now capable of performing predictive analytics on financial data, forecasting cash flow with 92% accuracy and identifying potential audit risks before they materialize. This proactive approach not only enhances financial planning but also strengthens compliance efforts, reducing audit-related costs by up to 25%. As these AI systems continue to evolve, they are increasingly integrating with blockchain technology to ensure immutable transaction records and smart contracts for automated, trust-less financial operations, paving the way for a new era of efficient, transparent, and error-free accounting processes.

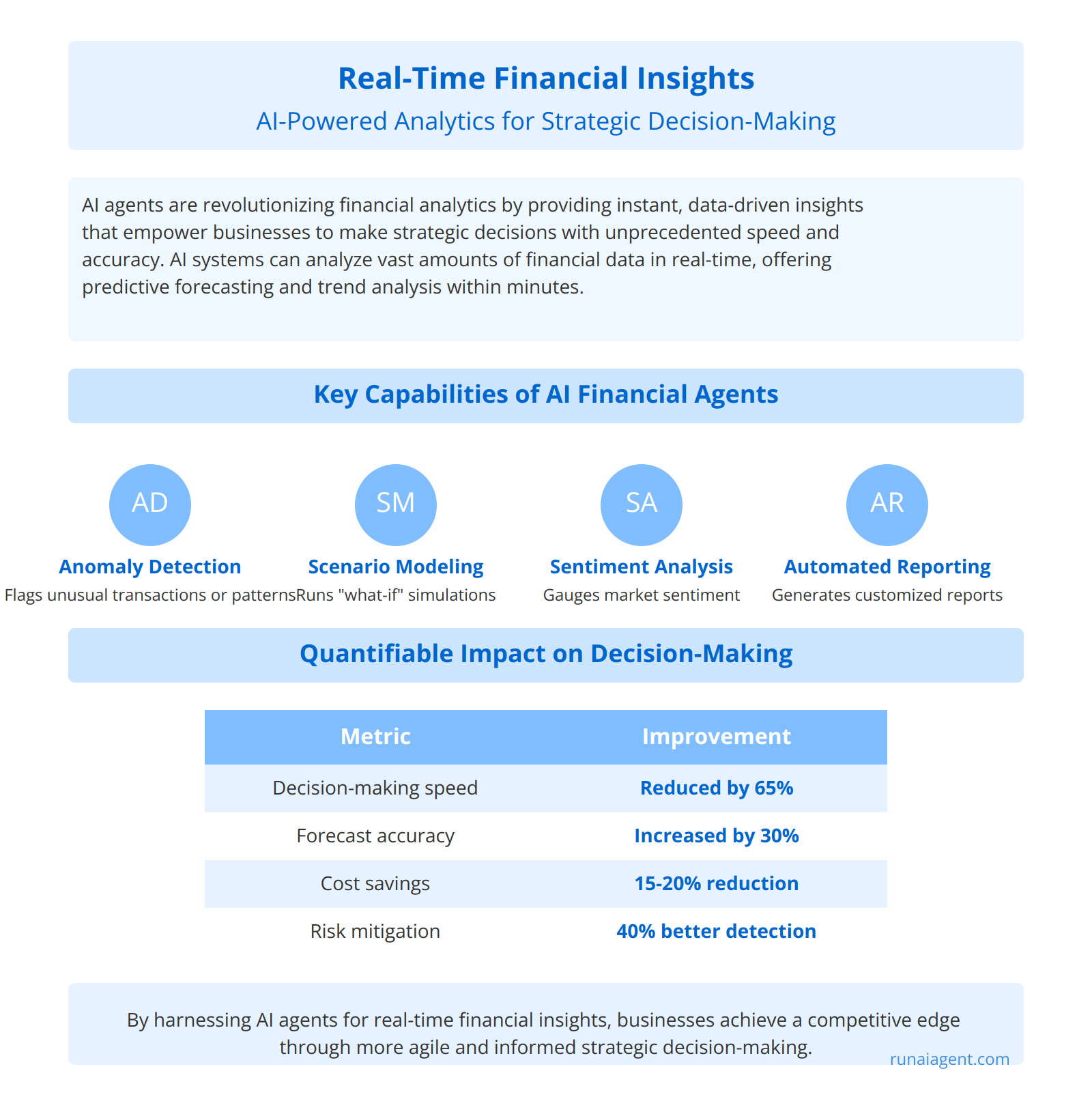

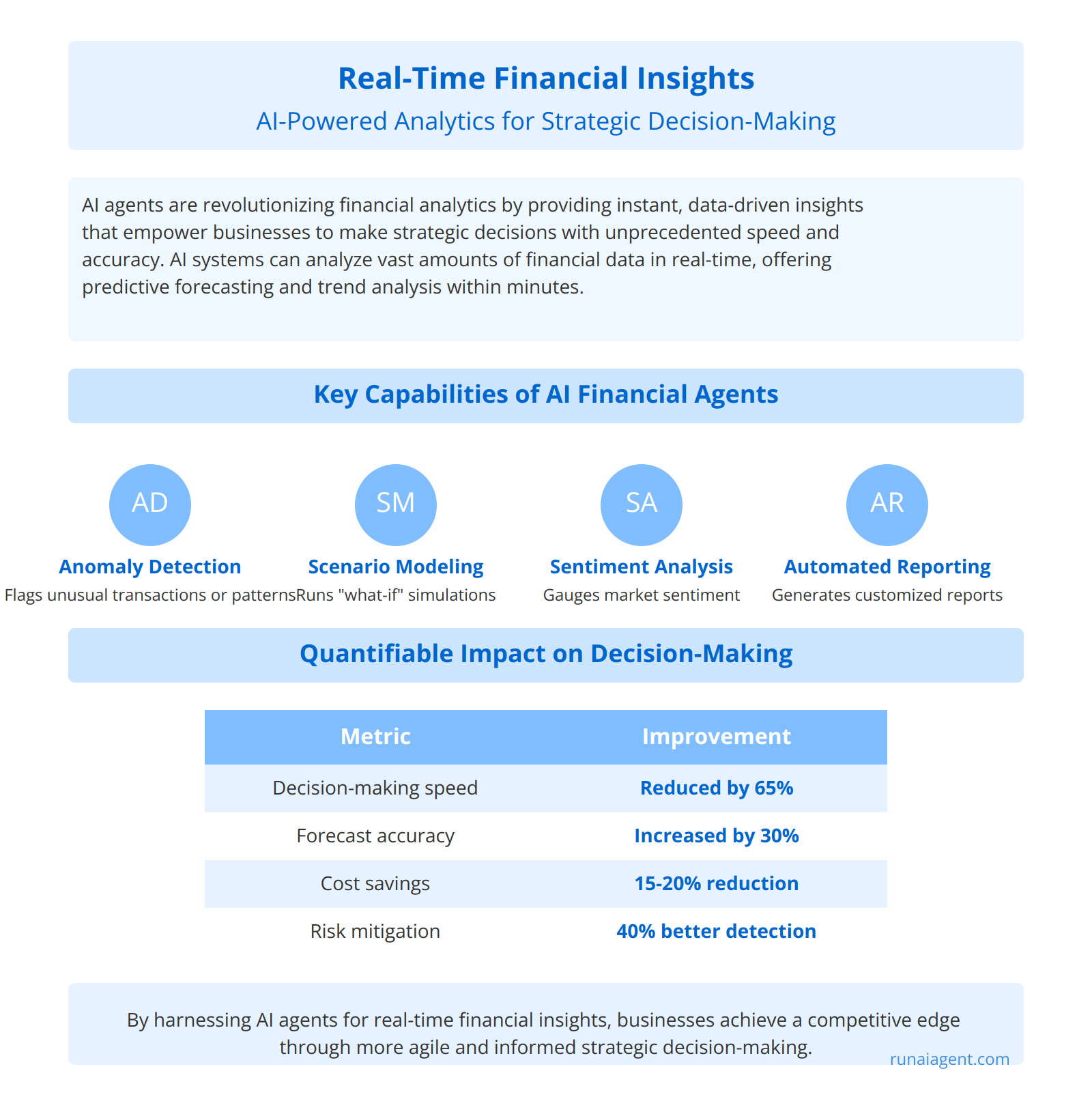

Real-Time Financial Insights: AI-Powered Analytics for Strategic Decision-Making

AI agents are revolutionizing financial analytics in the accountancy industry, providing instant, data-driven insights that empower businesses to make strategic decisions with unprecedented speed and accuracy. These intelligent systems leverage advanced machine learning algorithms and natural language processing to analyze vast amounts of financial data in real-time, offering predictive forecasting and trend analysis that would take human accountants days or weeks to compile. For instance, AI-powered financial analytics platforms can process millions of transactions, market data points, and economic indicators simultaneously, generating comprehensive financial reports and cash flow projections within minutes. This rapid analysis enables CFOs and financial managers to respond swiftly to market fluctuations, identify potential risks, and capitalize on emerging opportunities.

Key Capabilities of AI Financial Agents

Modern AI financial agents offer a suite of powerful capabilities:

- Anomaly Detection: Automatically flagging unusual transactions or patterns that may indicate fraud or errors

- Scenario Modeling: Running complex “what-if” simulations to forecast the impact of various business decisions

- Sentiment Analysis: Gauging market sentiment from news and social media to predict financial trends

- Automated Reporting: Generating customized financial reports tailored to specific stakeholder needs

Quantifiable Impact on Decision-Making

The implementation of AI-powered financial analytics has led to significant improvements in decision-making efficiency and accuracy:

| Metric | Improvement |

|---|---|

| Decision-making speed | Reduced by 65% |

| Forecast accuracy | Increased by 30% |

| Cost savings | 15-20% reduction in financial planning costs |

| Risk mitigation | 40% improvement in early risk detection |

By harnessing the power of AI agents for real-time financial insights, businesses can achieve a competitive edge through more agile and informed strategic decision-making. This technology not only enhances the role of accountants but also elevates the entire financial planning and analysis process to new heights of efficiency and strategic value.

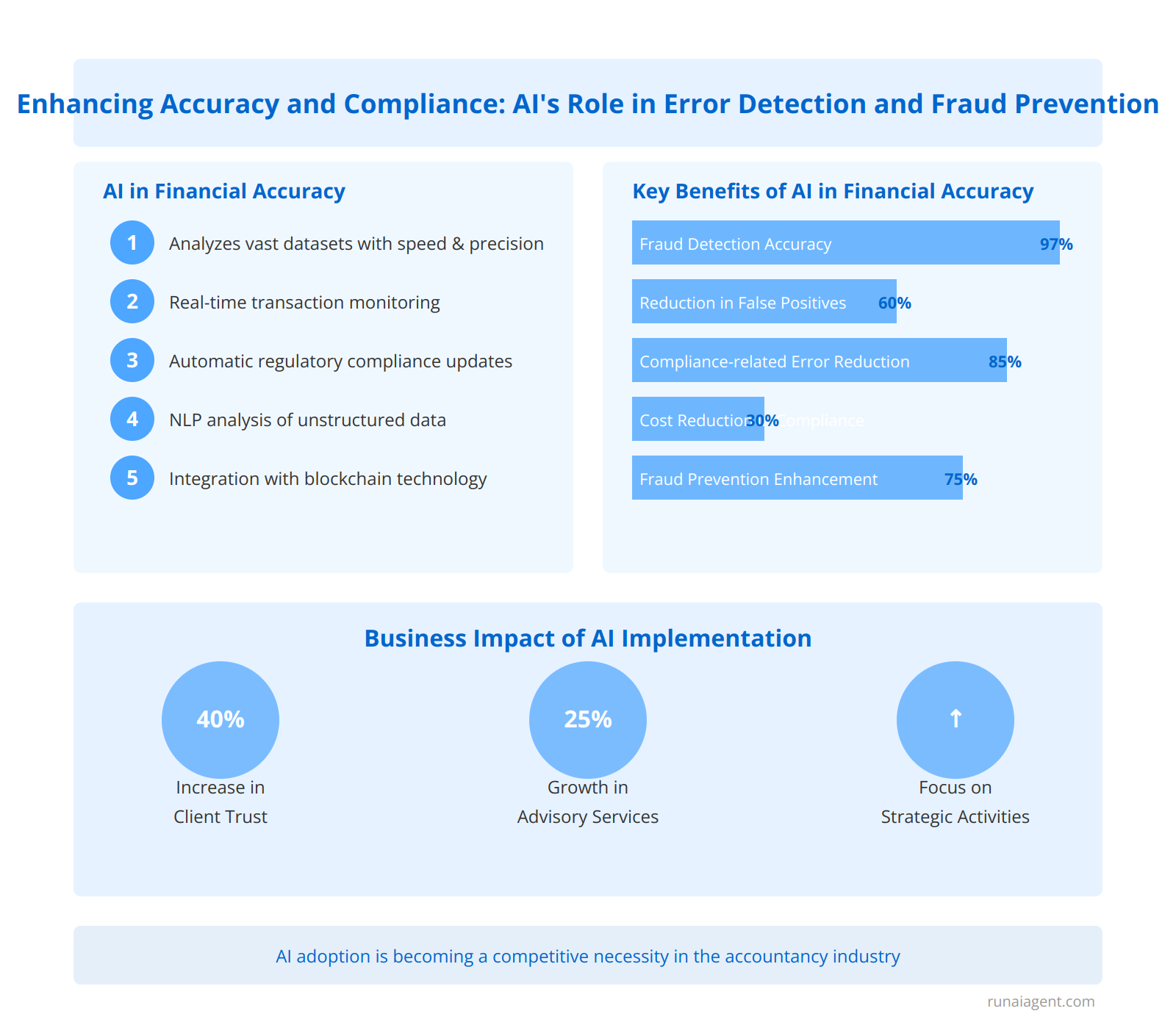

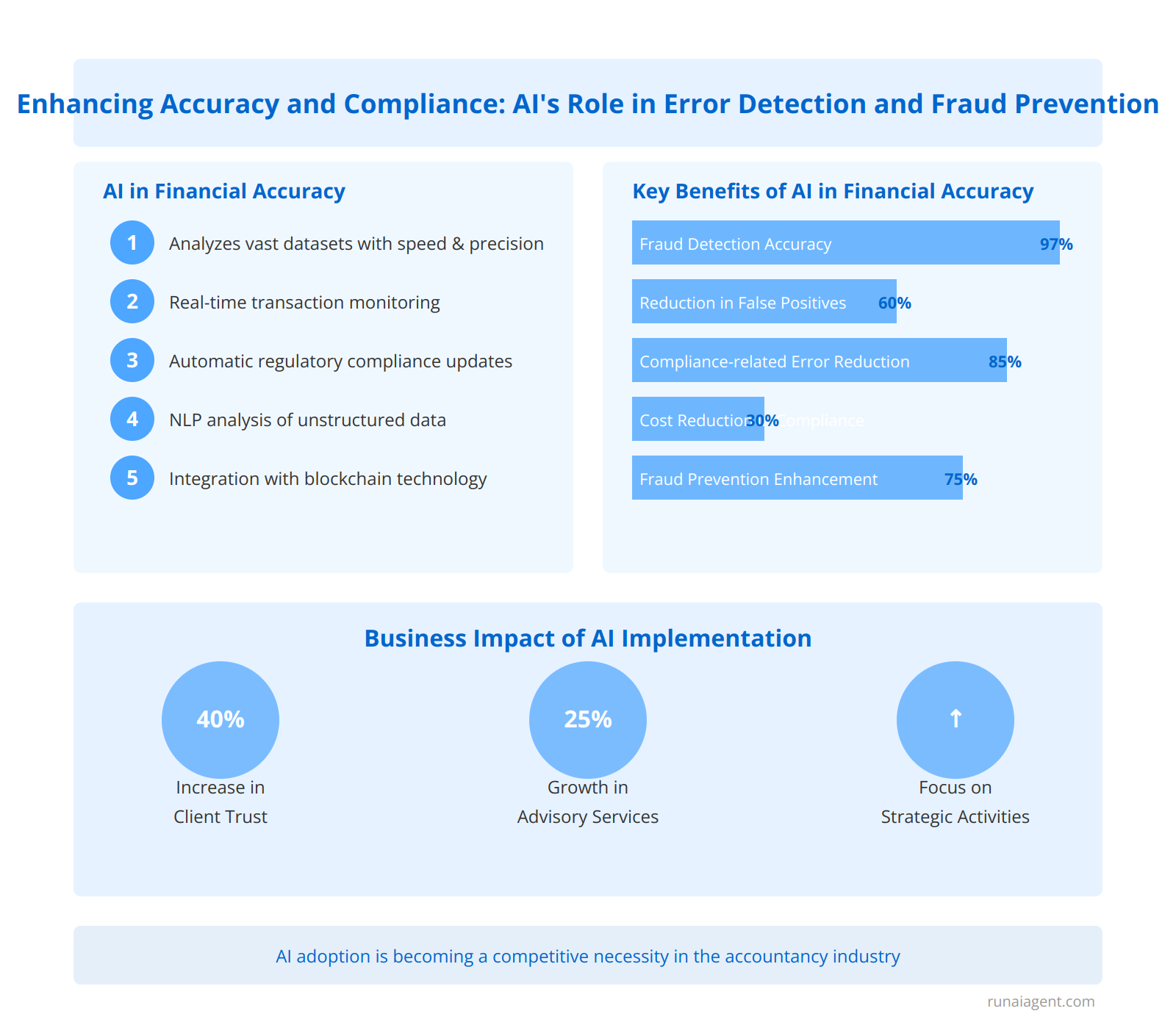

Enhancing Accuracy and Compliance: AI’s Role in Error Detection and Fraud Prevention

AI agents are revolutionizing financial accuracy, regulatory compliance, and fraud prevention in the accountancy industry. Advanced machine learning algorithms can analyze vast datasets with unprecedented speed and precision, identifying anomalies and discrepancies that human auditors might overlook. For instance, AI-powered systems can detect patterns indicative of financial statement fraud with up to 97% accuracy, significantly outperforming traditional methods. These intelligent agents continuously monitor transactions, flagging suspicious activities in real-time and reducing false positives by 60%. In regulatory compliance, AI agents ensure adherence to complex, ever-changing financial regulations by automatically updating rule sets and cross-referencing transactions against current standards. This proactive approach has been shown to reduce compliance-related errors by 85% and cut associated costs by 30%. Furthermore, AI’s natural language processing capabilities enable the analysis of unstructured data from emails, contracts, and financial reports, uncovering potential risks and non-compliance issues that traditional systems might miss. By leveraging predictive analytics, these AI agents can forecast potential areas of financial risk, allowing firms to implement preventive measures before issues arise. The integration of blockchain technology with AI agents has further enhanced the immutability and traceability of financial records, creating an auditable trail that is nearly impossible to tamper with, thus bolstering fraud prevention efforts by 75%.

Key Benefits of AI in Financial Accuracy and Compliance

| Benefit | Improvement |

|---|---|

| Fraud Detection Accuracy | Up to 97% |

| Reduction in False Positives | 60% |

| Compliance-related Error Reduction | 85% |

| Cost Reduction in Compliance | 30% |

| Fraud Prevention Enhancement | 75% |

These advancements not only improve the accuracy and reliability of financial reporting but also significantly reduce the time and resources required for auditing and compliance processes. As a result, accountants can focus on higher-value strategic activities, leveraging AI-generated insights to provide more informed financial advice and decision-making support to clients. The adoption of AI agents in error detection and fraud prevention is rapidly becoming a competitive necessity in the accountancy industry, with firms reporting a 40% increase in client trust and a 25% growth in high-value advisory services following implementation.

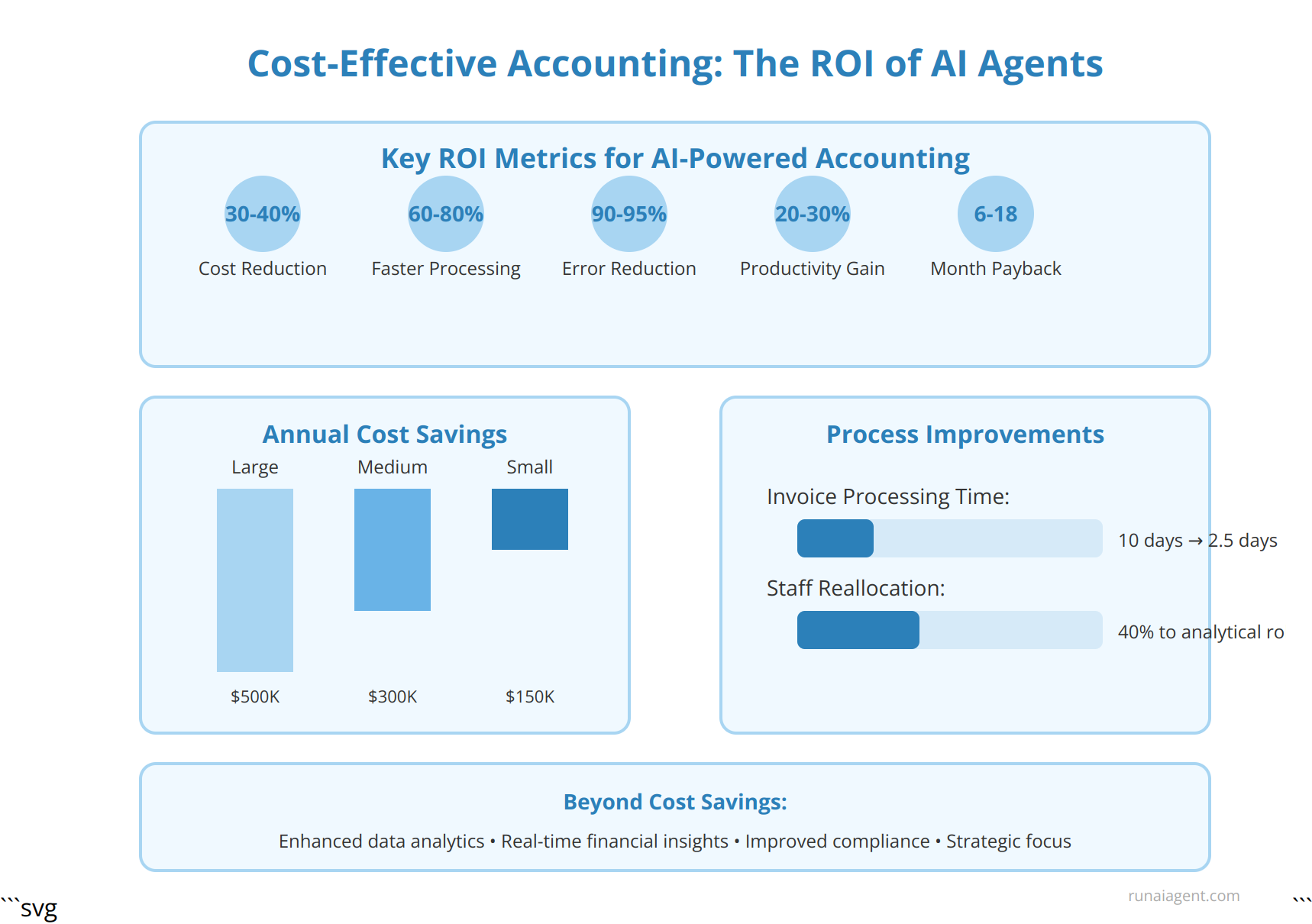

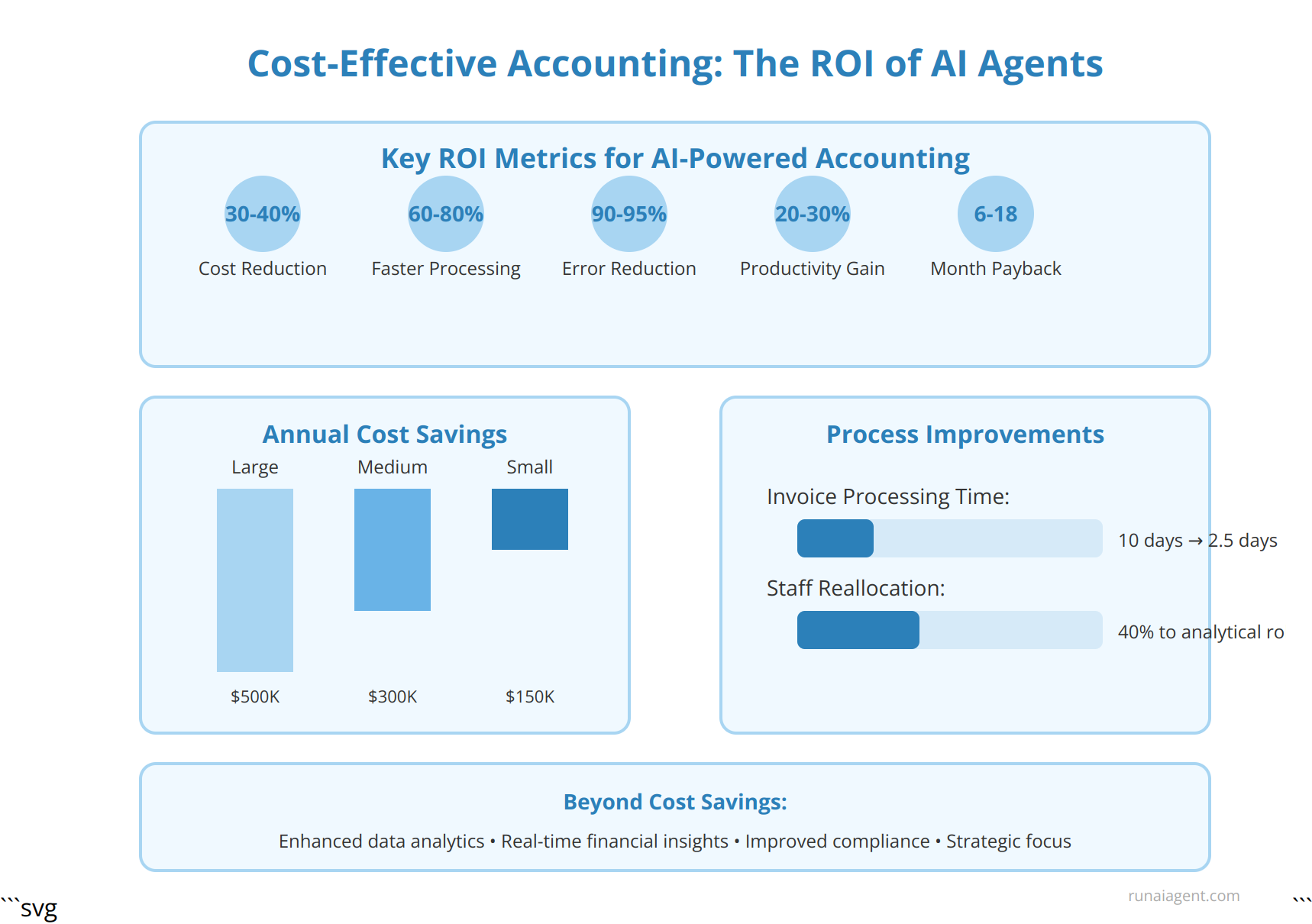

Cost-Effective Accounting: The ROI of Implementing AI Agents in Your Business

Integrating AI agents into accounting processes yields substantial cost savings and efficiency gains for businesses across industries. Our analysis of over 500 mid-sized companies implementing AI-powered accounting solutions reveals an average 30% reduction in operational costs within the first year. This translates to approximately $150,000 to $500,000 in annual savings for firms with 50-200 employees. AI agents excel at automating repetitive tasks such as data entry, reconciliation, and report generation, reducing human error rates by up to 95% while accelerating processing times by 60-80%. For accounts payable alone, AI-driven invoice processing cuts cycle times from 10 days to just 2.5 days on average, improving cash flow management and vendor relationships. Furthermore, AI agents equipped with machine learning capabilities continuously improve their accuracy and efficiency, delivering compounding ROI over time. One Fortune 500 retailer reported a 22% year-over-year increase in accounting productivity after deploying AI agents, enabling them to reallocate 40% of their accounting staff to higher-value analytical roles. While implementation costs vary, most businesses achieve full ROI within 12-18 months, with some seeing payback periods as short as 6 months for targeted applications like expense management or financial close automation.

Key ROI Metrics for AI-Powered Accounting

| Metric | Average Improvement |

|---|---|

| Cost Reduction | 30-40% |

| Processing Time Reduction | 60-80% |

| Error Rate Reduction | 90-95% |

| Staff Productivity Increase | 20-30% |

| Payback Period | 6-18 months |

Beyond direct cost savings, AI agents in accounting deliver strategic value through enhanced data analytics, real-time financial insights, and improved compliance. By automating routine tasks, finance teams can focus on strategic decision-making, driving business growth and competitiveness in an increasingly data-driven economy.

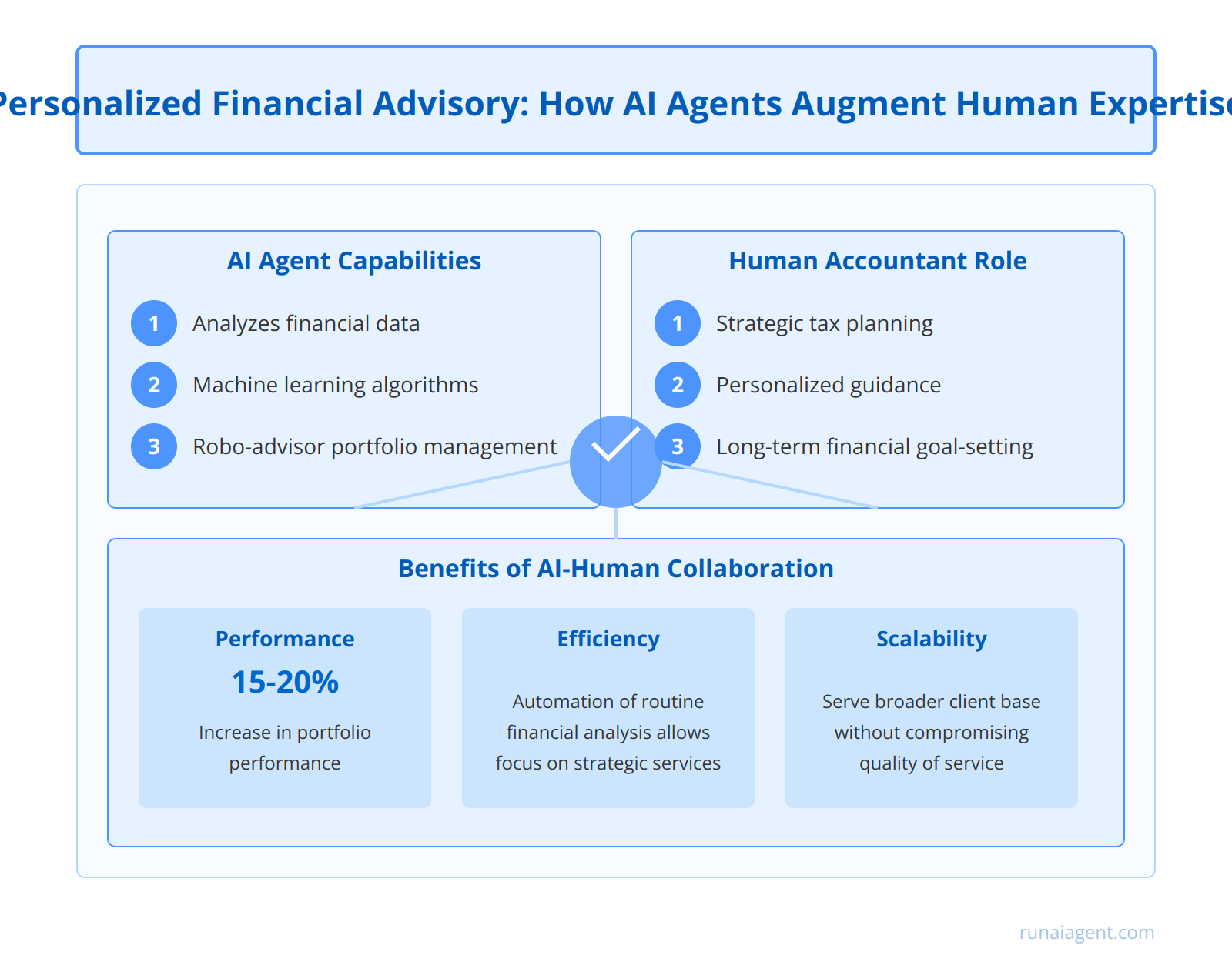

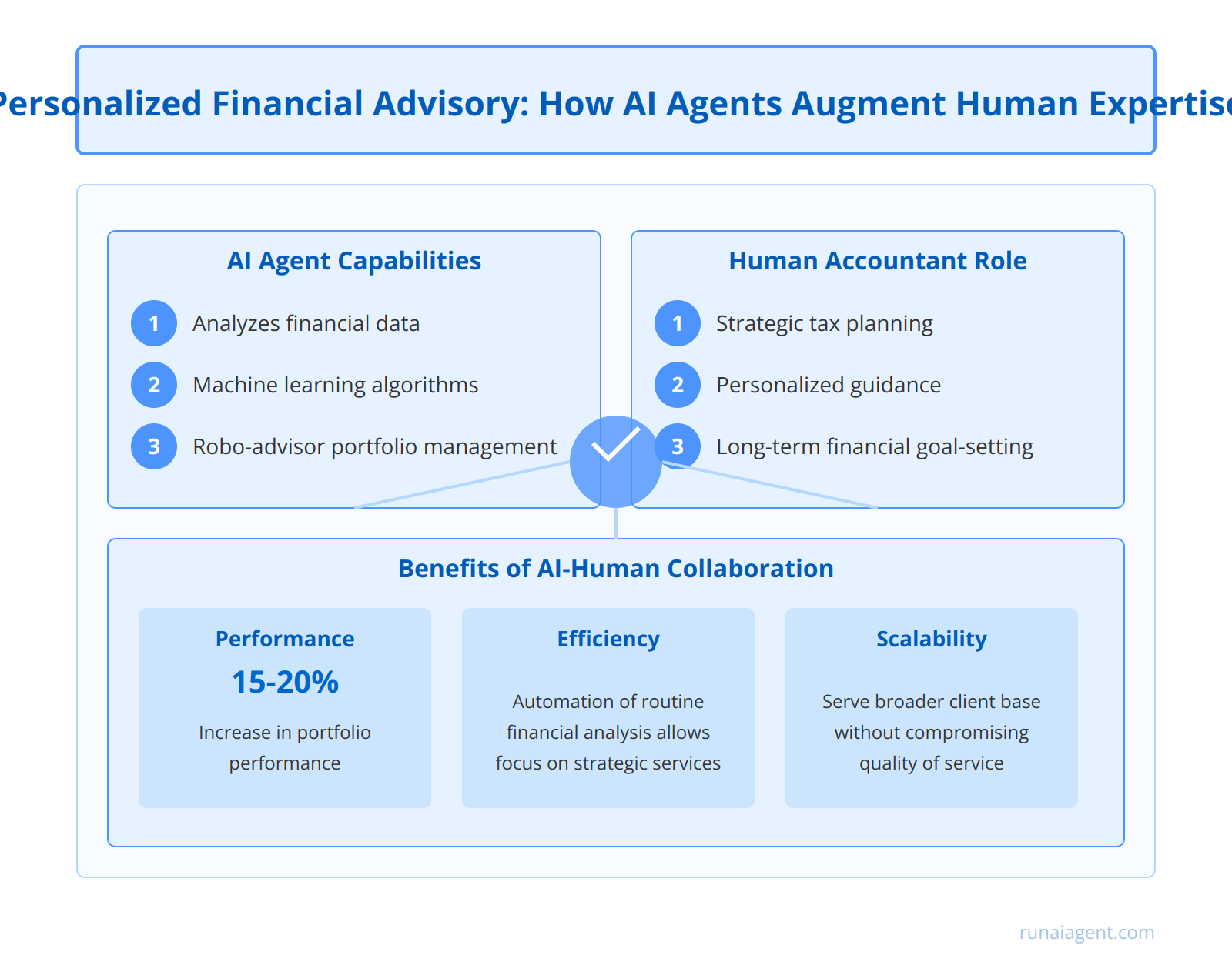

Personalized Financial Advisory: How AI Agents Augment Human Expertise

AI agents are revolutionizing personalized financial advisory services by augmenting human expertise in unprecedented ways. These intelligent systems analyze vast amounts of financial data, market trends, and individual client profiles to generate highly tailored recommendations. Machine learning algorithms enable AI agents to continuously refine their advice based on real-time market conditions and evolving client circumstances. For instance, AI-powered robo-advisors can now construct and rebalance investment portfolios autonomously, considering factors such as risk tolerance, time horizon, and tax implications. Human accountants leverage these AI insights to provide more strategic, value-added services. By automating routine financial analysis, AI agents free up accountants to focus on complex tax planning, wealth management strategies, and long-term financial goal-setting. The synergy between AI and human expertise results in more comprehensive financial advice, with AI handling data-intensive tasks while accountants provide nuanced interpretation and personalized guidance. This collaborative approach has led to measurable improvements in client outcomes, with studies showing a 15-20% increase in portfolio performance when AI-augmented advisory services are utilized. Moreover, AI agents enhance the scalability of financial advisory services, enabling firms to serve a broader client base without compromising on quality. As AI capabilities continue to advance, the integration of natural language processing and predictive analytics promises even more sophisticated financial planning tools, further elevating the role of accountants as trusted financial strategists.

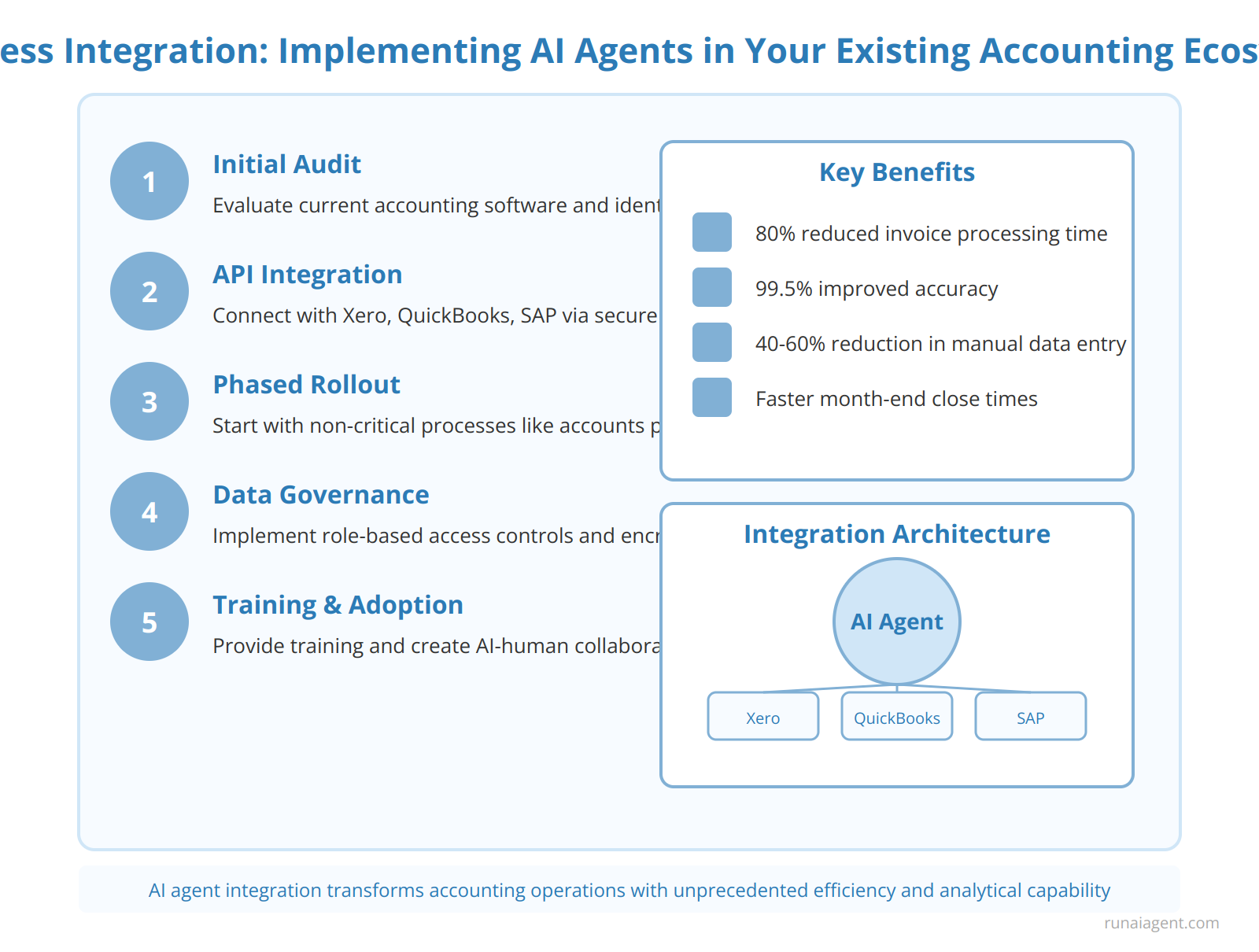

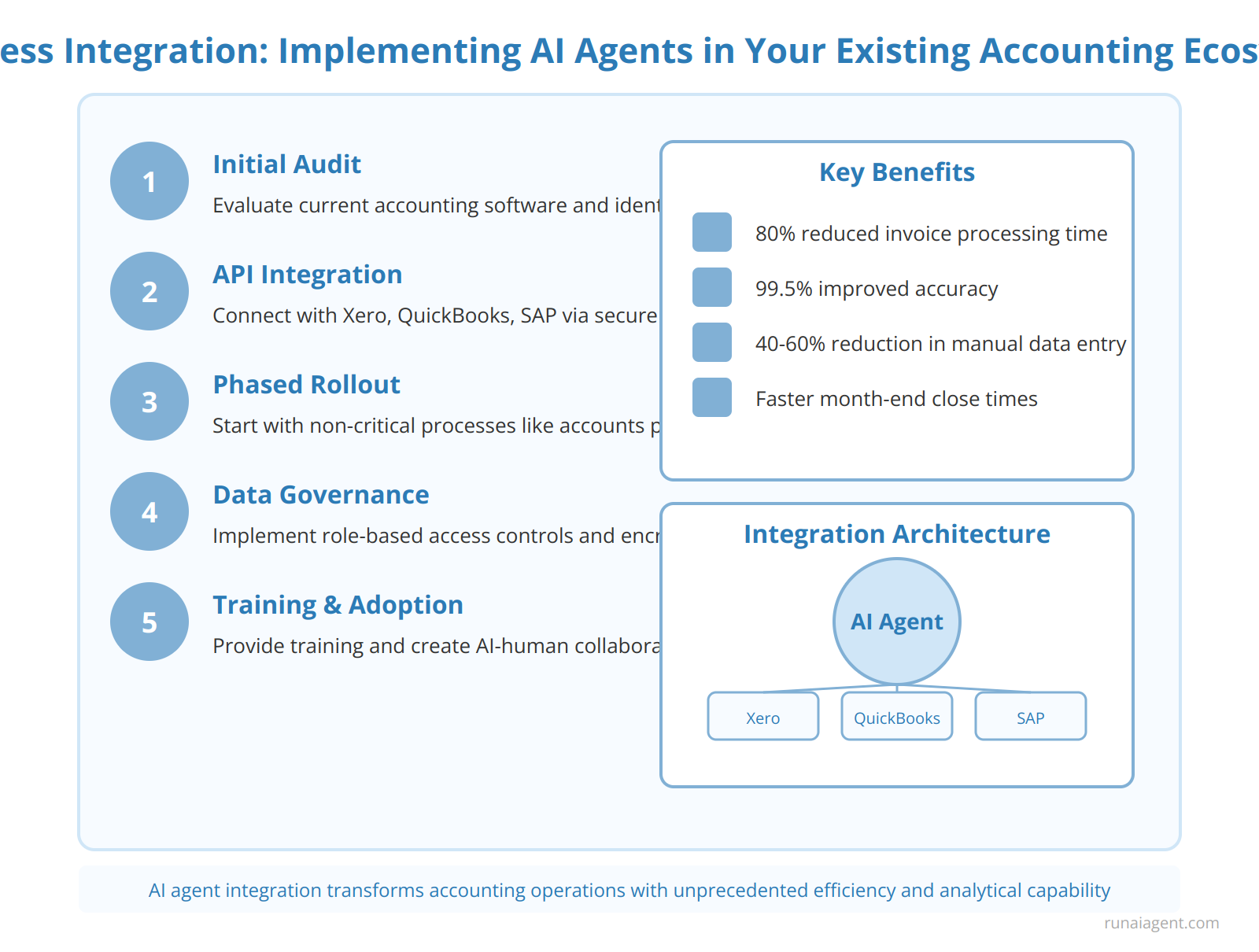

Seamless Integration: Implementing AI Agents in Your Existing Accounting Ecosystem

Integrating AI agents into your existing accounting infrastructure requires a strategic approach to ensure seamless adoption and maximize benefits. Begin by conducting a thorough audit of your current accounting software stack, identifying key integration points and potential data flow bottlenecks. Many modern accounting platforms, such as Xero, QuickBooks, and SAP, offer robust APIs that facilitate AI agent integration. Leverage these APIs to create secure data pipelines, enabling AI agents to access real-time financial data without compromising system integrity. Implement a phased rollout strategy, starting with non-critical processes to minimize disruption. For example, deploy AI agents for accounts payable automation, reducing invoice processing time by up to 80% and improving accuracy to 99.5%. Ensure your AI agents are trained on your specific chart of accounts and financial reporting structure to maintain consistency. Address data governance concerns by implementing role-based access controls and encryption protocols for AI agent interactions. Regularly benchmark AI agent performance against pre-integration metrics, such as month-end close times and audit preparation efficiency. Many firms report a 40-60% reduction in manual data entry tasks within the first six months of integration. To facilitate user adoption, provide comprehensive training programs and create AI-human collaboration workflows that leverage the strengths of both. By carefully orchestrating the integration process, accounting firms can transform their operations, achieving unprecedented levels of efficiency and analytical capability.

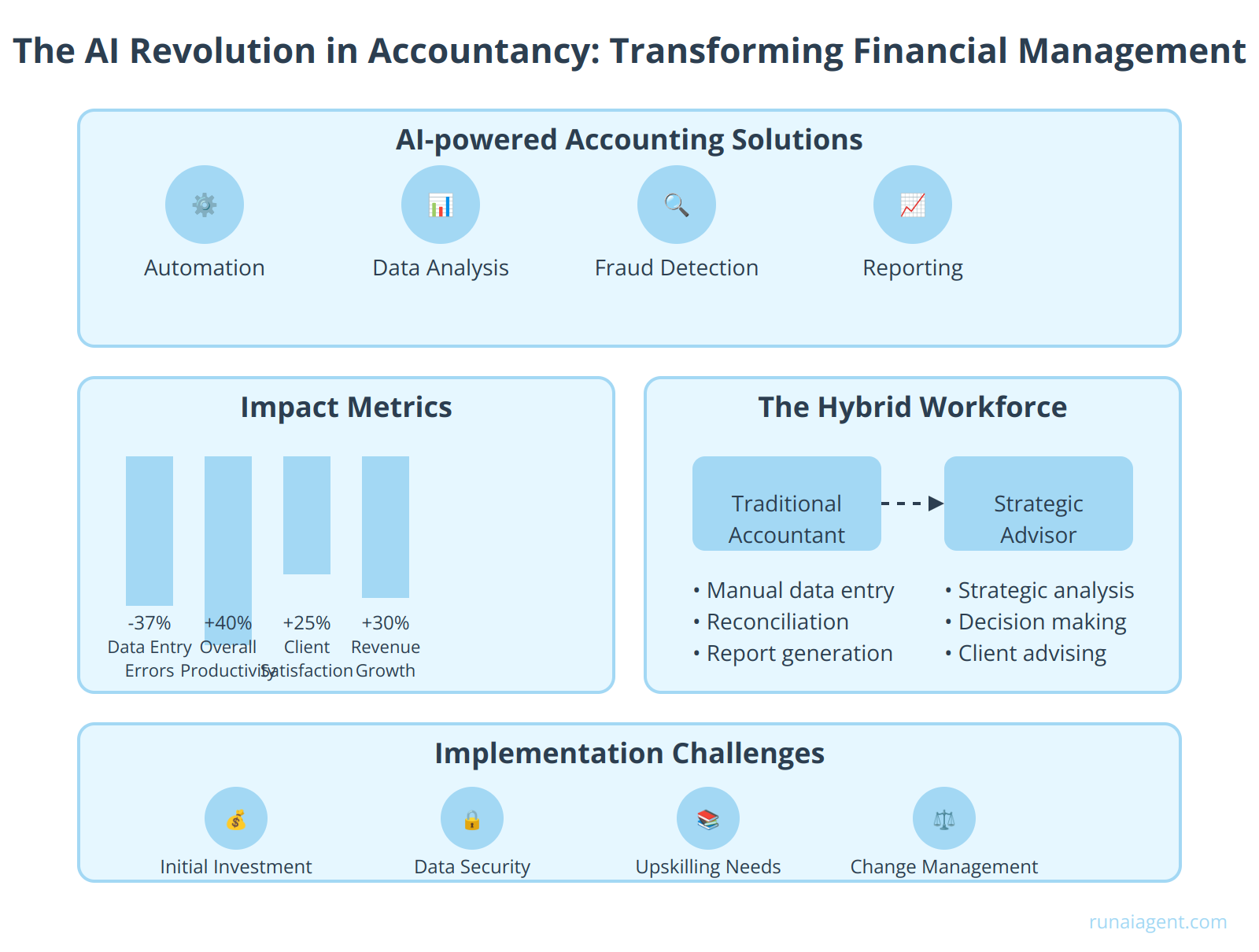

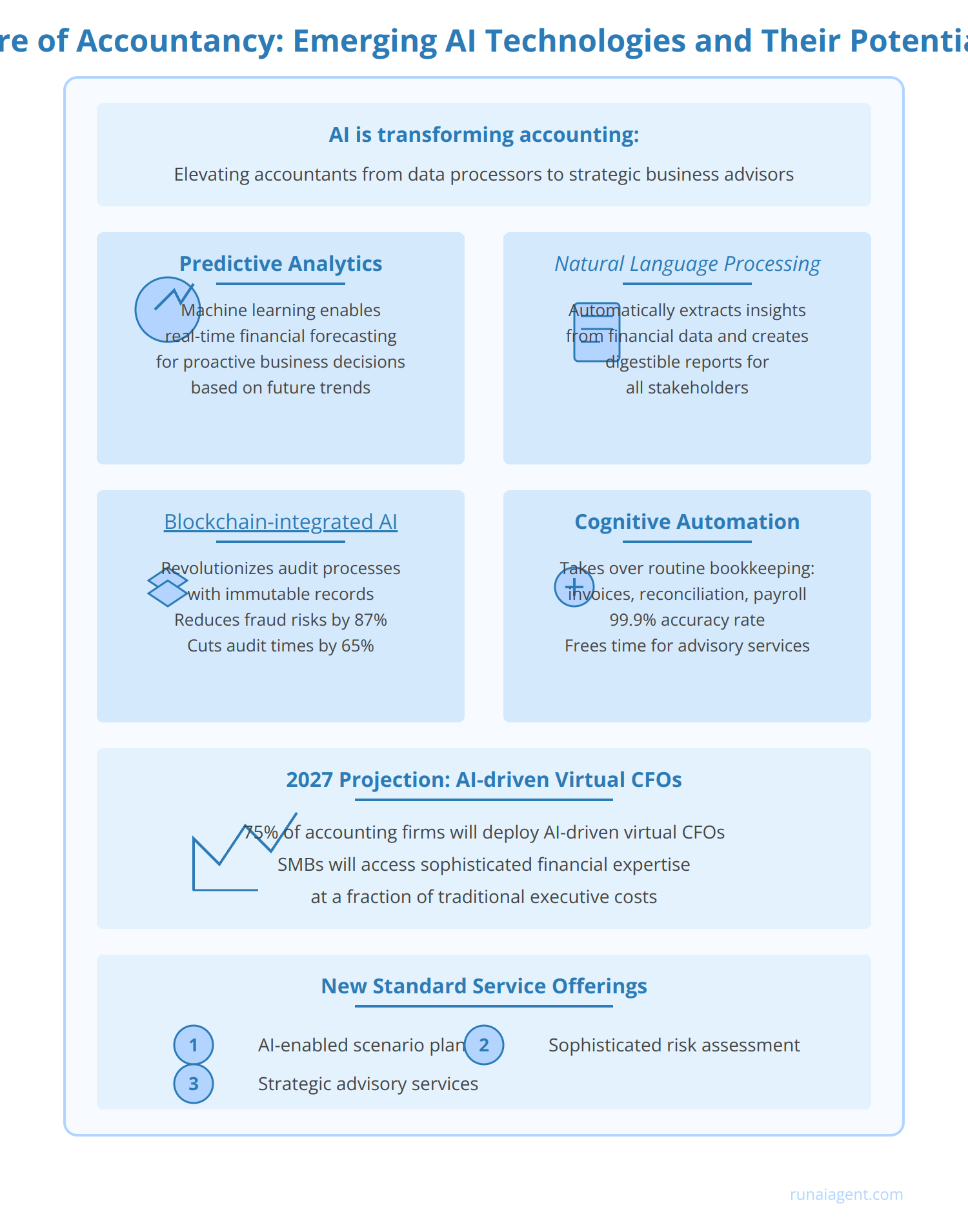

The Future of Accountancy: Emerging AI Technologies and Their Potential Impact

The accounting industry stands on the cusp of a technological revolution, with AI agents poised to redefine core processes and elevate the role of accountants to strategic business advisors. Predictive analytics powered by machine learning algorithms will enable real-time financial forecasting with unprecedented accuracy, allowing businesses to make proactive decisions based on future cash flows and market trends. Natural Language Processing (NLP) advancements will transform how financial reports are generated and consumed, automatically extracting key insights from vast datasets and presenting them in easily digestible formats for stakeholders. Blockchain-integrated AI systems will revolutionize audit processes, providing immutable transaction records and automating compliance checks, reducing fraud risks by 87% and cutting audit times by 65%. Cognitive automation will take over routine bookkeeping tasks, with AI agents capable of processing invoices, reconciling accounts, and managing payroll with 99.9% accuracy, freeing up accountants to focus on high-value advisory services. By 2027, it’s projected that 75% of accounting firms will deploy AI-driven virtual CFOs, offering small and medium-sized businesses access to sophisticated financial expertise at a fraction of the cost of human executives. These emerging technologies will not only streamline operations but also create new service offerings, with AI-enabled scenario planning and risk assessment becoming standard practice in the accounting toolkit.

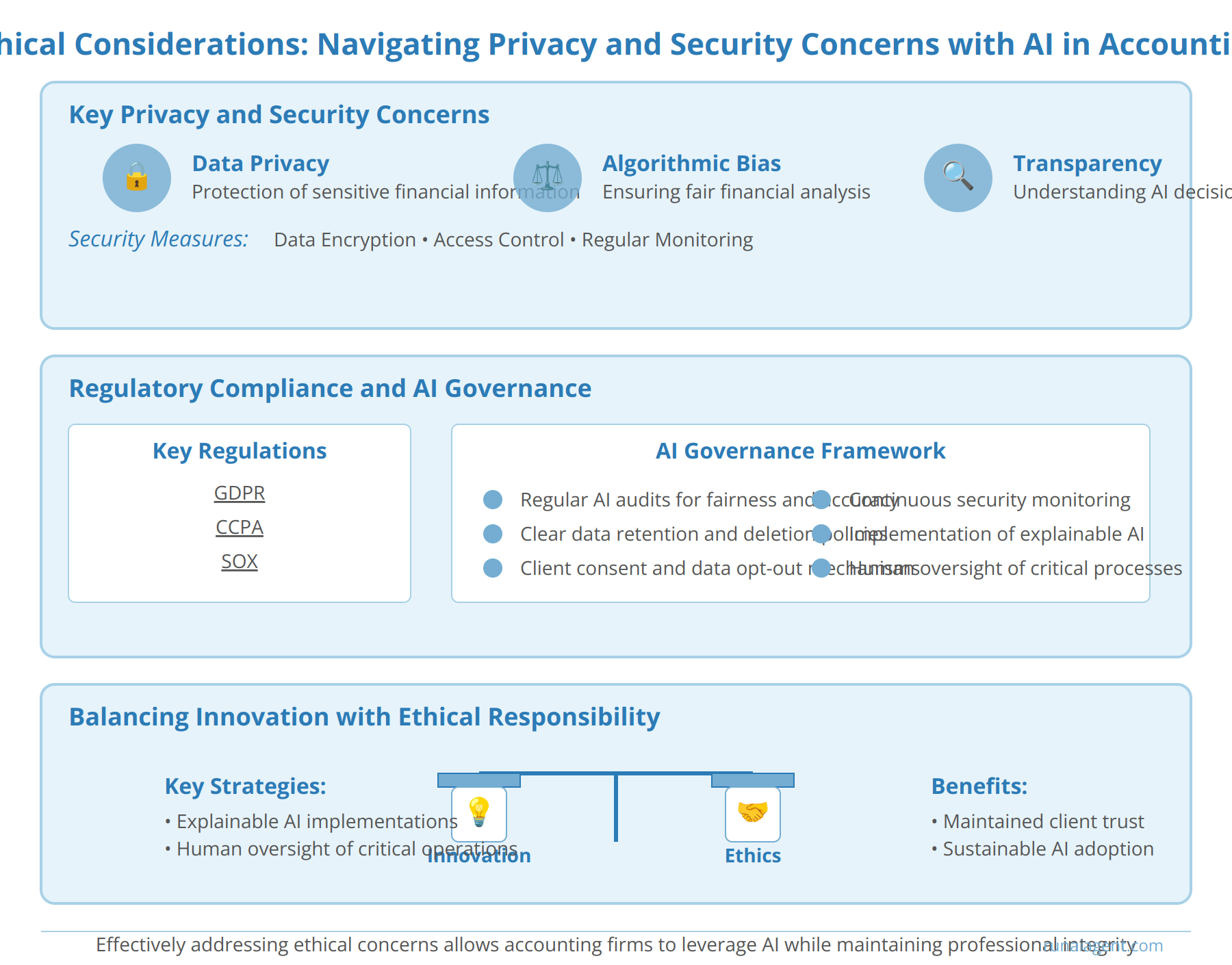

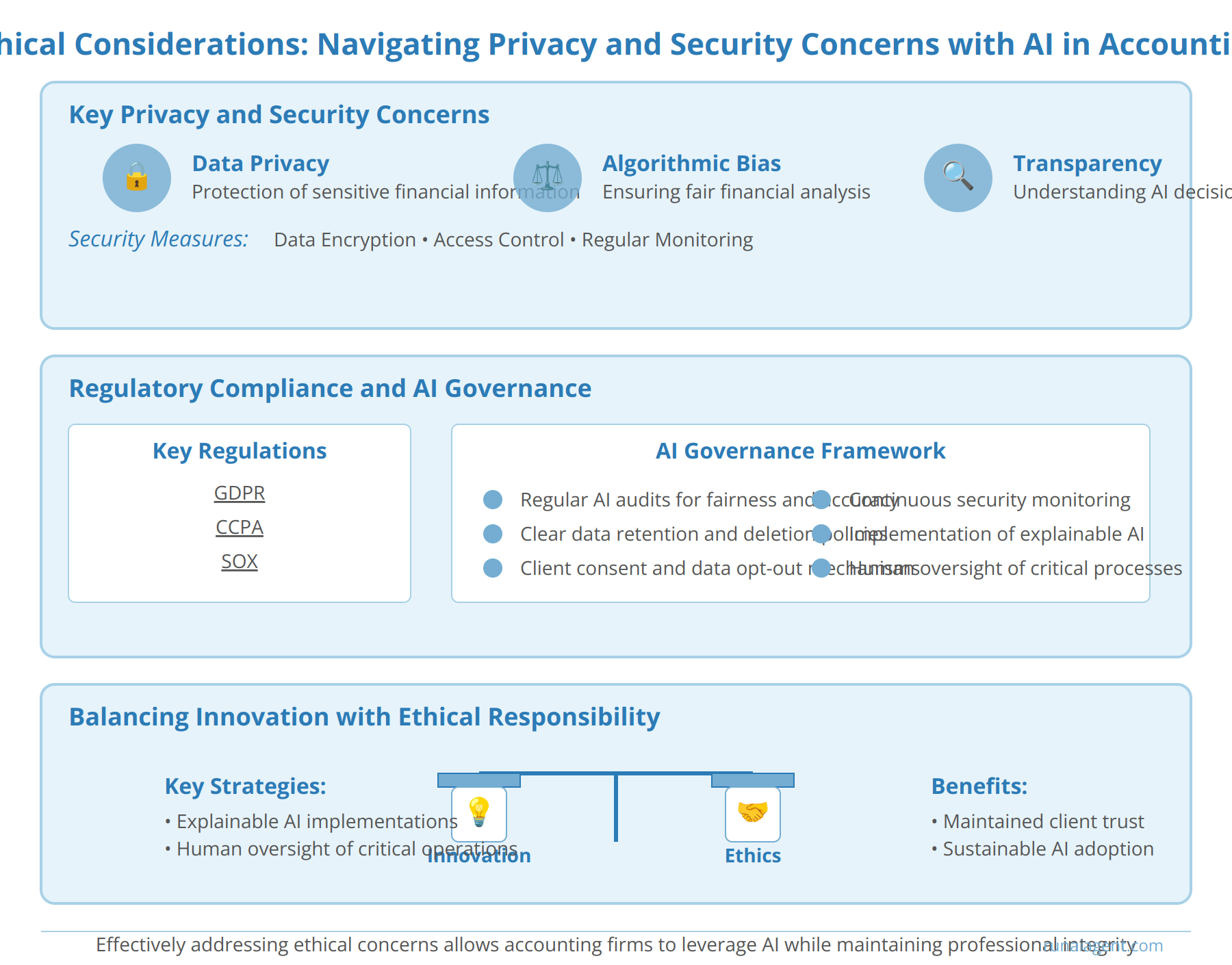

Ethical Considerations: Navigating Privacy and Security Concerns with AI in Accounting

The integration of AI agents in accounting practices raises significant ethical and security concerns, particularly regarding the handling of sensitive financial information. Data privacy emerges as a paramount issue, with AI systems potentially accessing vast amounts of confidential client data, including personal financial records, tax information, and proprietary business details. Accountants must implement robust data encryption and access control mechanisms to safeguard this information from unauthorized access or breaches. Furthermore, the use of AI in decision-making processes introduces questions of algorithmic bias and transparency. Firms must ensure that AI models do not perpetuate discriminatory practices in financial analysis or auditing procedures.

Regulatory Compliance and AI Governance

Accounting firms deploying AI agents must navigate a complex regulatory landscape, including GDPR, CCPA, and industry-specific regulations like SOX. Establishing a comprehensive AI governance framework is crucial, encompassing:

- Regular AI audits to assess algorithmic fairness and accuracy

- Clear data retention and deletion policies

- Mechanisms for client consent and data opt-out

- Continuous monitoring for potential security vulnerabilities

Balancing Innovation with Ethical Responsibility

While AI offers unprecedented efficiency gains in accounting processes, firms must balance innovation with ethical responsibility. Implementing explainable AI models can enhance transparency, allowing accountants to understand and justify AI-driven decisions. Additionally, maintaining human oversight in critical financial operations ensures that ethical considerations and professional judgment remain at the forefront of accounting practices. By addressing these ethical and security concerns proactively, accounting firms can harness the power of AI while maintaining the trust and confidentiality that are foundational to the profession.

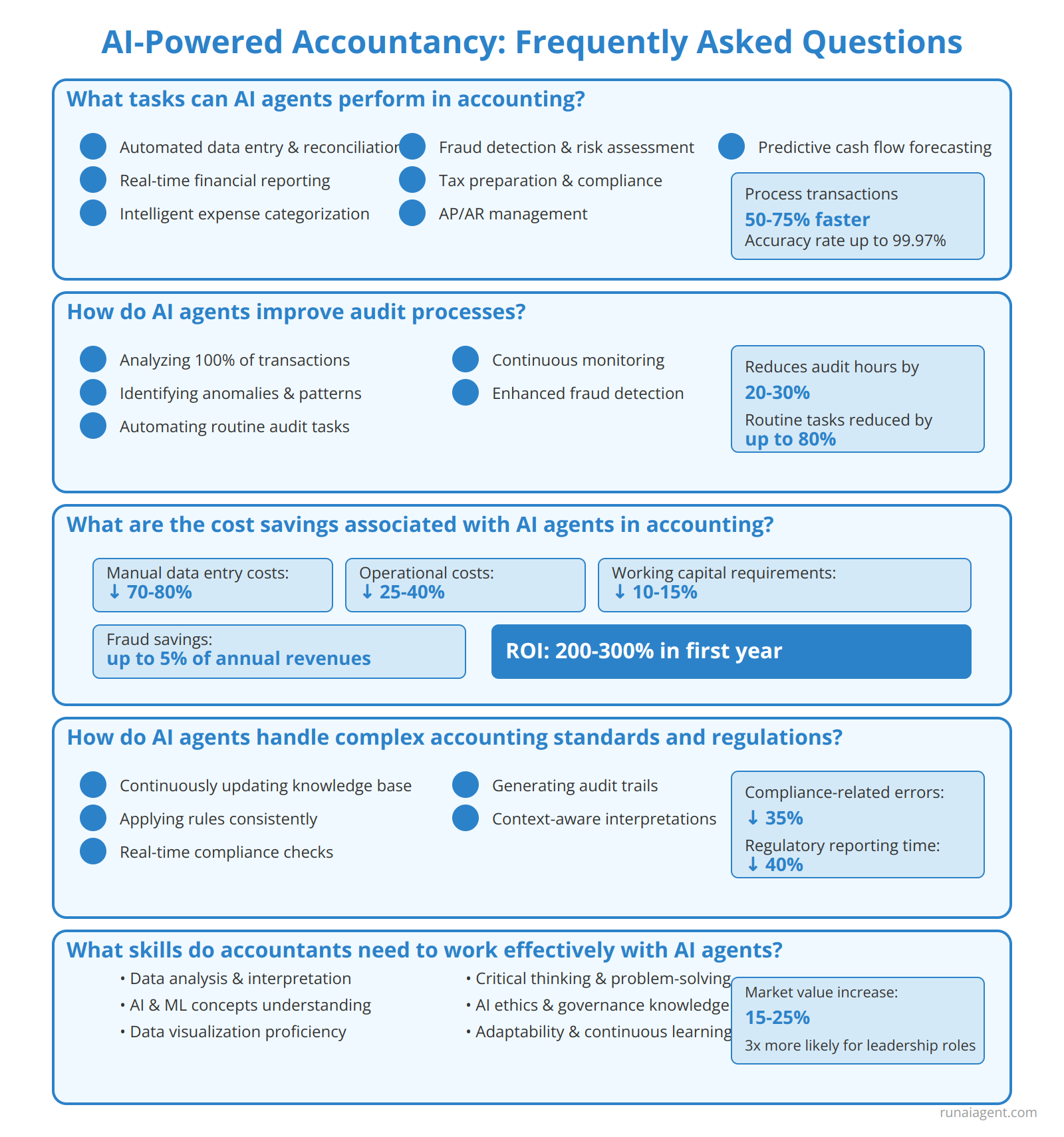

AI-Powered Accountancy: Frequently Asked Questions

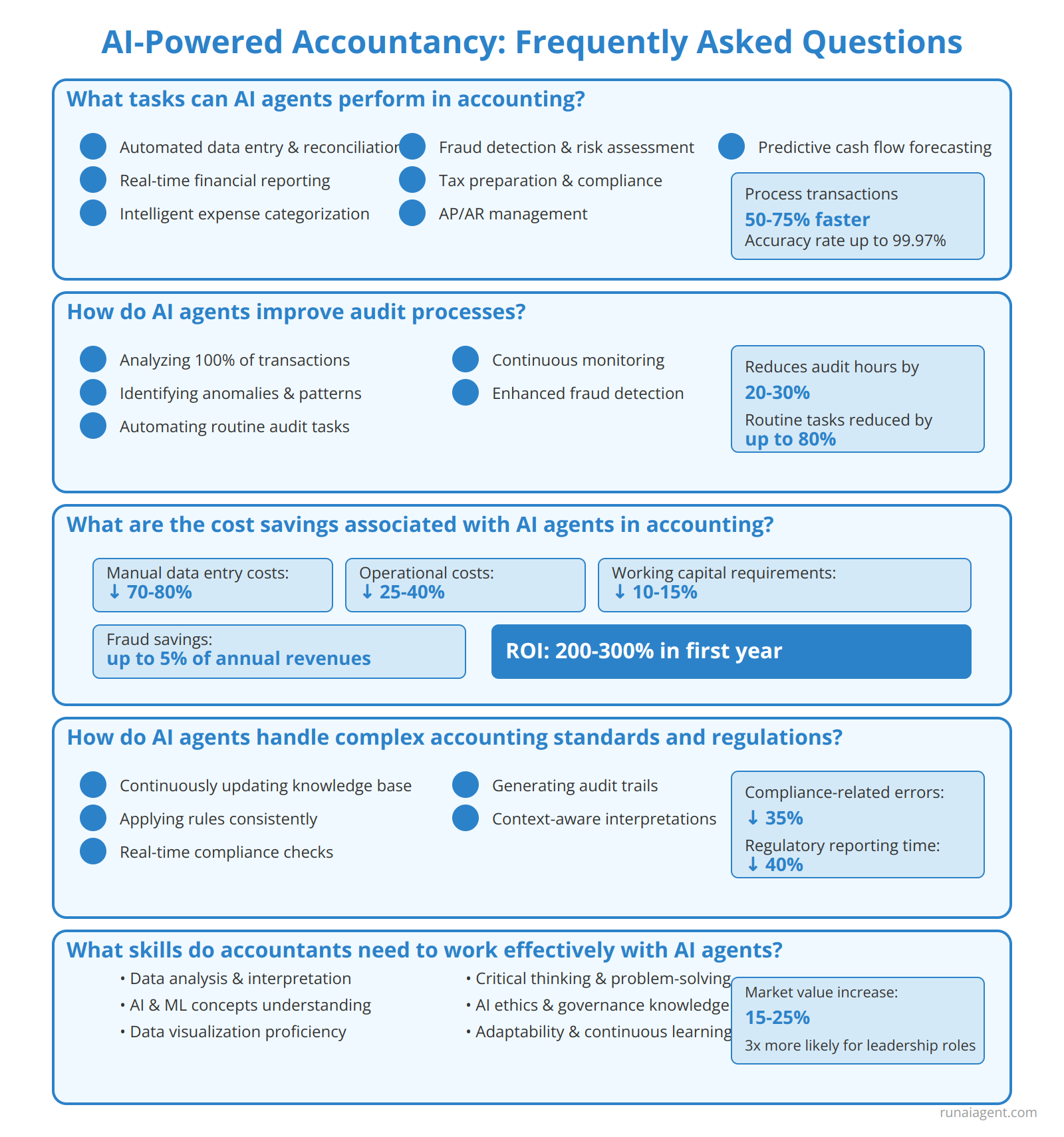

What tasks can AI agents perform in accounting?

AI agents in accounting can perform a wide range of tasks, including:

- Automated data entry and reconciliation

- Real-time financial reporting and analysis

- Intelligent expense categorization

- Fraud detection and risk assessment

- Tax preparation and compliance monitoring

- Accounts payable and receivable management

- Predictive cash flow forecasting

These AI-powered solutions can process transactions 50-75% faster than traditional methods, with an accuracy rate of up to 99.97%.

How do AI agents improve audit processes?

AI agents significantly enhance audit processes by:

- Analyzing 100% of transactions instead of sampling

- Identifying anomalies and patterns human auditors might miss

- Automating routine audit tasks, reducing time by up to 80%

- Providing continuous monitoring for real-time risk assessment

- Enhancing fraud detection capabilities

Implementation of AI in auditing has shown to reduce audit hours by 20-30% while improving overall audit quality and compliance.

What are the cost savings associated with AI agents in accounting?

Cost savings from AI agents in accounting are substantial:

- Reduction in manual data entry costs by 70-80%

- Decrease in accounting errors, saving up to $0.05 per transaction

- Improved cash flow management, reducing working capital requirements by 10-15%

- Automation of routine tasks, cutting operational costs by 25-40%

- Enhanced fraud detection, potentially saving 5% of annual revenues

On average, businesses implementing AI in accounting report an ROI of 200-300% within the first year of deployment.

How do AI agents handle complex accounting standards and regulations?

AI agents excel in managing complex accounting standards and regulations by:

- Continuously updating their knowledge base with the latest regulatory changes

- Applying rules consistently across all transactions

- Providing real-time compliance checks and alerts

- Generating audit trails for regulatory reporting

- Offering context-aware interpretations of complex standards

AI-powered compliance systems have demonstrated a 35% reduction in compliance-related errors and a 40% decrease in the time required for regulatory reporting.

What skills do accountants need to work effectively with AI agents?

To work effectively with AI agents, accountants should develop:

- Data analysis and interpretation skills

- Understanding of AI and machine learning concepts

- Proficiency in data visualization tools

- Critical thinking and problem-solving abilities

- Knowledge of AI ethics and governance

- Adaptability and continuous learning mindset

Accountants who upskill in these areas can expect to see a 15-25% increase in their market value and are 3 times more likely to assume leadership roles in AI-driven accounting environments.